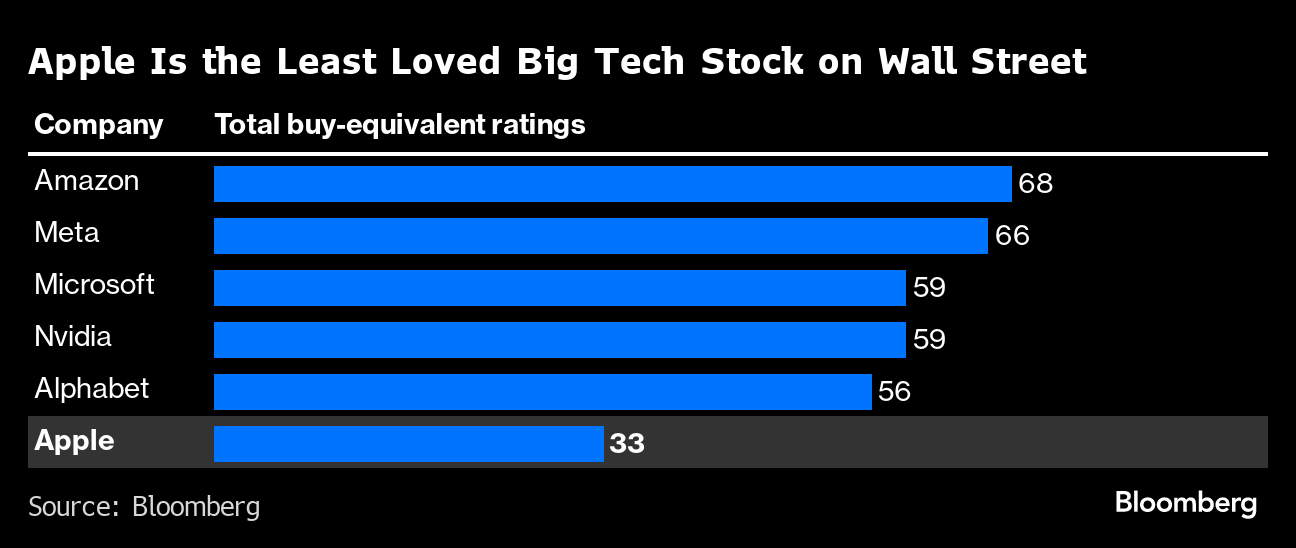

(Bloomberg) -- Apple Inc. was already the least-loved big tech stock on Wall Street. Growing concerns over iPhone sales have now triggered a second downgrade this week, cementing analysts' cautious approach.

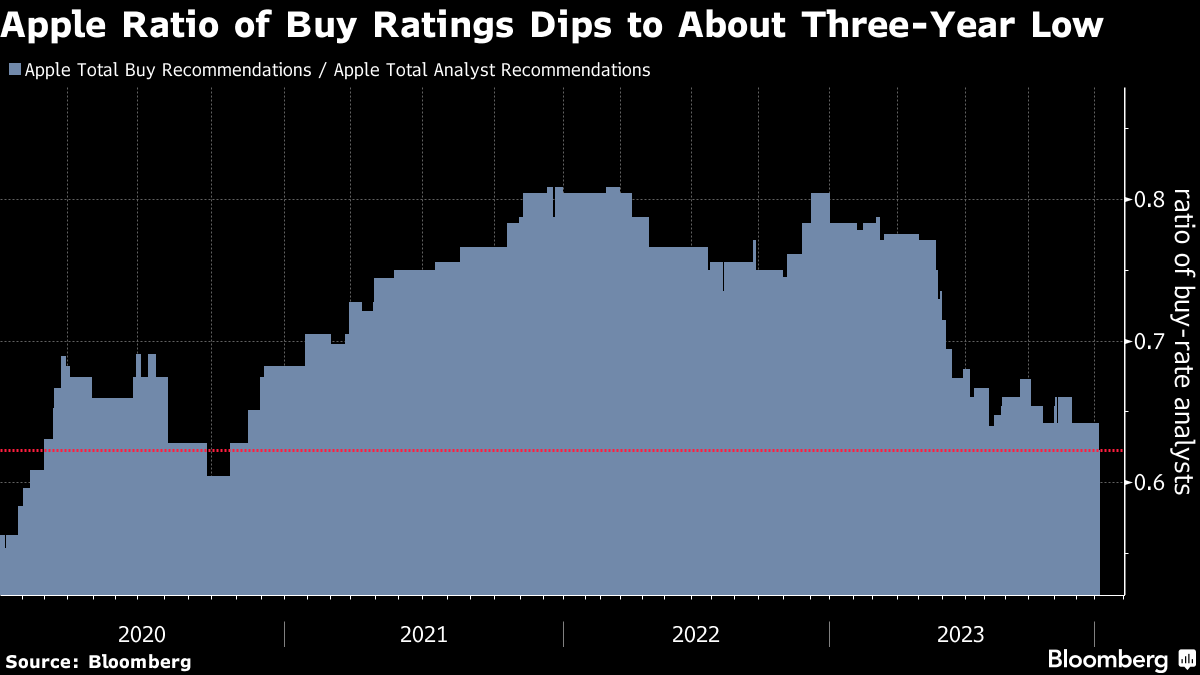

Piper Sandler & Co.'s Harsh Kumar cut his Apple rating on Thursday, citing a weak macro environment in China that will dampen demand for iPhones.

“We are concerned about handset inventories,” Kumar said in a note, lowering his recommendation for Apple to neutral from overweight after holding a bullish view since March 2020. “Growth rates have peaked for unit sales,” he said.

Kumar's downgrade follows a more bearish move by peers at Barclays Plc, where analysts led by Tim Long cut their rating to underweight on Tuesday.

Coming into 2024, Apple was the big tech stock with the least number of bullish recommendations, according to data compiled by Bloomberg. Piper Sandler's downgrade now pushes the company's buy-equivalent ratio down even further — with the percentage of analysts bullish on the company at a three-year low.

Apple was the only big tech firm to see revenues contract for the past four quarters. Wall Street is currently anticipating revenue growth of just 3.6% in fiscal 2024 and profit expansion of 7.9%, according to the average of analyst estimates compiled by Bloomberg.

The stock, which had rallied nearly 50% last year, has stumbled in the first sessions of 2024. It fell 1.2% on Thursday, its fourth straight negative session. Shares are down 5.5% this year, wiping off $164 billion in market value, according to data compiled by Bloomberg.

Nearly unanimously bullish on big tech, Wall Street is more cautious when it comes to Apple. The stock has attracted only 33 buy-equivalent recommendations. That pales in comparison to Amazon.com Inc.'s 68, Meta Platforms Inc.'s 66 and the 59 bullish ratings for Nvidia Corp.

--With assistance from Matt Turner and Ryan Vlastelica.

(Updates to market close.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.