Despite Bharat Electronics Ltd.'s healthy fundamentals and first-quarter earnings, analysts remain wary of the scrip's potential upside as all the positives are priced in.

Typical of a long-cycle business, the company has had a 145% stock rally in the past 12 months, largely led by a 70% higher order intake versus management guidance, UBS said in a note.

While the brokerage remains directionally constructive on the company's earnings and order book growth, it says the stock's medium-term growth potential is priced in.

It downgraded the stock's rating to 'neutral' from 'buy', and raised the target price from Rs 333 per share to Rs 340 apiece, an upside of 5.9% from the previous close.

Net profit of the aerospace and defence company increased 46.2% year-on-year to Rs 776 crore for the quarter-ended June 30, 2024. It maintained a 15% revenue growth guidance for FY25 and expects Ebitda margin to remain in the 23-25% range.

The company's margin strength gives confidence on profitability sustaining, Jefferies said. Management mentioned there are no signs of slowdown and government indigenisation focus is on track, it said.

A robust pipeline of export orders is a surprise element, the note said. "BEL is attractively priced within Indian industrial majors and is the niche area with the highest medium-term visibility on growth prospects in the investment cycle."

Jefferies retained 'buy' with a target price of Rs 370 per share, an upside of 19% from the previous close.

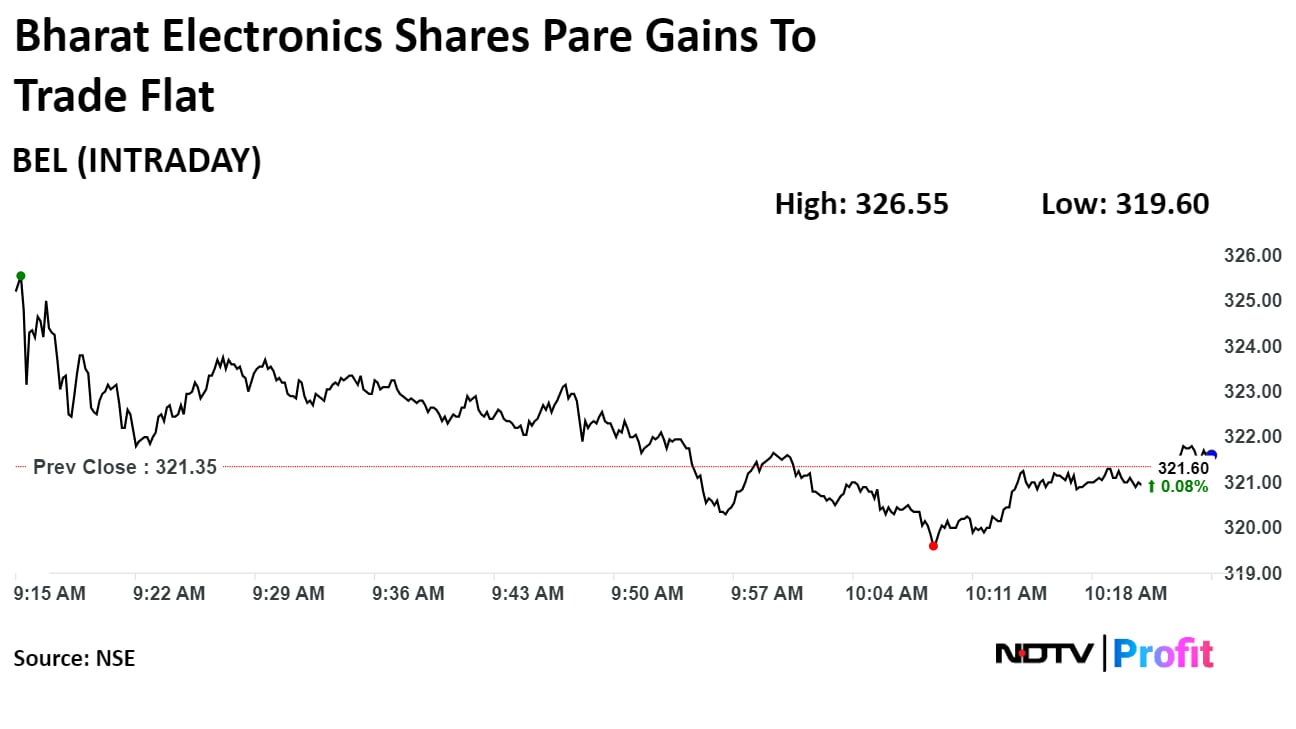

Bharat Electronics' stock rose as much as 1.62% before erasing gains to trade 0.12% lower at Rs 320.9 apiece, compared to a 0.09% advance in the benchmark Nifty 50 as of 10:22 a.m.

It has risen 142% in the last 12 months and 74% year-to-date. The relative strength index was at 56.

Twenty out of the 28 analysts tracking the company have a 'buy' rating on the stock, four recommend a 'hold' and four suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 2.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.