(Bloomberg) -- Walt Disney Co.'s India unit is being valued at less than half of what it hoped for in a proposed merger with Indian billionaire Mukesh Ambani's media business, reflecting the struggle global media giants face in one of the world's fastest-growing entertainment markets.

After weeks of negotiations following a non-binding pact with Ambani's Reliance Industries Ltd. to merge their entertainment business, Disney's India assets are valued at around $4.5 billion, less than the $10 billion the US entertainment giant has previously pursued, according to people familiar with matter, who asked not to be identified as the discussions are private.

The lower-than-expected figure is also due in part to a write-off of revenue originally due to Disney from its sale of cricket TV rights to embattled Zee Entertainment Enterprises Ltd., which is now expected to be unable to pay up.

No final decision has been made on the deal and its terms, and either party can still call off the transaction, according to the people.

The combined entity will be valued at as much as $11 billion, with Disney taking about a 40% stake. Reliance will have a 51% stake, with the rest held by James Murdoch's Lupa Systems LLC. The two companies aim to sign a binding deal in February, the people said.

A Disney India representative declined to comment. A Reliance spokesperson said the company doesn't comment on speculation.

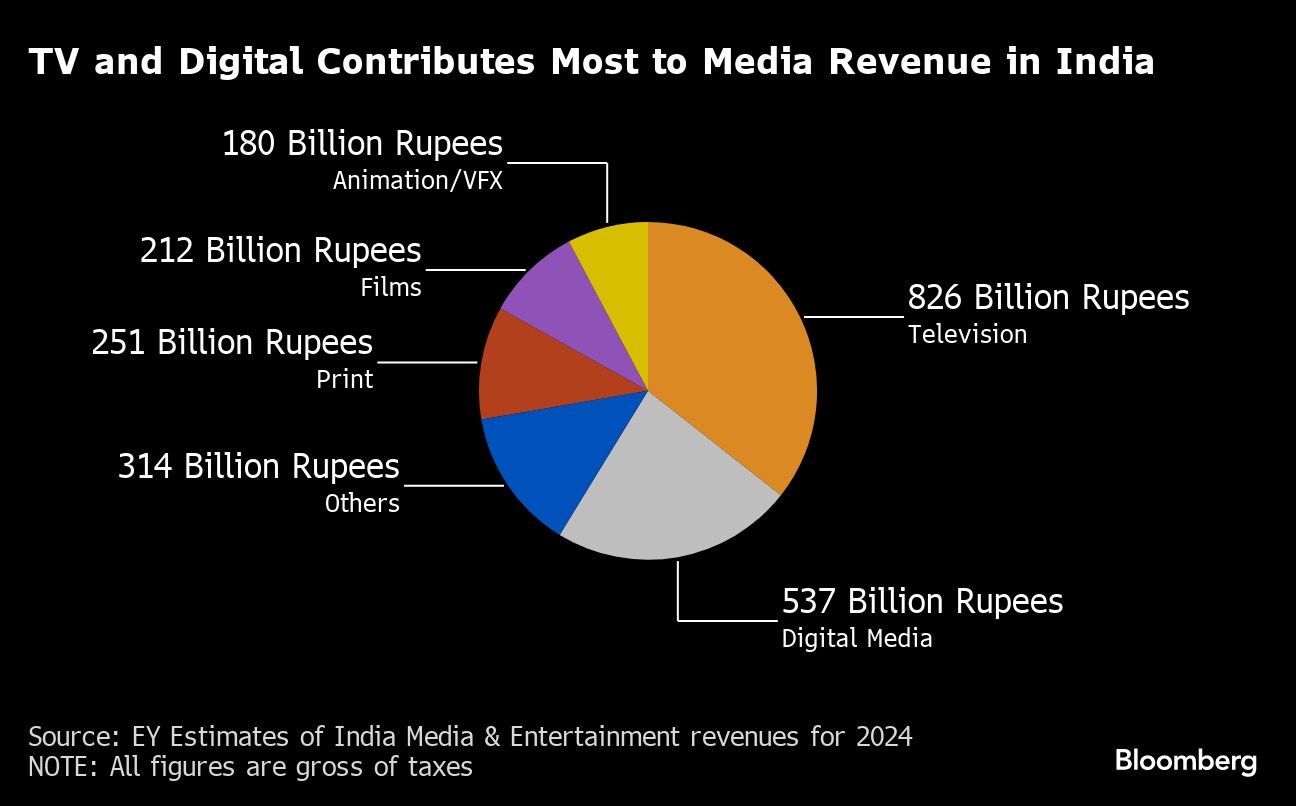

The merger, should it go through, will deepen Ambani's push into the media and sports industries and further consolidate India's $28 billion media and entertainment market. The collapse of a proposed $10 billion merger between Sony Group Corp.'s India unit and Zee Entertainment has also cleared a potential major competitor.

Disney's pursuit of a merger with Reliance comes as it struggles to retain subscribers amid intensifying competition with local rivals. In 2022, Ambani outbid Disney to get the streaming rights to the Indian Premier League for $2.7 billion and broadcast the popular domestic cricket tournament for free. That prompted Disney to adopt the same strategy, streaming Cricket World Cup matches in 2023 for free and drawing record viewership.

--With assistance from Baiju Kalesh.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.