Aurobindo Pharma Ltd.'s share price fell over 4% on Monday after the US Food and Drug Administrator issued 10 observations following the inspection at the company's facility in Telangana.

The inspection was conducted between Sept. 23 and Sept. 27, the Hyderabad-based bulk and generic drugmaker said in an exchange filing.

"The United States Food and Drug Administration (USFDA) inspected Unit-II, an API manufacturing facility, of Apitoria Pharma Private Ltd., a wholly owned subsidiary of the company, situated at Gaddapotharam Village IDA, Jinnaram Mandal, Sanga Reddy District, Telangana," the company said in the filing.

"The inspection closed with 10 observations," it said. The observations are "procedural in nature" and will be responded to within the stipulated time, it said.

Notably, Aurobindo Pharma was also in the news last week after UBS initiated coverage on the stock with a "sell" rating. The brokerage issued a target price of Rs 1,333, which projected a potential downside of 12% against the then market price.

In the quarter ended June 2024, Aurobindo Pharma had logged a 61% year-on-year jump in net profit to Rs 918 crore. The company's revenue grew 10% to Rs 7,567 crore.

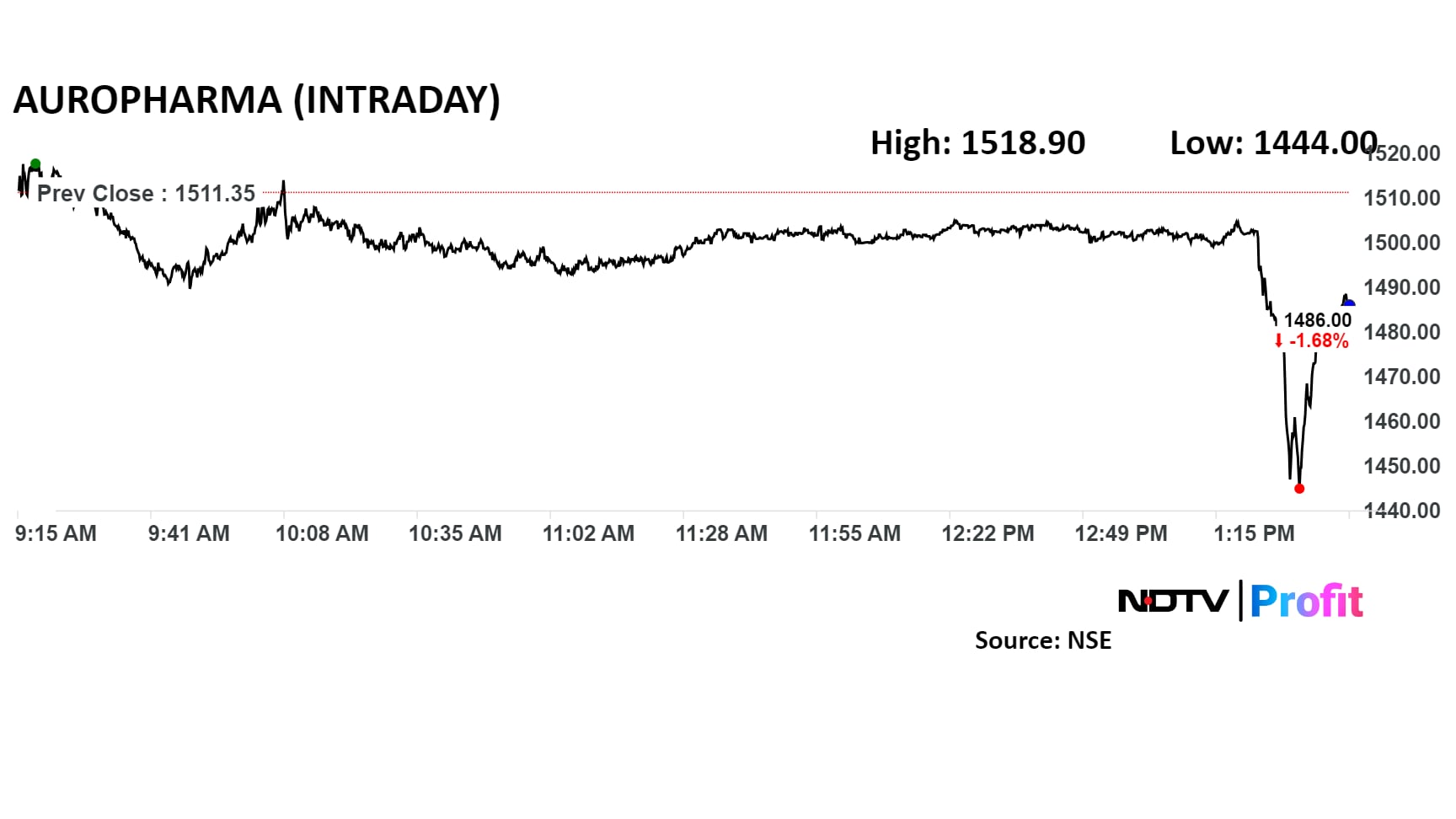

Shares of Aurobindo Pharma fell 4.49% to a low of Rs 1,443.5 apiece on the NSE. The stock later pared losses to trade 2.21% lower at Rs 1,447.90 apiece, compared with a 1.2% decline in the benchmark Nifty 50 as of 1:49 p.m.

The stock has risen 36.3% so far this year and 61.6% over the last 12 months. The stock's total traded volume so far in the day stood at 0.88 times its 30-day average. The relative strength index was at 70.1.

Twenty out of the 29 analysts tracking the company have a "buy" rating on the stock, five suggest a "hold" and four have a "sell", according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 6.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.