(Bloomberg) -- BlackRock Inc. says market optimism over the scope of interest-rate cuts next year may be going too far and recommends stepping back from longer-maturity bonds.

While some traders are positioning for the Federal Reserve to start cutting rates as soon as the first quarter, BlackRock strategists expect the easing will only begin in the middle of the year.

“We see the risk of these hopes being disappointed,” strategists including Wei Li and Alex Brazier wrote. “Higher rates and greater volatility define the new regime.”

In that environment, the asset manager prefers short- and medium-maturity bonds as a source of income, but is staying underweight long-dated Treasuries in its strategic allocation, according to the 2024 Global Outlook published by the BlackRock Investment Institute.

As rates are expected to remain above pre-pandemic levels, BlackRock has also downgraded its longer-term strategic view on developed-market stocks to neutral, citing rich valuations and the weak economic outlook. It's still keeping an overweight stance on AI-related companies.

Read More: Goldman Favors Options to Counter ‘Excessive' Rate-Cut Pricing

“Markets are swinging between hopes for a soft landing and recession fears,” they wrote. “This misses the point. The economy is normalizing from the pandemic and being shaped by structural drivers. The resulting disconnect between the cyclical narrative and structural reality is further stoking volatility.”

Supply constraints caused by geopolitics, shrinking workforces as a result of aging populations, and the transition to a low-carbon economy are driving changes that will result in lower growth, inflation stuck above official targets, and increased uncertainty, BlackRock warned. That's creating the kind of volatile environment where active managers will come into their own, the strategists said.

Out of Sync

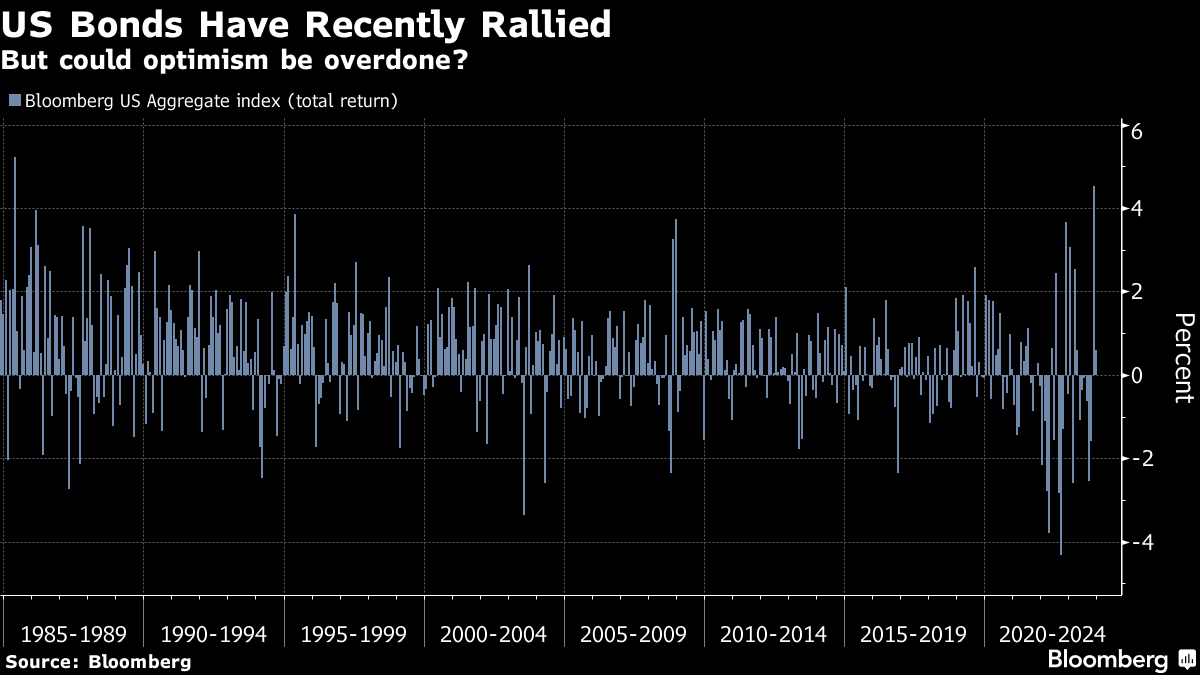

Still, the recommendations might look out of sync with recent market moves.

Stocks and bonds, whether short- or long-dated, have rallied. Volatility has tumbled as traders embrace the narrative that the Federal Reserve is finished raising rates. Now the focus is on when the Fed starts cutting, and by how much.

Traders have piled into rate-cut bets over the past few weeks as data showed inflation is easing and the economy is slowing. Money markets currently imply the Fed will start reducing rates in May, with pricing showing it and the ECB cutting by at least 125 basis points next year.

Read More: Biggest Blowout in Bonds Since the 1980s Sparks Everything Rally

The soaring US debt burden is another reason to avoid long-dated Treasuries, BlackRock said.

If borrowing costs stay near 5%, in a few years the government could find itself spending more on interest payments than healthcare benefits, the strategists wrote. That could lead to entrenched inflation and stumbling growth as central banks struggle to respond to a faltering economy with aggressive rate cuts, as they did in the past.

“This increases the long-run risk of higher inflation as central banks become less aggressive on inflation,” the report said. “We also see a rise in term premium, or the compensation investors demand for holding long-term bonds.”

Other BlackRock calls for 2024:

- Stays overweight US inflation-linked bonds on a strategic basis as it sees higher price pressures medium-term. Tactically, it recommends a neutral position given cooling inflation and focus on growth

- Underweight long-dated bonds on a strategic basis, neutral tactically

- Neutral on developed-market and emerging-market stocks strategically

- NOTE: BlackRock's strategic call has horizon of at least 5 years and tactical call is from six to 12 months

- Overweight US mortgage-backed securities

- Underweight emerging market local-currency bonds. Overweight hard-currency debt

- Favors Japanese stocks

--With assistance from James Hirai.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.