(Bloomberg) -- China Evergrande Group won breathing room to strike a restructuring agreement with creditors after a Hong Kong court again pushed back a decision on whether the world's most-indebted property developer should be wound up.

The proceedings have been adjourned to Jan. 29, Judge Linda Chan said in the city's High Court. The unexpected delay came as the original petitioner didn't push for an immediate liquidation on Monday, the latest twist in a lawsuit that has dragged on for more than a year.

The homebuilder now has eight weeks to agree a deal with offshore bondholders for what would be one of the nation's biggest-ever restructurings. Evergrande's lawyer said Monday a new proposal was sent on Nov. 26, and the firm is applying for another adjournment as it hopes to seek further support and more feedback from creditors.

“The petitioner changed its position and didn't push to wind up the company, which is a surprise to us,” Neil McDonald, a partner at law firm Kirkland & Ellis LLP, legal adviser to an ad-hoc group of creditors, said in an interview outside the court. Meanwhile, the creditor group has “has firmly rejected” the latest proposal that Evergrande put forward to the court, he added.

The builder's shares rallied as much as 13% on the adjournment decision. At a value less than HK$0.30, it remains a penny stock.

Offshore creditors had demanded controlling stakes in the equity of Evergrande as well as its two Hong Kong subsidiaries — Evergrande Property Services Group and China Evergrande New Energy Vehicle Group — as part of the debt discussions, Bloomberg News reported last week.

Evergrande had earlier proposed offering 17.8% of the parent and 30% of each of the subsidiaries.

Spiraling Crisis

China's property slump is deepening despite policy measures to put a floor the market's slump that began three years ago with a crackdown on the industry's reliance on debt. The International Money Fund warned earlier this year that the trouble could spill over to the financial industry and local government if confidence is not restored.

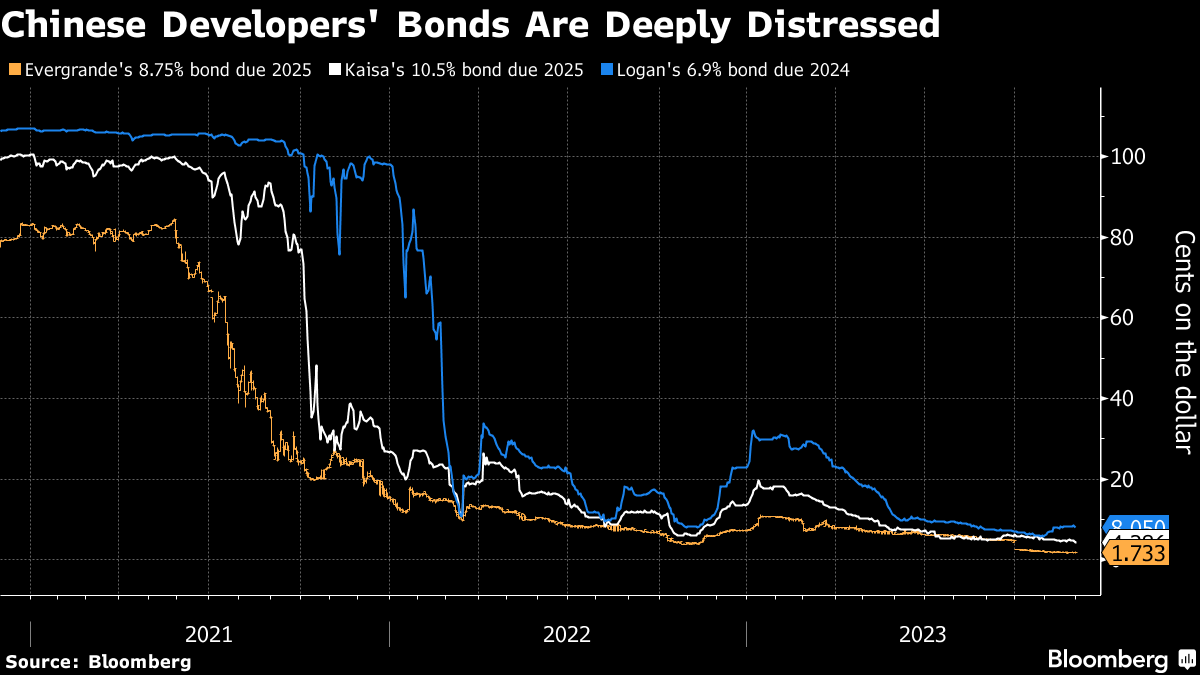

Evergrande has become a poster child for China's real estate troubles since the builder defaulted two years ago. It reported a combined loss of $81 billion in 2021 and 2022.

After several delays in bringing forward a restructuring plan, the Shenzhen-based company tried to secure creditor approval for its offshore-debt proposals in late August before delaying the meetings further, leaving the rescue in limbo.

The developer's lawyer said earlier this year that Deloitte estimated the recovery rate for the company's notes would be 3.4% on average if the firm is liquidated compared with 22.5% in a restructuring.

The petition for liquidation was filed in June 2022 by Top Shine Global Limited of Intershore Consult (Samoa) Ltd., which was a strategic investor in the homebuilder's online sales platform, and subsequently became a consolidated class action for other frustrated creditors.

When asked whether the ad-hoc group would step in to continue to push for a wind-up if the petitioner dropped the lawsuit, McDonald, the legal advisor for creditors, said “likely, yes.”

A separate lawyer representing bondholders said Evergrande's latest proposal will lead to a “materially worse recovery” compared to a liquidation.

Evergrande's billionaire chairman Hui Ka Yan, meanwhile, is under police control on “suspicion of illegal crimes,” according to a company statement in September. Three mansions connected to him on Hong Kong's Peak have been seized by creditors, two of them in recent days.

His company's restructuring plan in March proposed swapping defaulted debt for either new notes maturing in 10 to 12 years or a combination of new debt and equity-liked instruments.

Its lawyer said in a hearing in October that Evergrande was mulling a new restructuring proposal, one that would offer new shares in its units to creditors. That argument won what the judge had called back then “a final adjournment” of the hearing.

--With assistance from Venus Feng and Alice Huang.

(Adds more comment from creditor representatives)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.