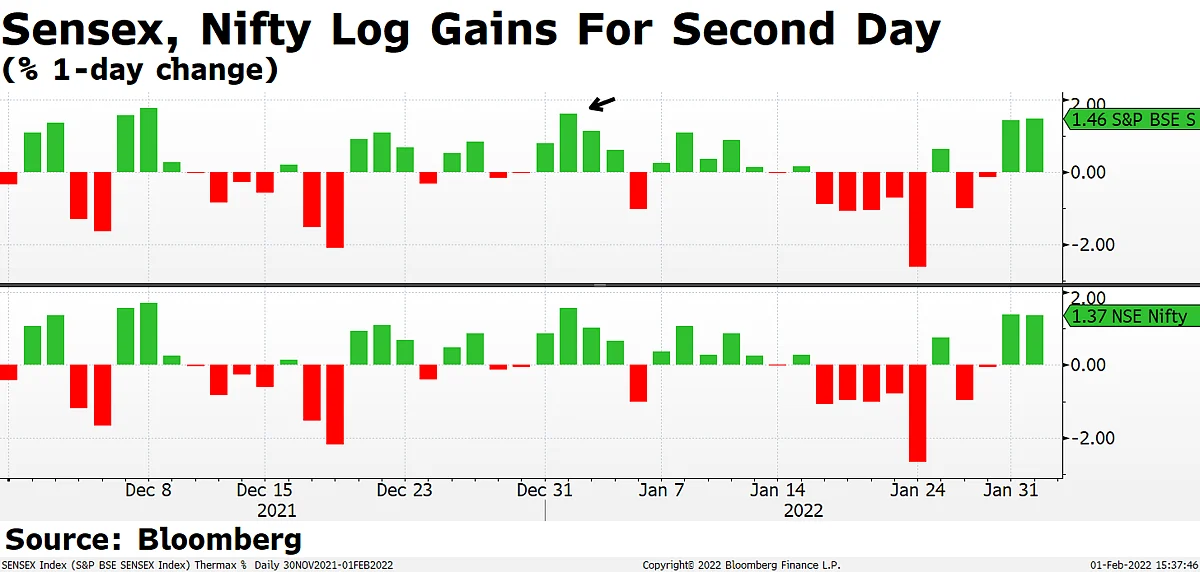

Sensex, Nifty Log Second Best Day In Nearly Two Months

Catch live updates on share prices, index moves, corporate announcements and more from the Sensex and Nifty, on Budget Day 2022.

- Oldest First

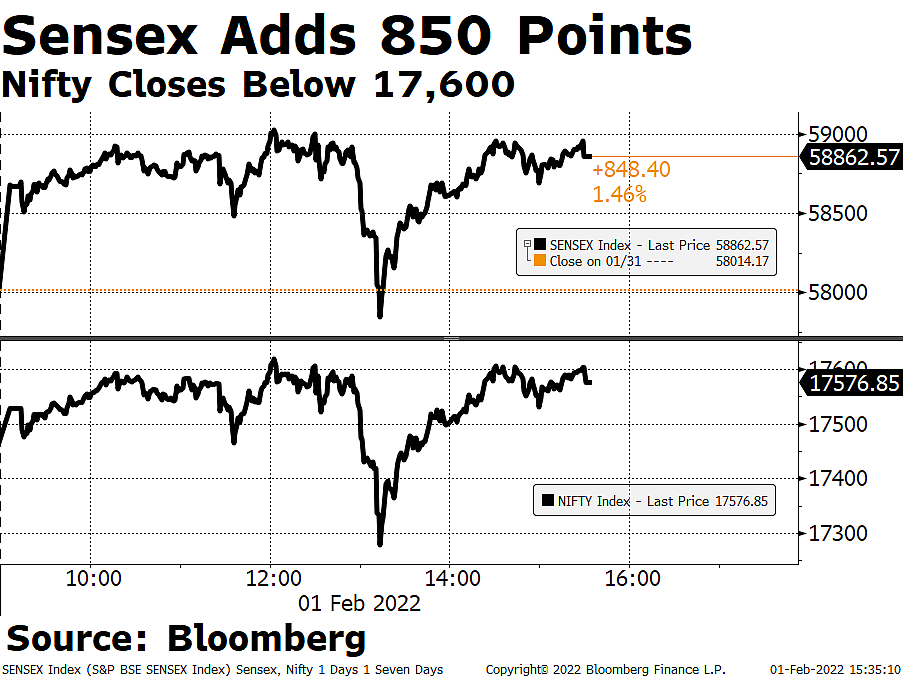

Closing Bell

India's stock benchmarks logged their second best day in nearly two months, aided by gains in metals, capital goods, basic materials, as stocks held on to their gains after Finance Minister Nirmala Sitharaman presented budget 2022.

The S&P BSE Sensex rose 1.46% to 58,862.57. The 30-stock gauge added over 1,000 points to an intraday high of 59,032.20. The NSE Nifty 50 also advanced by similar magnitude to 17,576.85. The 50-stock gauge gained nearly 300 points to an intraday high of 17,622.40.

The broader indices underperformed their larger peers with both the S&P BSE MidCap and S&P BSE SmallCap rising 1%. Barring S&P BSE Telecom, S&P BSE Energy, S&P BSE Auto, S&P BSE Oil & Gas indices, all the other 15 sectoral indices compiled by BSE Ltd. advanced with S&P BSE Metal adding nearly 5%.

The market breadth was skewed in the favour of bulls. About 1,762 stocks advanced, 1,585 declined and 102 remained unchanged.

"Despite a roller-coaster session, markets ended with solid gains, as investors cheered the government's focus on higher growth and capital expenditure boost in the Budget. The north-bound trend was also aided by overnight gains in the US market and a strong European markets trend in early trades", Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities Ltd. and added that "on daily charts, the market maintained an uptrend continuation formation and after a long time, it succeeded to close above the 50 day SMA which is broadly positive. For the day short-term traders, 17,400 and 17,250 would be key support levels to watch out for. Above the same, the Nifty would touch the level of 17,750-17,850. However, if the index slips below 17,500, a quick intraday correction could drag down the index up to 17,400-17,350 levels".

Cryptocurrencies, Virtual Digital Assets To Be Taxed At 30%

ITC, Godfrey Phillips India Gain As Government Leaves Taxes On Cigarettes Unchanged

Shares of Cigarette makers ITC and Godfrey Phillips India rose after India's budget did not propose any change in taxation of tobacco products, in a relief for the sector.

ITC is expected to see its EPS growing at 11%, with the stock attractively placed at 16.5 x price-to-earnings with a dividend yield of 5.5%.

Analysts expect ITC to report 6% YoY volume growth in FY23 with profits from tobacco sale rising 12% YoY.

Source: Bloomberg

FY23 Budget People-Friendly & Progressive, Says PM

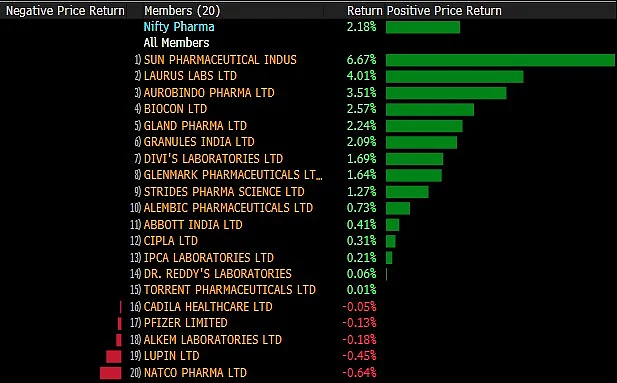

Sun Pharmaceuticals Leads The Gain In Healthcare Stocks