Amber Enterprises India Ltd.'s unit, ILJIN Electronics (India) Pvt., has signed a joint venture agreement with Korea Circuit Co. to establish a new company in India focused on the production and manufacturing of semiconductor substrates, including HDI and Flex PCBs.

ILJIN will hold a 70% stake in the JV, while the rest will be held by Korea Circuit. The newly formed company aims to leverage KCC's expertise in printed circuit boards to enhance local manufacturing capabilities in line with India's 'Aatmanirbhar Bharat' initiative.

The agreement includes terms that allow ILJIN to appoint the majority of the board of directors for the joint venture, ensuring operational control. Both parties plan to invest capital in multiple phases as per mutually agreed conditions.

This partnership underscores the growing demand for semiconductor substrates in India and is expected to contribute to the domestic electronics industry by reducing reliance on imports.

ILJIN is a material subsidiary of Amber Enterprises India, while the Joint Venture Partner KCC is an independent third-party.

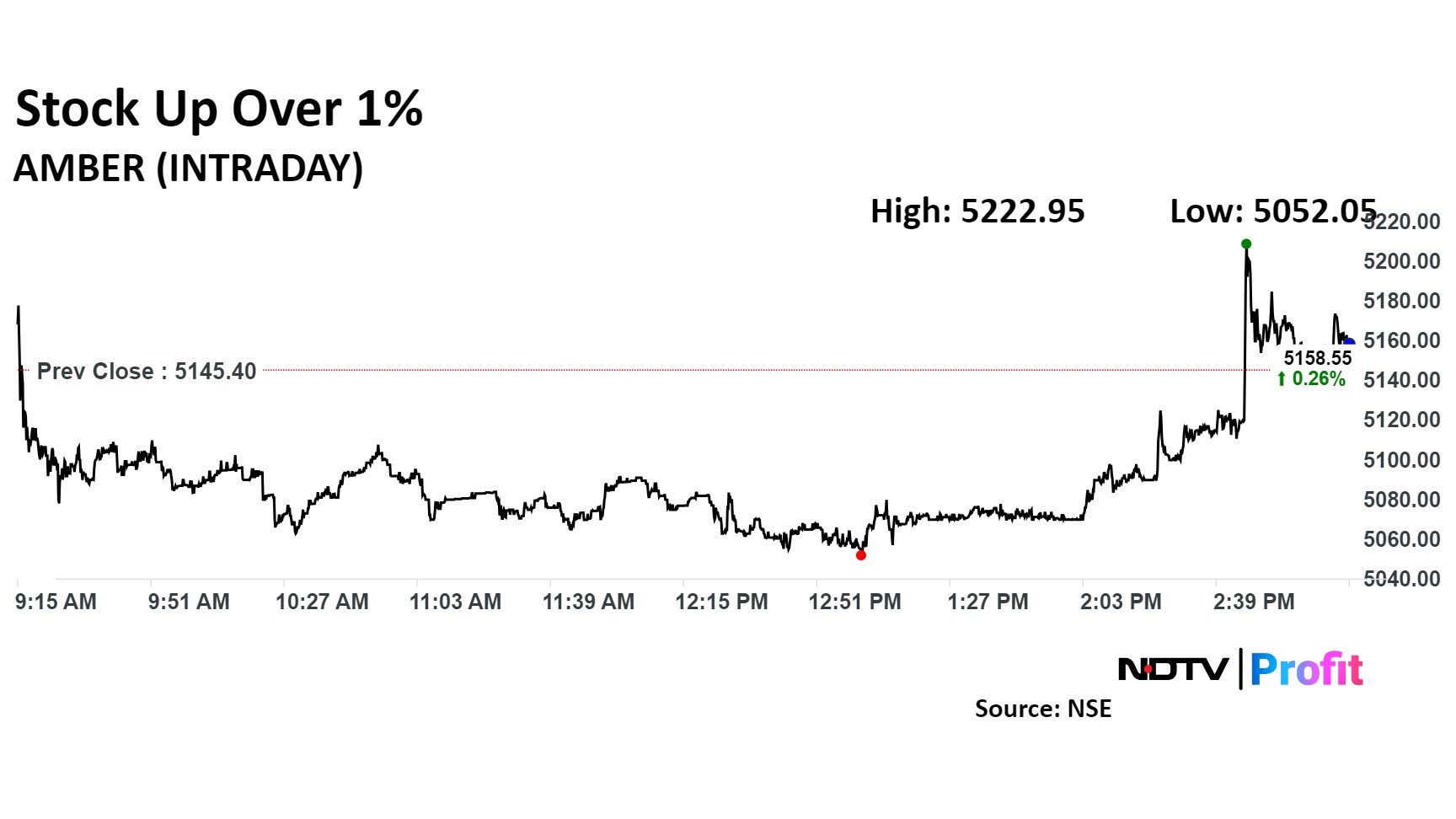

Shares of Amber Enterprises rose as much as 1.51% to Rs 5,222.95 apiece. It pared gains to trade 0.20% higher at Rs 5,155 apiece as of 03:10 a.m. This compares to a 0.28% decline in the NSE Nifty 50 Index.

It has risen 75.55% in the last 12 months. Total traded volume so far in the day stood at 0.25 times its 30-day average. The relative strength index was at 62.

Out of 26 analysts tracking the company, 20 maintain a 'buy' rating, four recommend a 'hold,' and two suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.