Allcargo Terminals Ltd. has made an investment in the Haryana Orbital Rail Corp. to further the development of multi-modal logistics parks and inland container depots, it said in an exchange filing. This initiative is poised to enhance ATL's logistics capabilities in North India, which is rapidly becoming a critical hub for trade and transport, it said.

The investment involves ATL acquiring a 7.6% stake in HORCL for Rs 115 crore, with an additional commitment to invest Rs 22.8 crore, by subscribing to equity shares in the future. This funding will be primarily sourced through long-term debt.

The HORCL project aims to develop a new electrified double broad gauge rail line connecting Palwal to Sonipat. This rail line will connect with the Dedicated Freight Corridor and Indian Railways, particularly benefiting industries and trade activities in the National Capital Region.

The MMLP at Farukhnagar is a vital component of this strategy. Currently under development by Allcargo Inland Park Pvt.—a wholly-owned subsidiary of TransIndia Real Estate—the facility is expected to be operational by March 2026. It will serve as a crucial logistics hub, improving ATL's service offerings and positioning it as a key player in the logistics sector.

Allcargo Terminals functions in the logistics sector, operating a network of Container Freight Stations and Inland Container Depots across the country. The company specialises in handling import and export operations for a wide variety of cargo types and sizes.

Strategically located near major ports, including Mumbai, Mundra, Kolkata, Chennai, and Dadri, Allcargo's facilities are designed to streamline logistics and enhance supply chain efficiency.

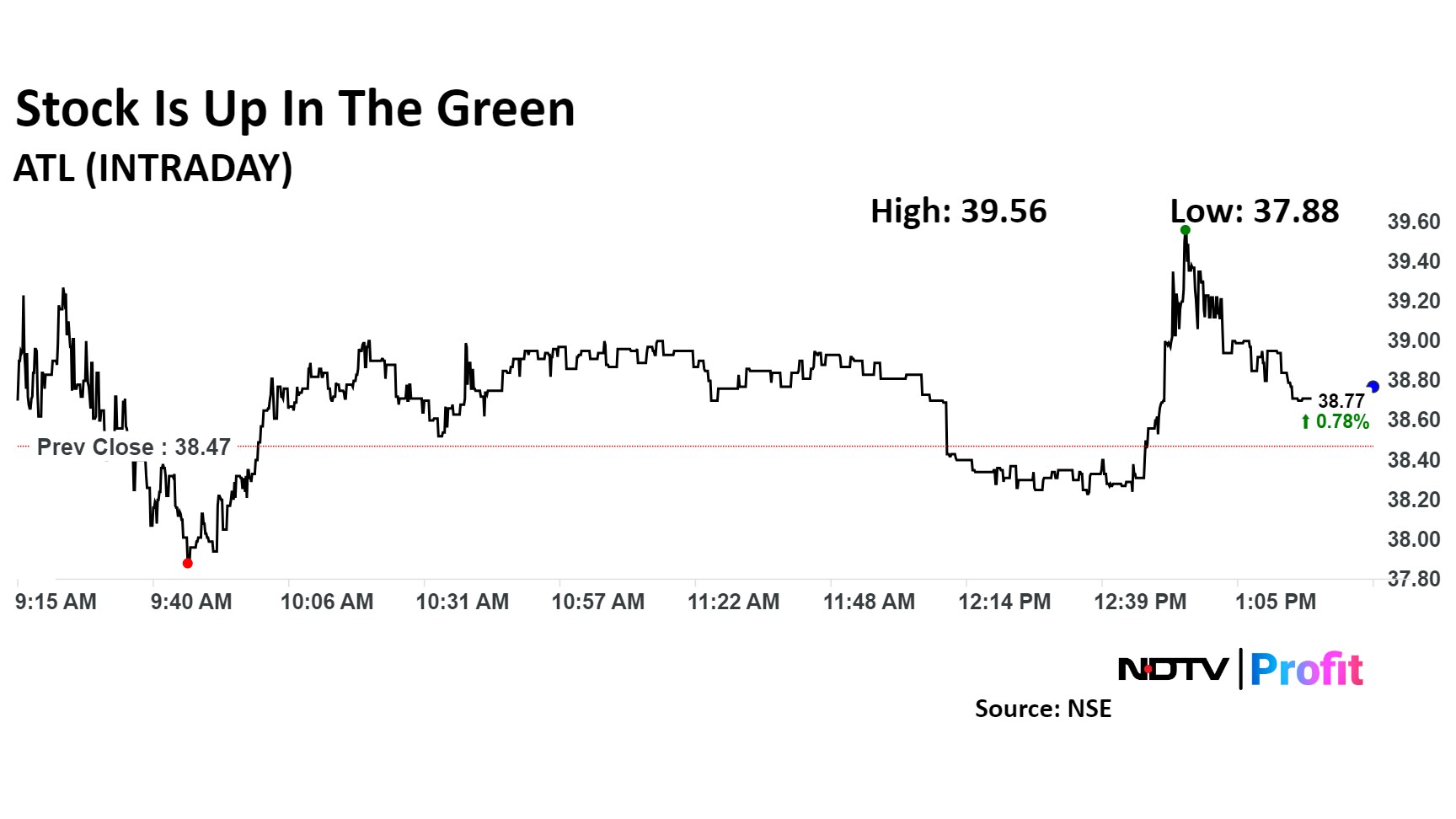

Allcargo Terminals Share Price

The scrip rose as much as 5.12% to Rs 40.44 apiece. It pared gains to trade 1.25% higher at Rs 38.95 apiece, as of 01:22 p.m. This compares to a 0.25% advance in the NSE Nifty 50.

It has declined 4.65% in the last 12 months. The relative strength index was at 32.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.