The broader markets didn't witness any selling pressure following a slump on June 4, when results of the Lok Sabha election gave Prime Minister Narendra Modi a third stint in office with a reduced majority. Yet, one can expect a “time-wise correction” in the markets and not one by price, according to Ruchit Jain, CMT Lead Research Analyst at 5PaisaLtd.

He said bourses are trading between the support and resistance levels of 23,200 and 23,500, respectively. The risk-to-reward ratio would be favourable to take a long on the index if there is a dip at the lower end of the range, he said.

“I wouldn't advise to take longs on the current levels but tomorrow or day after if there's any dip, then use that decline as a buying opportunity,” he told NDTV Profit.

He recommended a ‘buy' call for LIC Housing Finance Ltd., with a target price of Rs 760 and a stop loss at Rs 685; and SBI Life Insurance Co. at a target price of Rs 1,520 and stop loss of Rs 1,420.

Market participants await key inflation data from India and the U.S., along with the Federal Reserve's decision on interest rates due later in the day.

The NSE Nifty 50 ended 58.10 points up, or 0.25%, at 23,322.95, while the S&P BSE Sensex closed 149.98 points, or 0.2%, higher at 76,606.57.

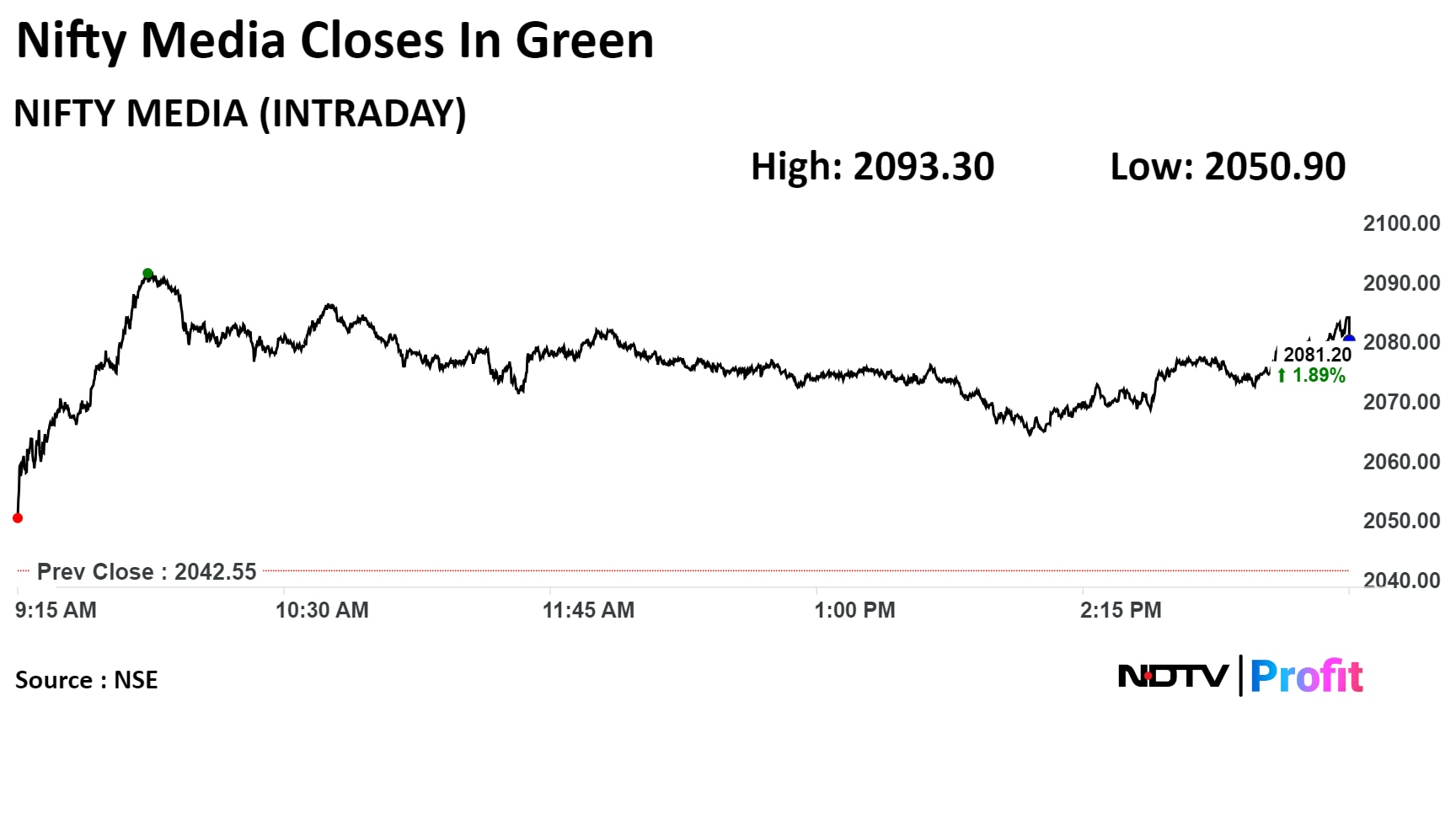

Sudip Bandyopadhyay, group chairman at Inditrade Capital Ltd., is positive on the media sector, listing the Kalanidhi Maran-led Sun TV Network Ltd. as his best performer.

The stock, he said, deserves better valuation. He listed the Dravida Munnetra Kazhagam's sweep of the MP seats in Tamil Nadu—of which Maran's brother Dayanidhi is an MP—and the resurgence of the Sunrisers Hyderabad in the Indian Premier League in 2024 as reasons.

The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.