(Bloomberg) -- Federal Reserve Chair Jerome Powell pushed back against Wall Street's growing expectations of interest-rate cuts in the first half of 2024, saying the committee will move cautiously with borrowing costs at a 22-year high but retain the option to hike further.

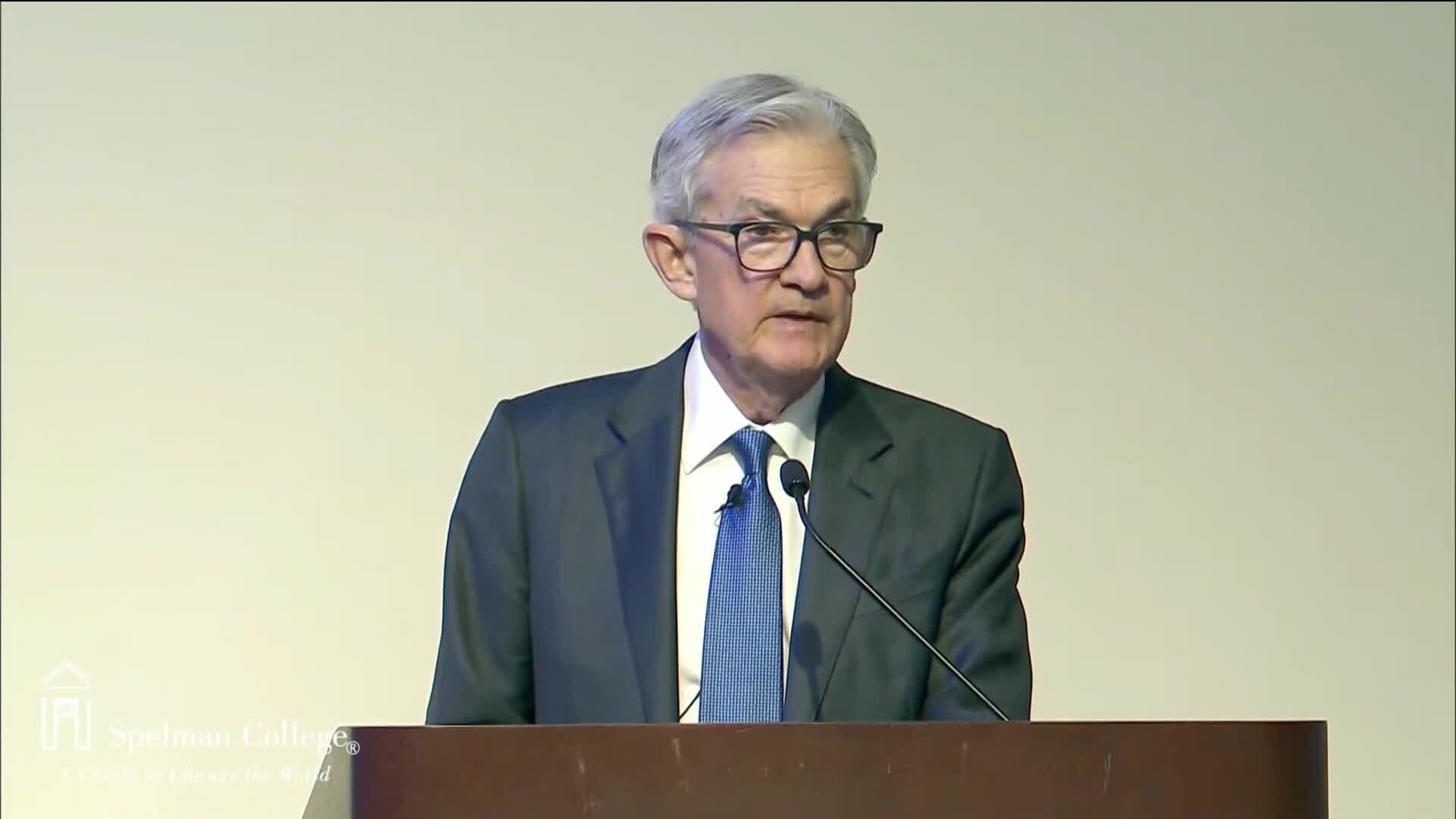

“It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease,” Powell said Friday in Atlanta. “We are prepared to tighten policy further if it becomes appropriate to do so.”

Powell signaled that Fed officials expect to leave interest rates steady when they meet Dec. 12-13, giving themselves more time to evaluate the economy after raising rates aggressively from near zero in March 2022 to above 5% in July. A slowing US economy and fall in the inflation rate have raised expectations among investors that the central bank could begin to cut rates as soon as March.

“Having come so far so quickly, the FOMC is moving forward carefully, as the risks of under- and over-tightening are becoming more balanced,” Powell said at Spelman College, a historically Black school in Atlanta.

Markets took Powell's brush-off in stride, boosting odds of a quarter-point cut by the Federal Open Market Committee's March meeting well above 50%, and fully pricing in a cut in May. Traders see more than a full point of cuts by December 2024.

Conversely, Fed officials projected rates at 5%-5.25% at the end of next year, according to their median forecast released in September — just one-quarter point lower than the current level.

Treasury yields and the dollar fell and the S&P 500 rose, as investors focused on remarks suggesting that Powell was more dovish than he previously was, including his remark that policy is now “well into restrictive territory.”

“We don't need to be in a rush now, having moved quickly and forcefully,” he said during a Q&A session following his prepared remarks. “We're getting what we wanted to get. We now have the ability to move carefully.”

The Fed chair did highlight recent progress, noting that over the six months ending in October, core inflation, which excludes food and energy, ran at an annual rate of 2.5%, compared to the overall goal for 2% annual gains.

“Monetary policy is thought to affect economic conditions with a lag, and the full effects of our tightening have likely not yet been felt,” Powell said.

Wall Street's focus on possible near-term rate cuts was raised by comments this week by Fed Governor Christopher Waller, a leading inflation hawk, who acknowledged that the central bank would be willing to consider rate cuts if inflation continues to move lower. He cited monetary policy guidelines, including a popular one developed by Stanford University's John Taylor known as the Taylor Rule, as calling for a lower policy rate as inflation falls.

“People were looking for stronger pushback against Waller,” Brett Ryan, a senior US economist at Deutsche Bank AG. said of Friday's market reaction. “Powell didn't say anything different. It was the lack of explicit pushback against Waller's comments that the market is taking in a dovish direction.”

Powell's comments leaving open the possibility of more policy tightening repeated his view following the FOMC's last meeting in November. Two officials – Richmond Fed's Thomas Barkin and Fed Governor Michelle Bowman – also this week raised the possibility of additional hikes if inflation proves to be stubborn.

In addition, the Fed chair described the labor market as “very strong,” though he noted that with recent slowing, “the economy is returning to a better balance between the demand for and supply of workers.”

Meanwhile, incoming economic data continue to illustrate a downshift in activity. Similar to results from the Fed's latest Beige Book, industry comments in the latest Institute for Supply Management's survey of manufacturers underscored growing concern.

Read More: Factory Gauge Shrinks to Extend Worst Stretch in Two Decades

One computer and electronic products manufacturer described the economy as “slowing dramatically,” with customers delaying orders to right-size inventory, according to the ISM report issued Friday. A maker of chemical products was “starting to feel softening in the economy” and a challenging outlook, while a wood products-maker said high borrowing costs have “dampened demand.”

--With assistance from Rich Miller and Vince Golle.

(Updates with market reaction, economist comment starting in fifth paragraph.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.