Higher demand stemming from a normal monsoon, easing inflation, the festive and wedding season, and increasing preference for fast fashion will contribute to 8–10% revenue growth in the current fiscal for the organised retail apparel sector, according to Crisil Ratings.

Slow area addition, existing store rationalisation and stable input prices will also support operating margin.

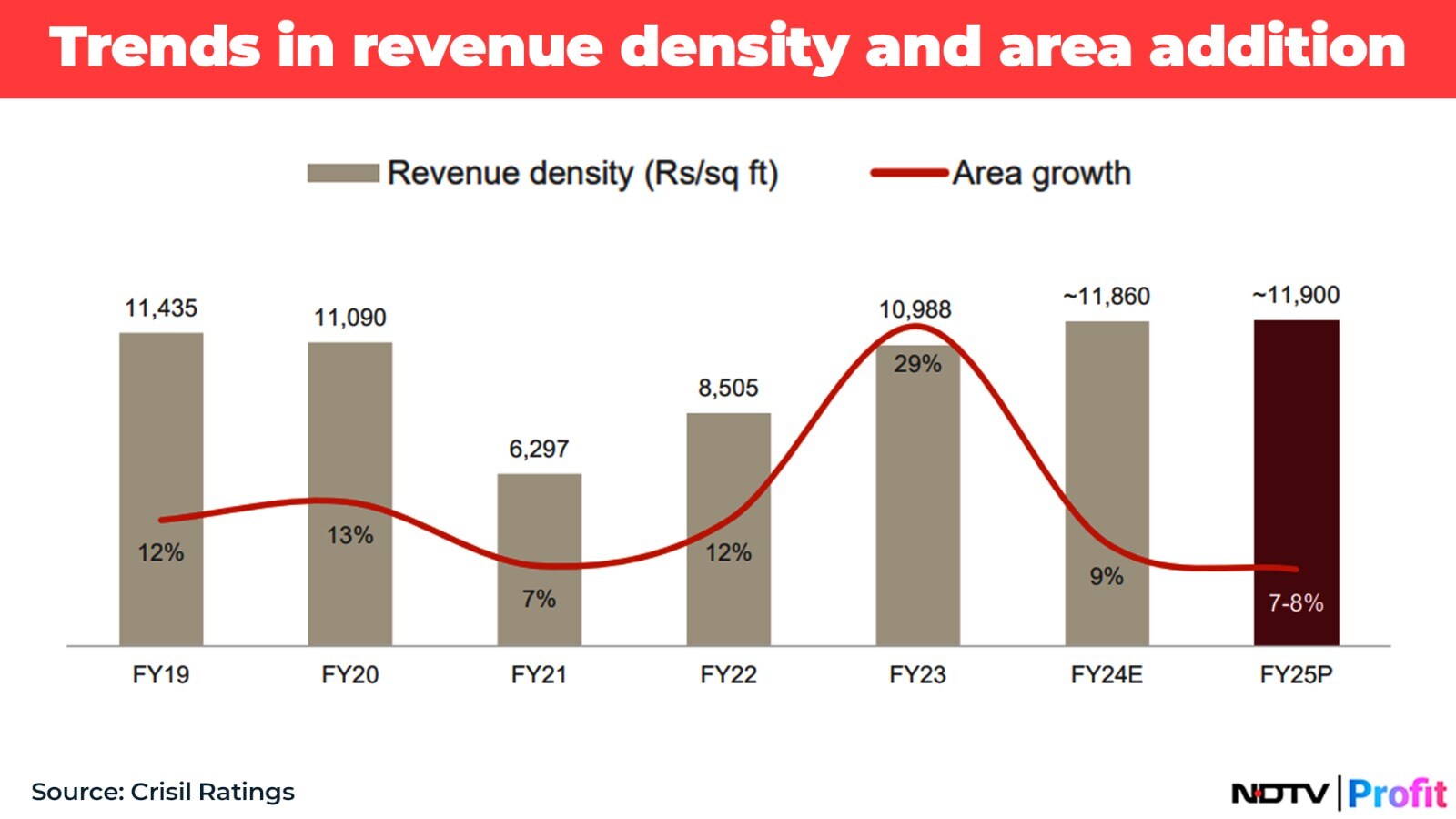

Revenue growth in fiscal 2025 will be slower than the compound annual growth rate of 11–12% seen between 2018 and 2023, the report said. Revenue density is expected to remain flat at Rs 11,900 per square foot.

As a result, retailers are exercising caution in opening new stores and instead prioritising efficiency improvements in existing locations, controlling costs, and minimising reliance on external debt.

The strategy is projected to help maintain operating margins between 7.2% and 7.4%, even amid ongoing high marketing expenses, thereby ensuring stable credit profiles, Crisil said, after analysing 37 apparel retailers that account for over a third of the organised industry.

The strategy is projected to help maintain operating margins between 7.2% and 7.4%, even amid ongoing high marketing expenses.

"The marginal increase in profitability this fiscal will be driven by apparel retailers streamlining existing stores and opening new stores only as necessary, given that demand has not fully recovered," said Associate Director Anil More.

"Besides, the need to offer higher discounts and incur marketing spends to attract customers will limit the overall improvement in operating margin to 7.2–7.4% against 7.0% in fiscal 2024."

Crisil said improved inventory management and stable input costs will help prevent significant inventory write-offs this year. This marks a contrast to last year, when sharp fluctuations in costs reduced profitability by 100-110 basis points.

Changing Trends

Crisil said retailers are adjusting business strategies, enhancing supply chain efficiency and focussing on new trends, like in fast fashion, to meet evolving consumer behaviour.

The mass market is the largest segment in the apparel business, followed by premium and luxury. Fast fashion has become a major subset of the mass market.

"The mass market segment accounts for ~60% of total sales now, compared with ~56% before the pandemic, due to the rising popularity of fast fashion, which is expected to be the primary revenue driver this fiscal," said Anuj Sethi, senior director at Crisil.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.