(Bloomberg) -- Fifteen years of economic stagnation have left the typical UK household £8,300 ($10,550) poorer than peers in countries like France and Germany, according to a major report on the state of the nation.

The finding from the Resolution Foundation and the Centre for Economic Performance at the London School of Economics accompanied proposals to shake the UK out of its economic malaise by boosting growth, raising living standards and cutting inequality.

The 300 page report could help shape the agenda for a Labour government under its leader Keir Starmer if they win the next election.

The researchers proposed sweeping measures to boost productivity by closing the wealth gap between Britain's cities, championing services exports and increasing public investment.

“The UK has now seen 15 years of relative decline, with productivity growth at half the rate seen across other advanced economies,” Resolution said in the 300-page final report from its “Economy 2030 Inquiry,” a collaboration with the LSE.

The task is “huge but not insurmountable,” Resolution said. Were Britain to close the average income and inequality gap with Australia, Canada, France, Germany and the Netherlands, “the typical household would be 25% — £8,300 — better off, with income gains of 37% for the poorest households.”

Starmer and Chancellor of the Exchequer Jeremy Hunt will speak at an event in London on Monday to launch the report, with further comments from Bank of England officials and prominent economists.

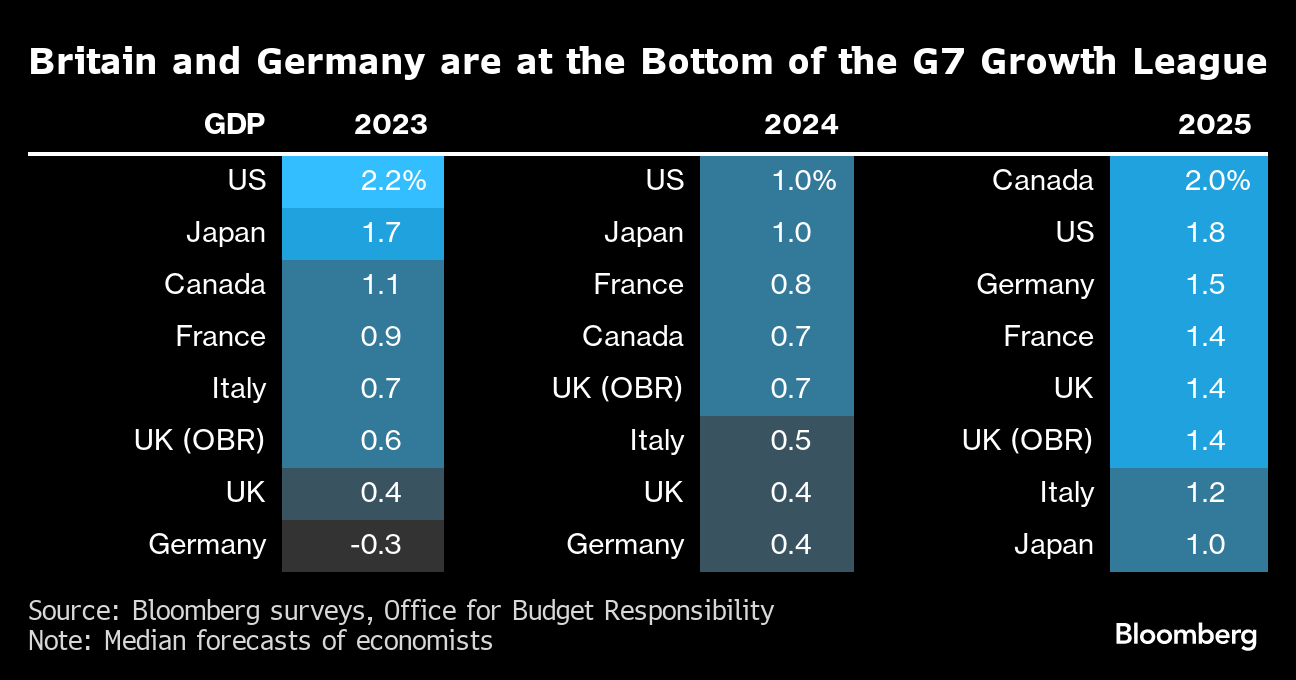

The event reflects growing concerns across the political spectrum about Britain's lagging economic performance since the global financial crisis in 2008. Growth has slowed and productivity, which is vital to raising living standards, has been particularly weak relative to equivalent nations.

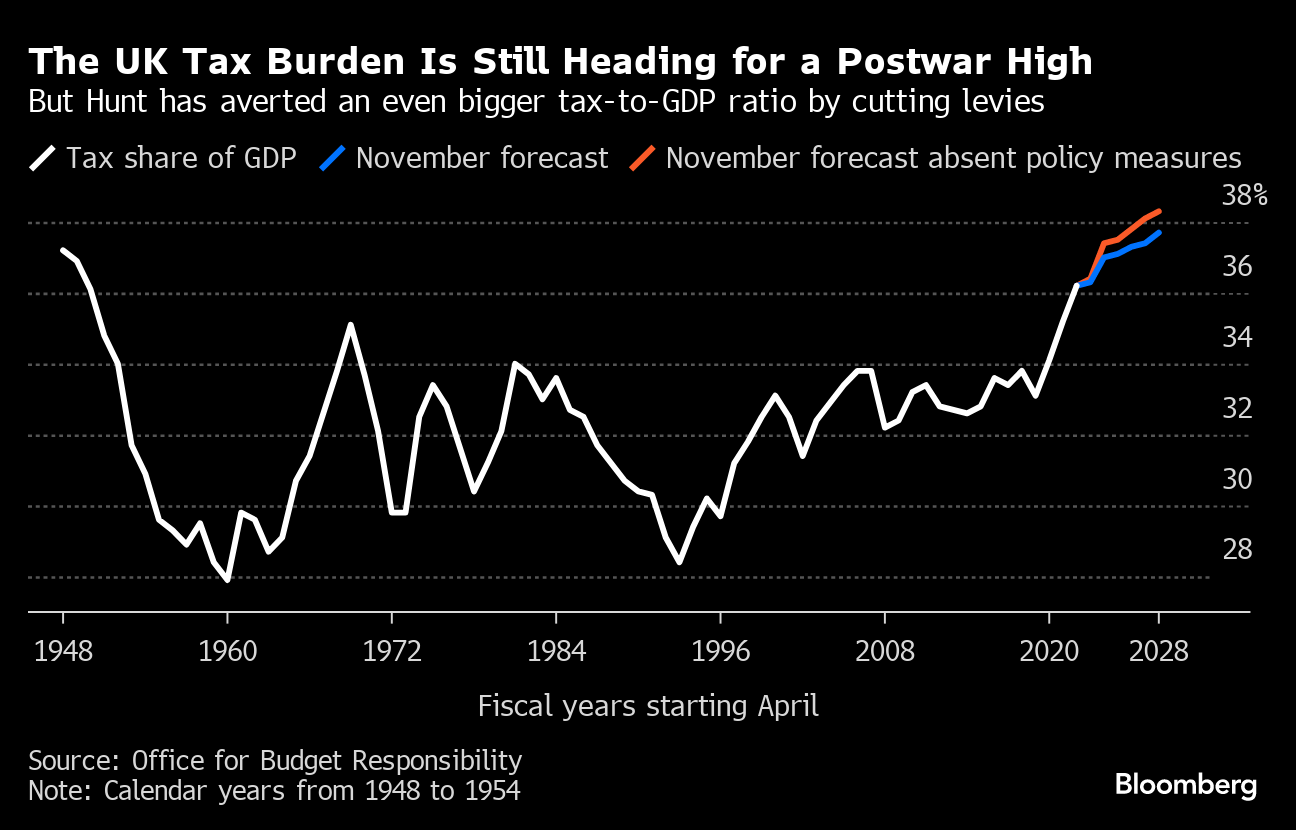

The government's current plans “are not serious,” Resolution said, just days after the Autumn Statement, when Hunt cut £20 billion of taxes but signalled public services faced big budget cuts.

Prime Minister Rishi Sunak has put boosting the economy and slashing inflation at the heart of the government's agenda, claiming Labour's plans would threaten the progress that has been made.

“We have turned a corner,” Sunak told reporters with him for the COP28 climate talks in Dubai. “We have grown the economy, and we are now focused on controlling spending and controlling welfare so we can cut taxes. The Labour Party want to borrow £28bn a year. That's just going to push up inflation.”

Resolution said a new economic strategy is needed and politicians must be honest about the trade offs involved. The think tank called for more public investment and funding for public services, but said taxes need to rise.

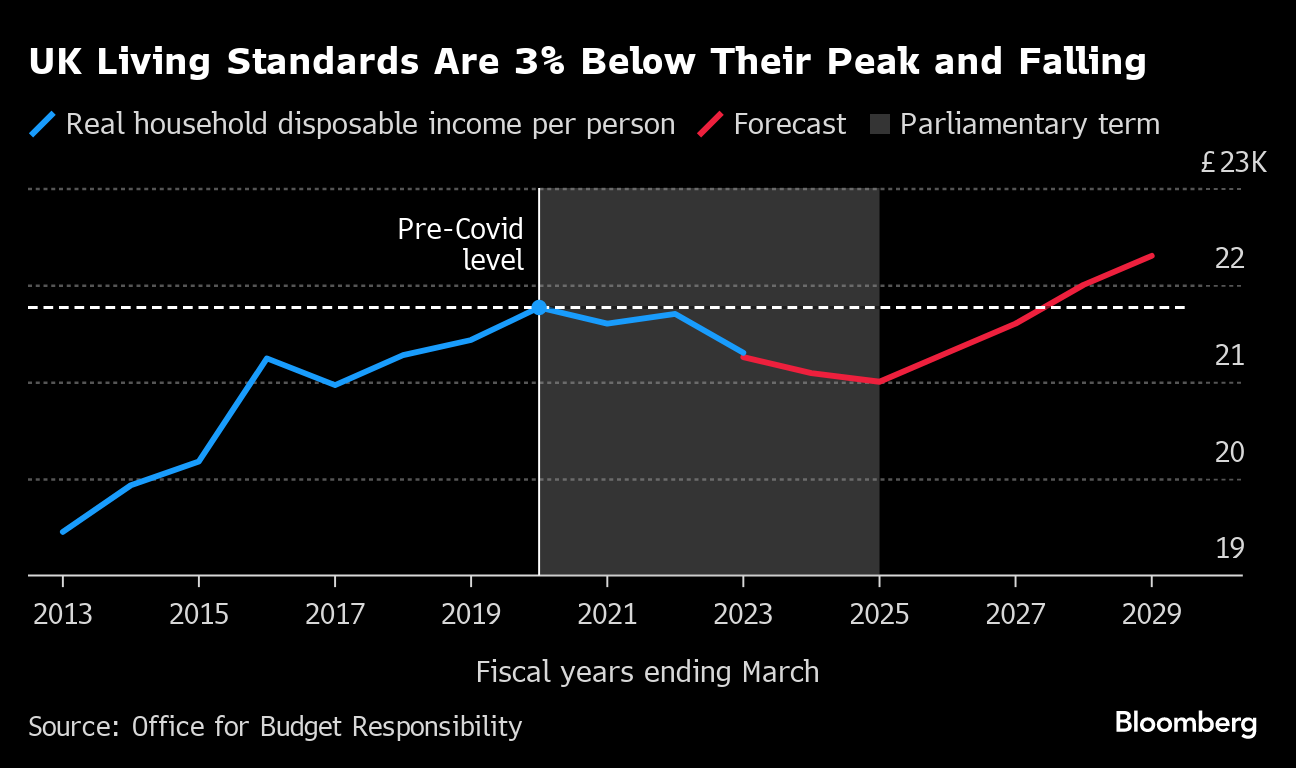

For now, the current strategy has left the economy sputtering and workers getting poorer in real terms as productivity has fallen behind other comparable nations.

As a result, Wages in Britain have flatlined, costing the average worker £10,700 a year in lost pay growth, according to the report. Nine million younger workers have never worked in an economy with sustained average wage rises.

The findings chime with analysis by Bloomberg economists Dan Hanson and Ana Andrade, who calculated that hourly labor productivity in the UK is 24% below where it would be had it maintained its pre-financial crisis trend.

They found that a lack of investment explained a quarter of the gap, with less innovation and a slowdown in the adoption of new ideas accounting for the remainder.

What Bloomberg Economics Says ...

“Jeremy Hunt found out first hand in his Autumn Statement how hard it is to move the needle on the UK's subdued long-term growth trajectory. At the heart of the challenge — unlocking faster productivity gains, which have slowed to a crawl over the past 15 years. Lifting investment spending, aiding the flow of capital to where it's needed most, taking advantage of opportunities presented by artificial intelligence and opening up the economy to trade should all be part of that plan. There will need to be some tough fiscal choices along the way.”

—Dan Hanson and Ana Andrade, Bloomberg Economics. Click for the INSIGHT.

Resolution estimated that its plan could boost gross domestic product by 7% over 15 years. Higher taxes and stronger growth are needed to “raise investment, rescue public services, and repair public finances.”

Public capital spending needs to to 3% of GDP to close the living standards gap with similar countries. The current government plans to cut investment to 1.8% of GDP by 2028-29. Investment should be increasingly funded by domestic savings, not borrowing from abroad, it added.

--With assistance from Andrew Atkinson and Ellen Milligan.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.