Bank of Maharashtra's gross advances rose 19% on a yearly basis to Rs 2.09 lakh crore in the April–June quarter according to provisional figures released by the bank.

The bank's total business rose 13.4% to Rs 4.76 lakh crore in the quarter-ended June 2024, according to an exchange filing on Thursday.

The bank reported an advance of 9.4% in deposits at Rs 2.67 lakh crore in the first quarter, as compared with Rs 2.44 lakh crore in the same period last year.

CASA ratio—the proportion of deposits that come from low-cost current and savings accounts—dipped to 49.86% from 50.97% in the year ago period. A lower CASA ratio indicates that the bank relies heavily on costlier wholesale funding, which can hurt the bank's margin.

The credit deposit ratio, that measures how much a bank lends in relation to the deposits raised, rose to 78.18% in comparison to the earlier 71.89% in the same period in the previous fiscal. The higher CD ratio indicates that the loan disbursed exceed deposits.

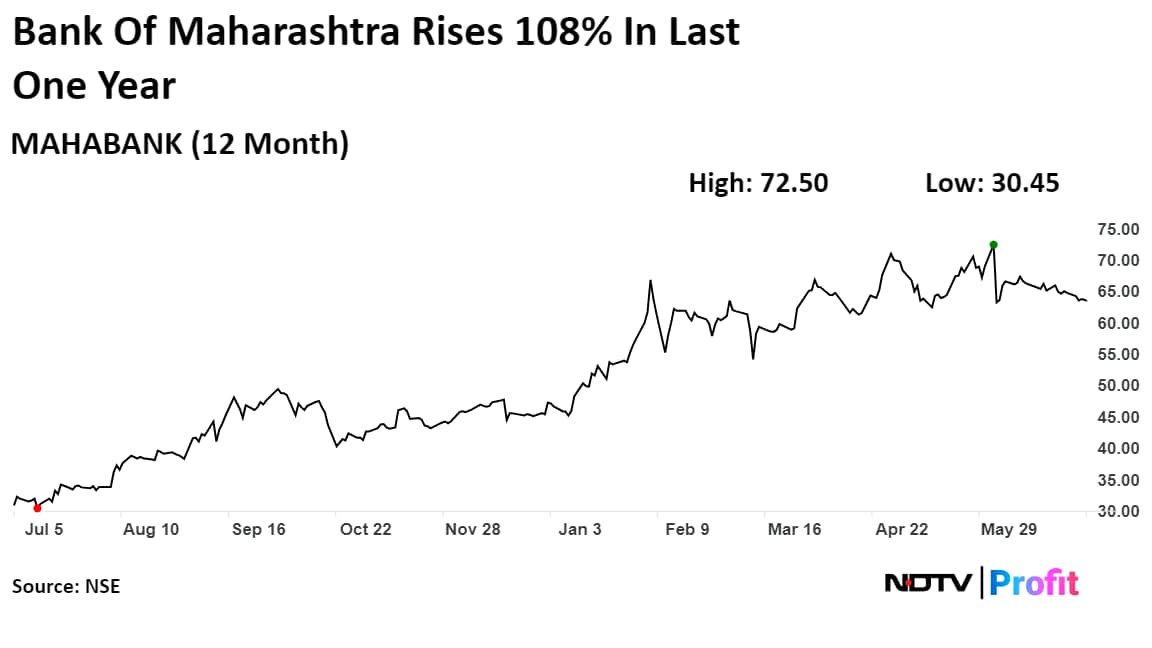

The scrip fell as much as 0.47% to Rs 63.54 apiece, the lowest level since July 2. It pared losses to trade 0.28% lower at Rs 63.66 apiece, as of 3:07 p.m., as compared to a 0.04% advance in the NSE Nifty 50.

It has risen 108.38% in the last 12 months. Total traded volume so far in the day stood at 2.3 times its 30-day average. The relative strength index was at 42.

Two analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 36.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.