(Bloomberg) -- With losses deepening this week, Chinese stocks are trading at their biggest discount to emerging-market peers in a quarter of a century.

Losses on equities in China, whose credit outlook was cut to negative by Moody's Investors Service on Tuesday, have so far erased some $500 billion of shareholder wealth this year after major indexes tumbled as much as 16%. A gauge of developing-nation stocks excluding China, by contrast, has rallied 13%, adding about $2 trillion in market value.

The divergence, not seen since at least 1998, shows how the influence of the world's second-biggest economy on developing-nation assets is waning as a slowdown in growth, debt overhang and property crisis drive away foreign participation. Investors are also concerned about geopolitical tensions and the risk of regulatory interventions by Chinese authorities.

Meanwhile, a buoyant US economy and expectations for interest-rate cuts by the Federal Reserve next year have been bolstering other developing nations in recent months, although key gauges fell on Tuesday, with the MSCI emerging-market stocks index dropping 0.9% as of 1:20 p.m. in London, and its currencies counterpart falling 0.3%. The MSCI China Index slid as much as 2.3%.

Also on Tuesday, Turkish lira bonds surged for a second day amid signs that foreign investors were returning to a market they'd long ago abandoned. Egyptian dollar bonds of varying maturities also surged, accounting for all 10 of the biggest gainers in emerging markets worldwide.

South Africa's rand led declines among currencies in Europe, the Middle East and Africa as data showed its economy contracted more than forecast. The Hungarian forint led gains and is on track for its first year of increases since 2016.

Here are five charts showing how China has been languishing other emerging markets:

Relative Performance

The MSCI China Index has tumbled 15% this year in both local-currency and dollar terms. Its underperformance, which began in October 2020, has taken the gauge to the lowest level since at least 1998 against the MSCI Emerging Markets Ex-China Index.

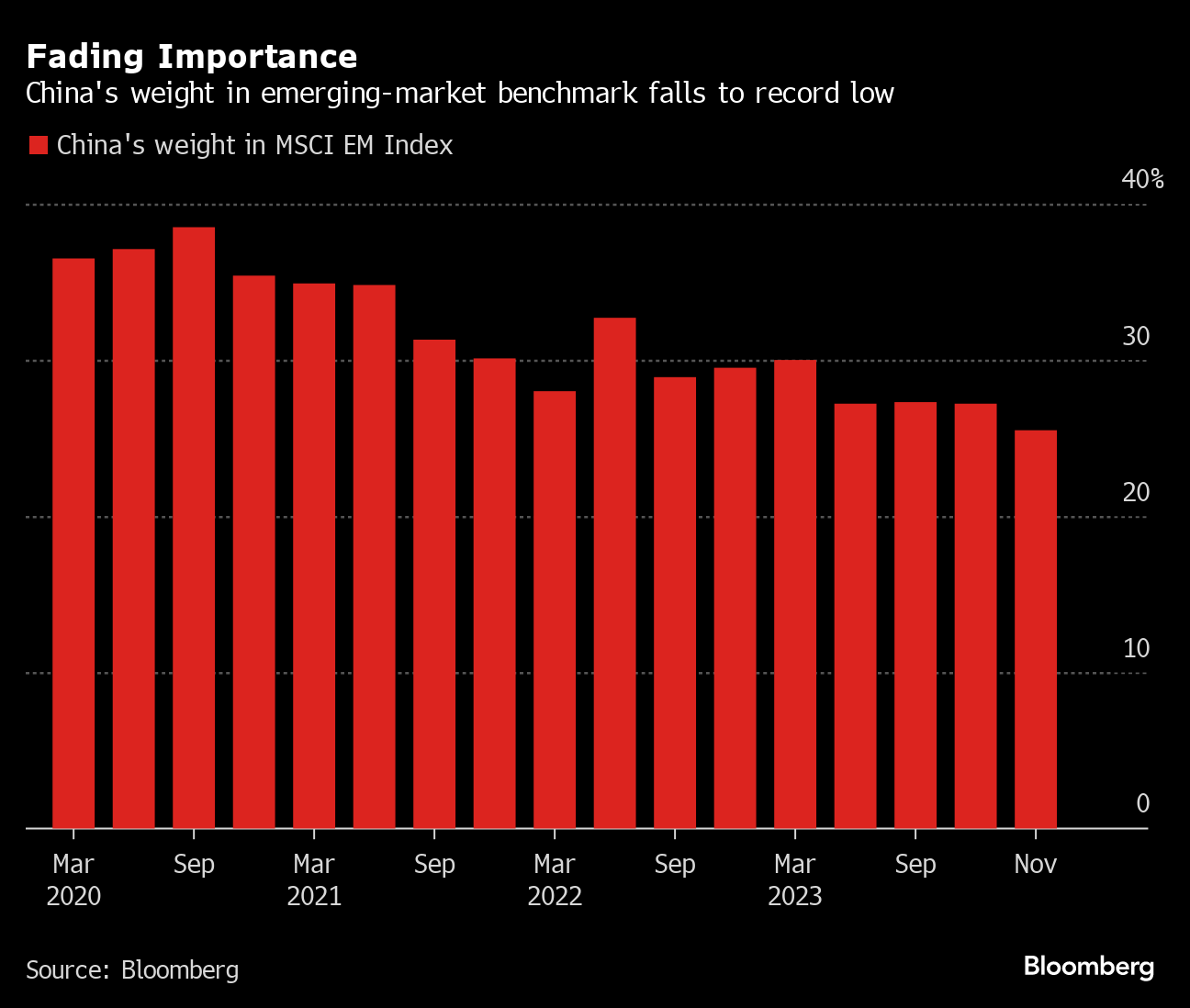

Index Weights

The underperformance has reduced China's weight in the MSCI Emerging Markets Index to 25.5%, from more than 38% three years ago. China no longer dominates emerging markets the way the US commands the MSCI World Index of developed-market stocks, where it enjoys a 69% weight.

Earnings Estimates

The year began with analysts raising their earnings estimates for China while lowering them for the rest of emerging markets. That changed once expectations for a robust recovery in the world's second-biggest economy have shown to be wrong. Smaller developing nations have not only erased that lag in earnings forecasts, but have also overtaken China.

Valuations

Investors are now willing to pay a 41% premium for stocks in emerging markets other than those from China. Based on forward price-earnings ratios, this valuation mark-up is the highest since the Federal Reserve started to hike interest rates in early 2022.

Market Capitalization

Benchmark indexes may show a roller-coaster performance for 2023, but individual developing nations have rallied handsomely, with at least 25 of them handing investors returns of 10% or more. The combined market capitalization of emerging markets continues to grow, while that of China is shrinking.

(Updates with market moves throughout.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.