(Bloomberg) -- Hotter-than-expected inflation likely ensures the Federal Reserve keeps its options open to raise interest rates again in November or December following an expected pause this month.

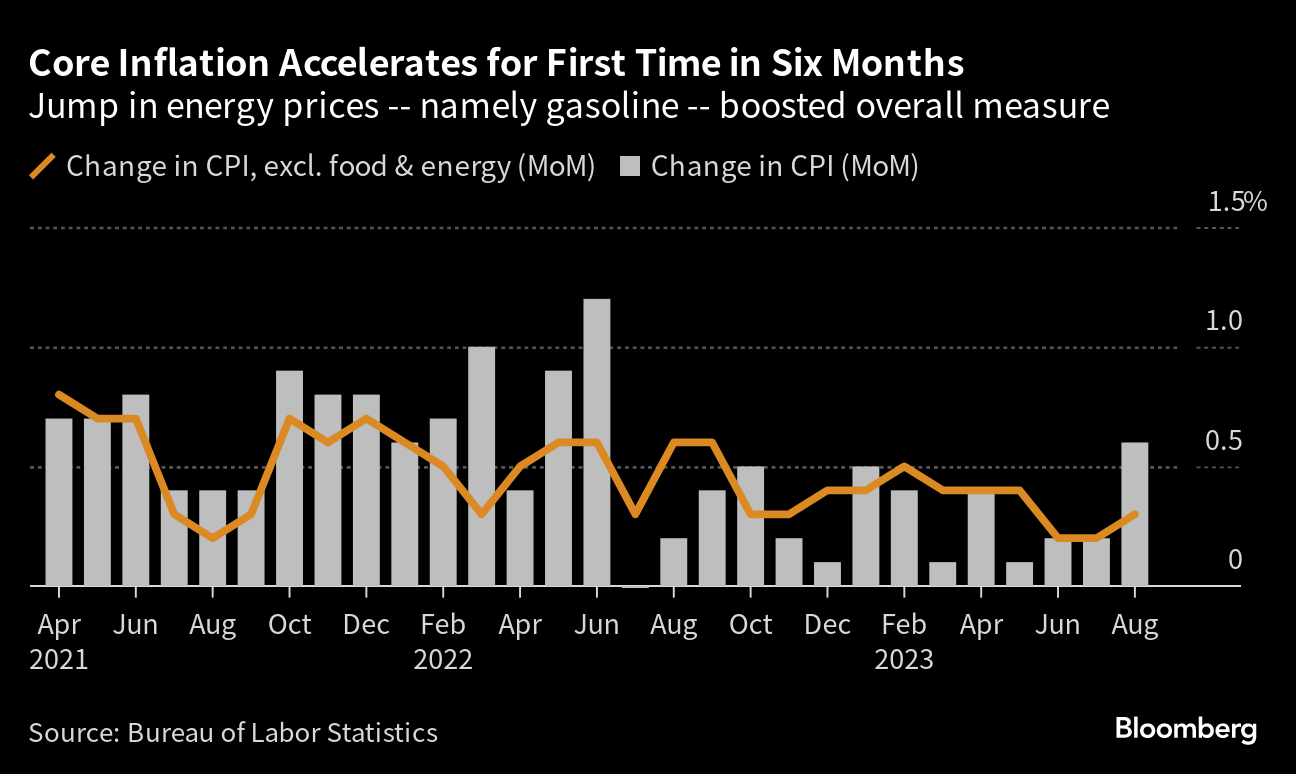

The so-called core consumer price index, which excludes food and energy costs, advanced 0.3% from July, the first acceleration in six months, Bureau of Labor Statistics data showed Wednesday. From a year ago, it increased 4.3%, still well above the Fed's goal even as it was the smallest advance in nearly two years.

“The core CPI is a bit disappointing,” said Kathy Bostjancic, chief economist at Nationwide Life Insurance Co. “This will keep the Fed on a hawkish alert and suggests a rate hike is possible in November and December.”

Read More: Here Are the Latest Inflation Buzzwords You Need to Know

Fed Chair Jerome Powell said in late August at the Kansas City Fed's conference in Jackson Hole, Wyoming, that inflation remained too high, and central bankers were prepared to tighten more if necessary. The Federal Open Market Committee raised its benchmark rate in July to a range of 5.25% to 5.5%, a 22-year high, and its most recent projections had one more rate increase penciled in for 2023.

Investors aren't sure another hike will happen. They see the Fed leaving rates unchanged at its Sept. 19-20 policy meeting, and bets were less than even for an increase in November, according to futures.

“These data are supportive of a pause in September,” said Rubeela Farooqi, chief US economist at High Frequency Economics. “However, the FOMC is not likely to declare victory until it sees further evidence of improvement towards the 2% target. They will remain open to further rate hikes, if needed.”

Treasury yields retreated to little-changed levels after the report, reflecting that the report hasn't much altered investors' view of the rate path significantly.

Excluding housing and energy, services prices rose 0.4% from July, the fastest in five months, and 4% from a year ago, according to Bloomberg calculations. The so-called supercore index has been seen as important because it is heavily influenced by the labor market, so a still-tight job market could keep these prices elevated for some time.

What Bloomberg Economics Says...

“We think the Fed is likely to look through the energy-price increase, but it's not clear they'll do the same for the increase in transportation services ... Our baseline is still for the Fed to hold rates steady after September, but the risk of a rate hike in November has increased.”

— Anna Wong and Stuart Paul

To read the full note, click here

While core inflation could be softer in September, “I continue to think we'll see a step up in the core rate in Q4 that could cause the Fed to pull the trigger on another hike at the December meeting,” said Omair Sharif, president of Inflation Insights LLC.

Central bankers could be worried that surging energy prices may raise inflation expectations, which are seen as key to the inflation outlook. West Texas Intermediate oil prices rose Tuesday to the highest level since Nov. 11, as OPEC data show global markets face a 3-million-barrels-a-day shortfall next quarter.

The policy-setting FOMC has raised its benchmark federal funds rate 11 times since March 2022. Officials including Powell have emphasized that, as they near the end of their aggressive rate-hike cycle, they'll proceed carefully and rely on the data to determine whether further increases are needed.

--With assistance from Matthew Boesler.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.