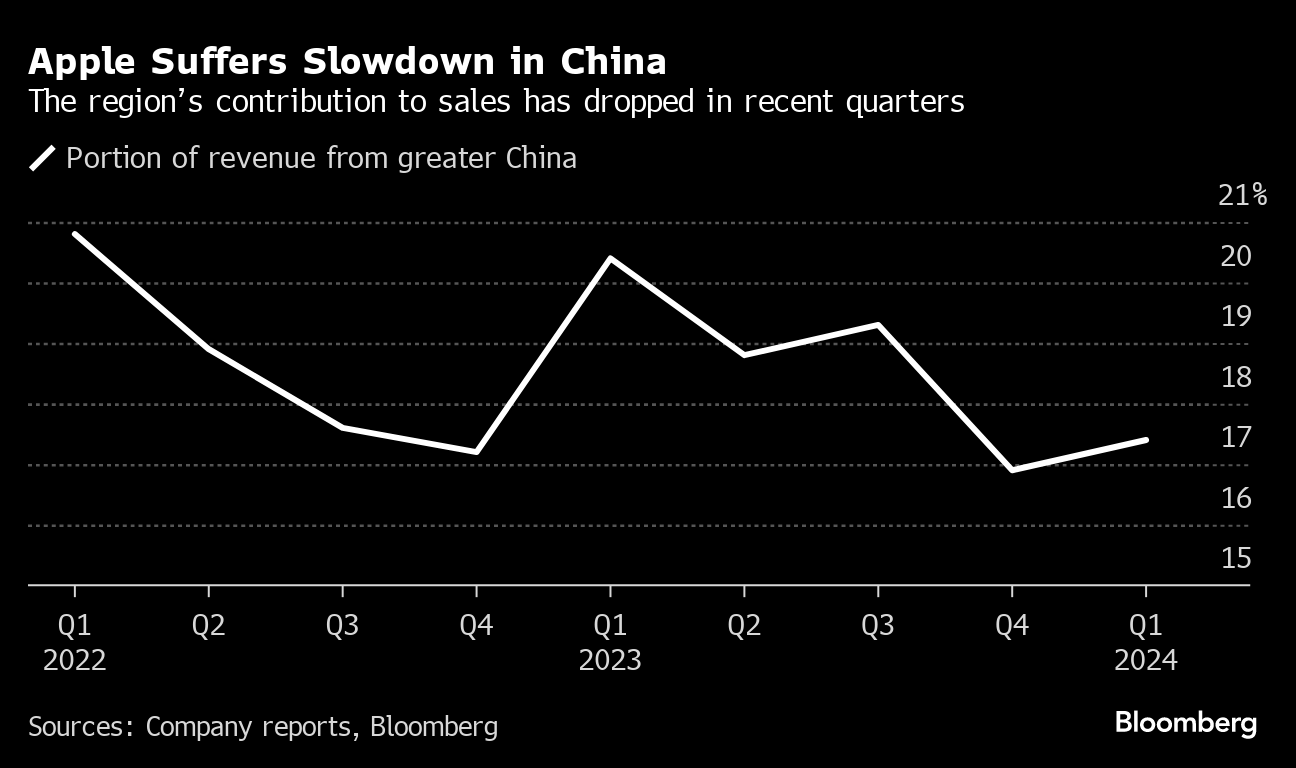

(Bloomberg) -- Apple Inc.'s latest quarterly results triggered investor fears that the company is losing clout in China, a long-prized market that generates roughly a fifth of its sales.

Revenue from the region plunged 13% last quarter, marking the worst decline since the 2018 holiday season. The drop was jarring enough to overshadow otherwise strong results, which included Apple's first overall sales growth in a year.

But the signs of trouble in China have been accumulating for months. The country's government imposed stricter bans on the use of foreign technology in the workplace. Local rival Huawei Technologies Co. released a hot new smartphone touted as a local alternative to the iPhone. And Apple began offering rare discounts on its latest models.

Read More: Is 2024 the Year US-China Tensions Finally Trip Up Apple?

Sales of iPads and wearable technology have been particularly weak in the country, adding up to a bleak picture. The company also warned that iPhone growth in the current quarter won't be as strong as Wall Street anticipated, forcing analysts to rethink their projections. They went through a similar exercise with Apple's previous earnings three months earlier.

“We believe expectations need to move lower, yet again,” Brandon Nispel, an analyst at KeyBanc Capital Markets, said in a note to clients.

China's importance to Apple goes beyond its status as the company's third-largest market by revenue. It's the country where Apple produces the vast majority of its devices, but also a tantalizing growth opportunity thanks to its 1.4 billion people and expanding middle class.

On a conference call with analysts Thursday, executives said their faith in China wasn't shaken. Apple's installed base is still growing, and current customers continue to upgrade their devices, Chief Executive Officer Tim Cook said. Still, iPhone revenue fell by a percentage in the mid-single digits when holding currency rates constant.

“I remain very optimistic about China over the long term,” Cook said.

Chief Financial Officer Luca Maestri described the phone sector in China as the “most competitive market in the world.” And Apple isn't the only player struggling to grow. Several of the top mobile makers saw shipments decrease last quarter, according to IDC. In fact, Apple took first place in the market because it didn't shrink as much as others, the research firm said.

Read More: iPhone Takes Top Spot in China for First Time Despite Challenges

But Huawei has bucked the downward trend. The company — blacklisted by the US over national security concerns — saw shipments surge 36% in China. That vaulted it to fourth place.

The technology company launched the Mate 60 Pro phone last year just before the iPhone 15 went on sale. The Huawei device, which runs on Chinese-made chips, is benefiting from a renewed wave of nationalism in the country.

That's led to countermeasures. Last month, Apple began offering discounts of as much as 500 yuan ($70) on the iPhone 15 — a step it doesn't usually have to take. The markdown was equivalent to about 5% off its top-of-the-line model.

A resurgent Huawei and other manufacturers are posing a bigger threat than before, said Ivan Lam, an analyst at Counterpoint Research. In some cases, consumers are buying those brands rather than older iPhone 13 and 14 models, he said.

“This is a competitive issue,” Lam said.

--With assistance from Charlotte Yang.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.