The energy sector benefited immensely from the Russia-Ukraine war. As crude oil prices hit the roof, oil companies saw revenues skyrocket on the back of higher realisations.

In turn, they rewarded shareholders with dividends and bonus issues.

GAIL India is one of these energy companies to treat its shareholders with bonus shares.

Here is all you need to know about the company's bonus issue.

- GAIL announced bonus shares on 27 July 2022.

- The company will issue bonus shares in a ratio of 1:2. This means one bonus share for every two existing shares.

- The record for the same is 6 September 2022.

Previously, the company did a bonus issue in 2019. It issued bonus shares in the ratio of 1:1. This bonus issue is to double its share capital and diversify business beyond natural gas transmission.

GAIL has sought approval to increase the share capital to Rs 100 bn from Rs 50 bn. It has planned a capex of Rs 300 bn over the next 3-4 years.

The company is looking to diversify into the specialty chemicals business. It is also looking for an acquisition in solar glass and module manufacturing. This acquisition will be along with the setting up of wind and solar power plants.

Apart from this, it also wants to set up ethanol manufacturing plants.

The issue of bonus shares will increase the liquidity making it more affordable for investors.

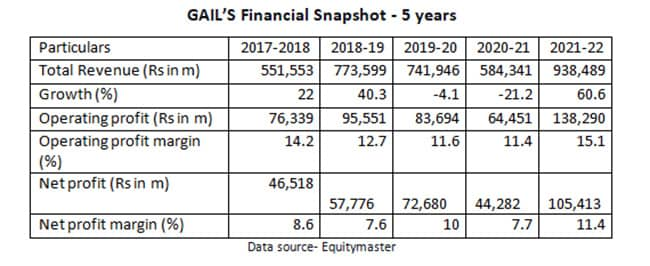

A Look At The Financials

For the financial year 2022, the company's revenue was up 73% YoY at Rs 9.4 tn. Net profit saw a 138% YoY growth and came in at Rs 1.1 tn.

This was on the back of a higher natural gas sales margin. As part of the expansion, it is laying natural gas truck pipelines to create a national gas grid.

This will double the share of natural gas in the primary energy basket to 15% in GDP by 2030.

Earlier this year, GAIL kicked off the nation's first project for blending hydrogen into the natural gas system.

The company also declared a final dividend of 100%, amounting to Rs 10 per share.

Over the last five years, GAIL's revenue has grown at a CAGR of 13.7%, while net profit has grown at a 24.2% CAGR.

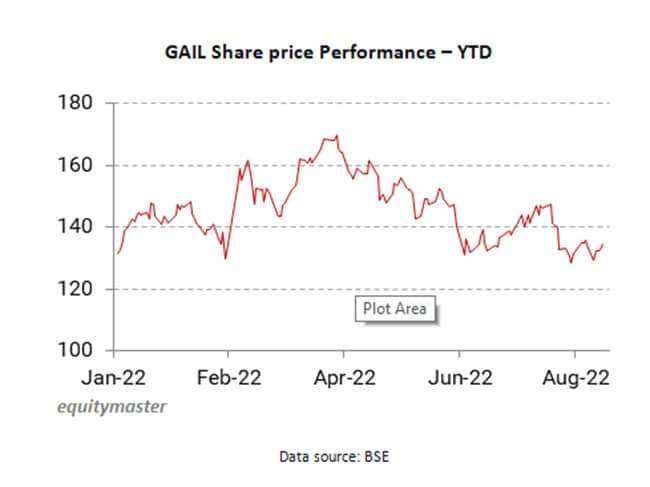

How Shares Of GAIL Have Performed Recently

GAIL's share price is down 8.9% in the past month. However, on a YTD basis, the shares are trading higher by 1.6%.

GAIL is one of the leading green hydrogen companies in India but has fallen due to macroeconomic headwinds.

The stock touched its 52-week high of Rs 173.5 on 19 April 2022. Its 52-week low was Rs 125.2 on 20 December 2021.

GAIL is currently trading at a PE (price to earnings) multiple of 4.9 times.

About GAIL

GAIL India, a government of India undertaking, is an integrated natural gas company in India.

The company is an integrated energy company along with natural gas value chain with global footprints. It's in the business of natural gas, liquid hydrocarbons, and petrochemicals.

It owns over 11,500 km of natural gas pipelines, over 2,300 km of LPG pipelines, six LPG gas-processing units, and a petrochemical facility.

It also has a joint-venture interest in Petronet LNG, Ratnagiri Gas and Power, and the CGD business in several cities.

GAIL has owned subsidiaries in Singapore and the US. It is for expanding its presence outside India in LNG and shale gas assets.

You can compare GAIL with its peers on our website: GAIL vs Petronet LNG.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

This article is syndicated from Equitymaster.com.

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.