Edtech firm Byju's valuation in long-time investor Prosus' books has been marked down yet again, this time to below $3 billion, down over 86% from its once $22-billion worth.

“We are not disclosing the (exact) valuation, but it is sub-$3 billion,” said Ervin Tu, interim chief executive officer of Prosus, in its earnings call for the first half of FY24.

In June earlier this year, Prosus had cut Byju's valuation to $5.14 billion. The Netherlands-based investor, which has invested $536 million in Byju's since 2018, holds a 9.6% effective stake in the company.

Prosus said that as of September 2022, it "no longer exerts significant influence over the financial and operating policies" of Byju's.

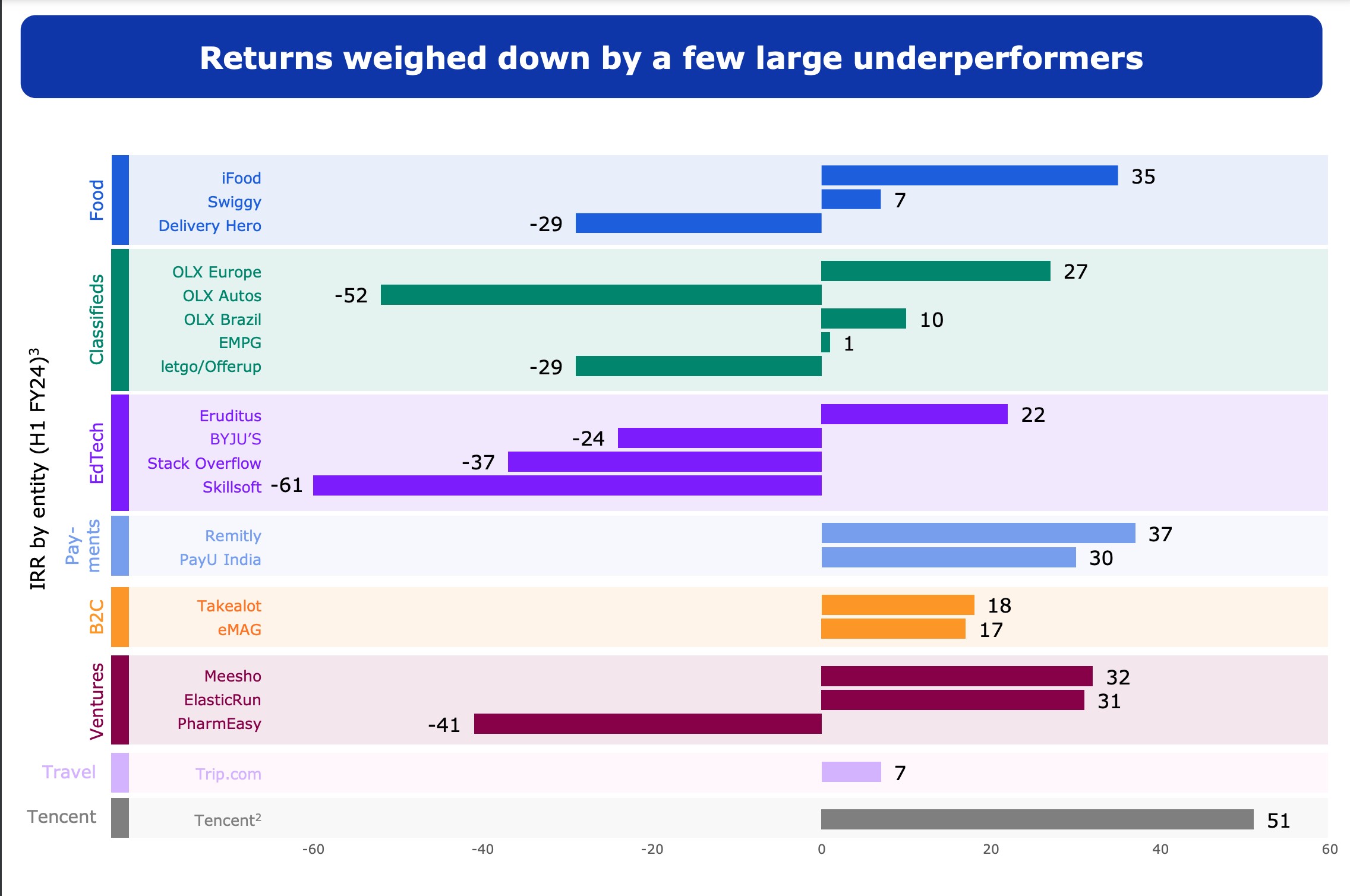

Overall, Prosus' internal rate of return fell considerably, which it attributed to a "few large underperformers," including Byju's and Pharmeasy.

However, Prosus' India payments business, PayU, performed well, driven by India payments and credit businesses.

"India is Prosus' largest market in the core PSP segment, contributing around 48% of revenues. In the first half of FY24, PayU's revenues grew significantly, driven by growth from existing merchants, Wibmo and its omnichannel business," the company said in a press statement.

Byju's troubles have amplified over the last two weeks, with the edtech giant being dragged to NCLT by the BCCI as well as over Rs 9,300 crore worth of showcause notice being slapped on it by India's Enforcement Directorate.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.