Diageo India Pvt. has issued a clarification on recent media reports on its Chief Executive Officer Hina Nagarajan receiving summons from the anti-corruption police in New Delhi. The company has called them "grossly misleading".

Nagarajan, who is CEO and managing director of Diageo's majority-owned company United Spirits Ltd., was reportedly summoned in a case pertaining to billing and discount practices involving government agencies that ran liquor retail shops between 2017 and 2020.

The summons asked Nagarajan to provide several documents related to the company's sales, Reuters reported. Diageo holds approximately 56% ownership in United Spirits.

"This is to bring to your attention that a prominent news wire has published an article on July 25, 2024 titled, ‘Diageo India's CEO summoned by Delhi city police in liquor payments case', which is grossly misleading as it distorts facts pertaining to a routine information and fact-finding exercise being carried out by government authorities," the company said in the clarification.

"We have received a notice that we believe may have been sent to other manufacturers as well. Such notices from regulatory authorities requesting information are usually addressed to the company head—this is a routine process," the statement said.

The company is cooperating with the authorities, it said. Diageo India has always maintained the highest standards of regulatory compliance and the headline and article suggesting any kind of culpability is irresponsible reportage, it said.

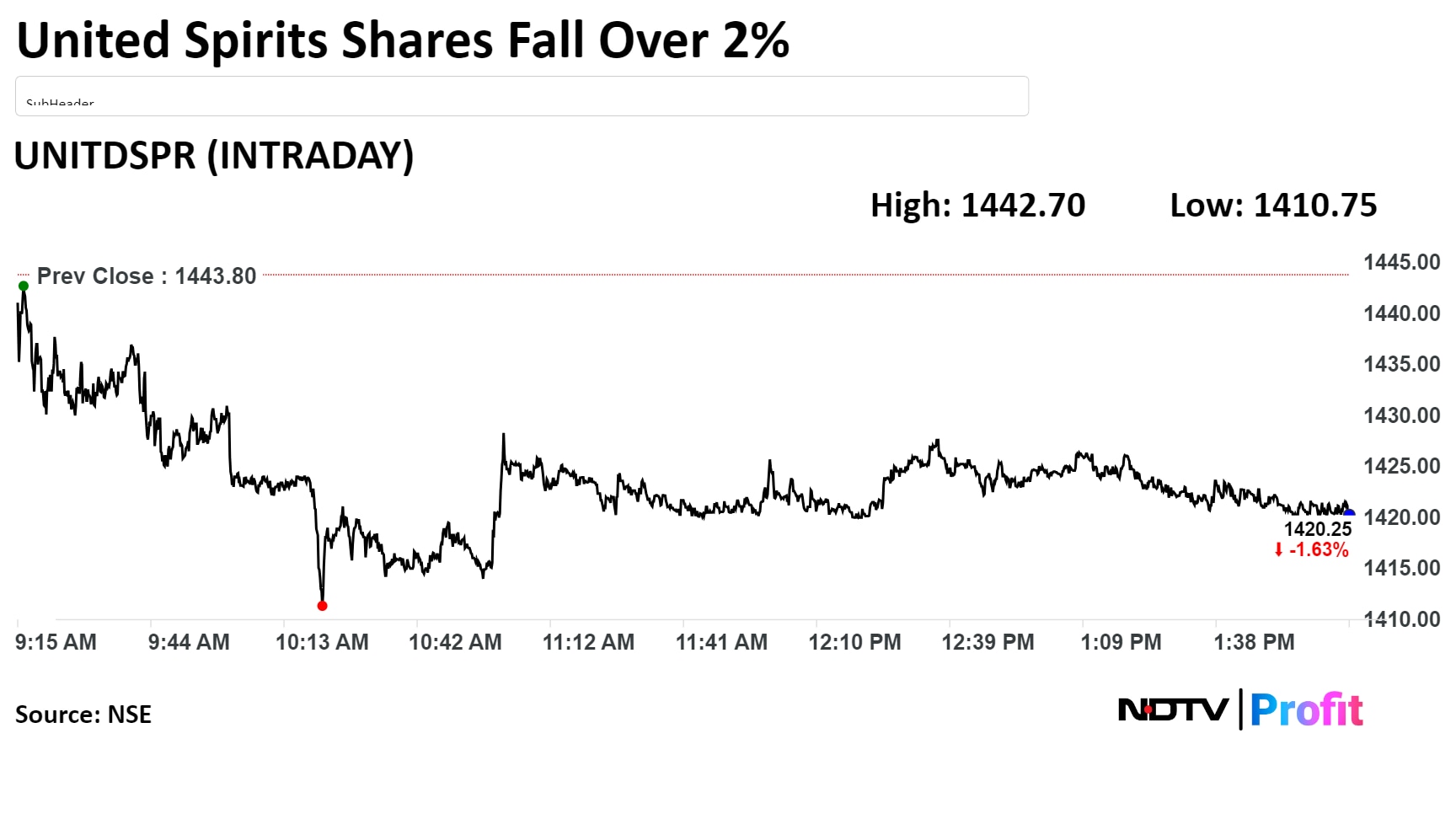

Shares of United Spirits Ltd. fell as much as 2.29% to Rs 1,410.75 per share, compared to a 1.53% advance in the NSE Nifty 50 as of 2:04 p.m.

The stock has rose 44% in the last 12 months and rose 27% on a year-to-date basis. The relative strength index was at 74, indicating that the stock is overbought.

Twelve out of the 24 analysts tracking the company have a 'buy' rating on the stock, eight recommend a 'hold' and four suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 2.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.