A slump in Indian company foreign-currency loans to an 11-year low is raising concerns that weaker borrowers may struggle to refinance a record amount of maturing debt amid the pandemic.

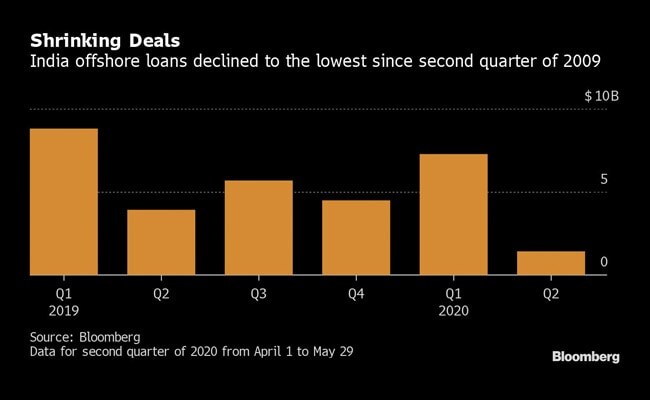

Local firms have secured $1.4 billion from offshore loans since April 1, down from $7.3 billion in the first quarter, according to data compiled by Bloomberg. Their overseas bond issuance has also dropped. The Covid-19 crisis has further crimped options for foreign-currency funding, worsening a credit crunch sparked by the collapse of shadow lender IL&FS in 2018.

Harder access to overseas financing adds to liquidity pressures for Indian borrowers, especially with Asia's third-biggest economy expected to shrink this year for the first time in more than four decades. Even with a $265 billion stimulus from Prime Minister Narendra Modi's government to help cope with the impact of the pandemic, some global banks are becoming wary of lending on concerns India's nationwide lockdown will erode corporate credit profiles.

Indian companies face a massive amount of loans and bonds to roll over, with $31 billion of offshore debt maturing this calendar year, and $34 billion next year. The need for non-rupee financing has become more acute as bloated government borrowing this fiscal year risks crowding them out of the local-currency credit markets.

"International lenders are becoming cautious while considering increasing commitments to borrowers in India in the current uncertain environment," said Sandeep Bhatt, a Mumbai-based senior regional manager for India at Export Development Canada. "This poses an increased refinancing risk for companies with weaker credit."

Among local firms with the most offshore loans and bonds to refinance through December is Tata Steel Ltd., whose credit rating was cut deeper into junk at Fitch Ratings last month. Distressed borrowers including Dewan Housing Finance Corp. and Reliance Communications Ltd. also have debt maturing this year.

Representatives of Dewan Housing Finance, Reliance Communications and Tata Steel didn't immediately reply to emails seeking comments on any refinancing plans.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.