An asset quality review of India's banking sector conducted in 2015 helped bring out bad loans hidden under the surface. While it led to considerable pain for banks, it gave investors a clearer picture of the loan books of these lenders.

A similar quality review for non-bank finance companies by the regulator would help restore credibility to the sector and eventually reopen the debt markets for them, said Ashish Gupta, head of equity research at Credit Suisse.

“The regulator shied away from doing a comprehensive review in September-October last year,” Gupta told BloombergQuint in an interview. “The debt markets aren't comfortable with all non-banking finance companies. This (asset quality review or stress test) helps in restoring credibility to their balance sheets and debt markets will, in turn, open and become available to them.”

Without putting them to that test and without restoring credibility, if they continue to be shut out of the debt market, that is a bigger dis-service.Ashish Gupta, Head-Equity Research, Credit Suisse

Refinancing Pressure

Gupta, who was among the first to flag off a brewing corporate loan problem for Indian banks in 2012, said that restoring access of NBFCs to the debt markets is critical.

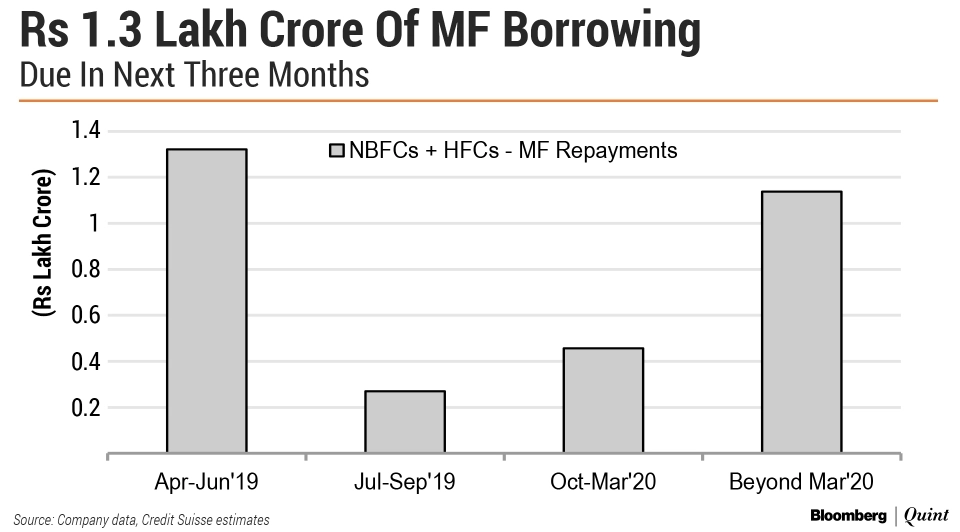

About Rs 1.3 lakh crore in debt raised by NBFCs from mutual funds comes up for repayment in the next three months. This could a “point of worry” for the sector as their ability to raise money from the debt market remained patchy.

Mutual funds have Rs 3.2 lakh-crore exposure to non-bank financial services companies, and a third of this matures over the next three months, according to a Credit Suisse report. Of this, 43 percent is in the form of commercial paper, and 80 percent of that is maturing in the quarter ended June, it said.

“The ability of mutual funds to fund NBFCs either for growth or for rollovers is getting constrained,” said Gupta while citing the slowing inflows into debt funds in particular.

Over the past six months, the funds raised by NBFCs from the debt markets have been cornered by a few large firms like HDFC Ltd. and LIC Housing Finance Ltd.

In contrast, NBFCs and housing finance companies, which are perceived to be weaker, have been starved of funds. These firms have had to rely on securitisation, public bond issues and external commercial borrowings.

Much of this liquidity raised has gone towards refinancing, which means growth has been compromised. This, in turn, further impacts the profitability and rating profile of these firms.

How do you break that vicious cycle?

“One way is some sort of equity intervention. If you bring down the leverage of these entities, then the debt market's comfort with these entities may go up,” said Gupta while adding that an RBI-driven asset quality review may be a second way to provide comfort to investors.

Housing Finance And The Real Estate Sector

In particular, housing finance companies have been in focus due to their declining credit profile.

The long term rating of Reliance Home Finance was downgraded to D last week because of a delay in servicing bank debt. Rating agencies have also put firms like DHFL and PNB Housing Finance under watch.

One aspect hurting these firms is the exposure to developer loans. As a percentage of their overall loan book, developer loans have risen because retail loans have been securitised and sold down.

If we look at the core asset of these HFCs, which is mortgages, there is no discomfort with that. I think it is the developer exposure which is causing discomfort....Going forward, one learning from this episode may be that even if an HFC is 75 percent mortgages, you have to see it as a hybrid rather than entirely a mortgage book.Ashish Gupta, Head - Equity Research, Credit Suisse

Is Banking Licence The Way Only Out?

The financing troubles faced by non-bank lenders have prompted some of them to consider universal banking as an option. Recently, Indiabulls Housing Finance Ltd. announced a plan to merge with The Lakshmi Vilas Bank Ltd. The transaction is perceived to be driven by Indiabulls desire to get a banking licence.

While not commenting on any specific deal, Gupta said a mechanism where all NBFCs must be “forced” to convert into a bank after growing to a certain threshold limit should be considered. He said Reserve Bank of India had approved similar conversions with micro lenders becoming small finance banks.

It is in the regulator's interest to ensure NBFCs have a stable source of funding as they become larger and systemically important. And, a banking platform also provides a regulatory framework and closer supervision.Ashish Gupta, Head of Equity Research, India (Financials), Credit Suisse.

Watch the full interview here:

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.