(Bloomberg) -- Investors looking for an end to the freefall in shares of Chinese e-commerce company Alibaba Group Holding Ltd. may be in for a long wait, if options traders are correct.

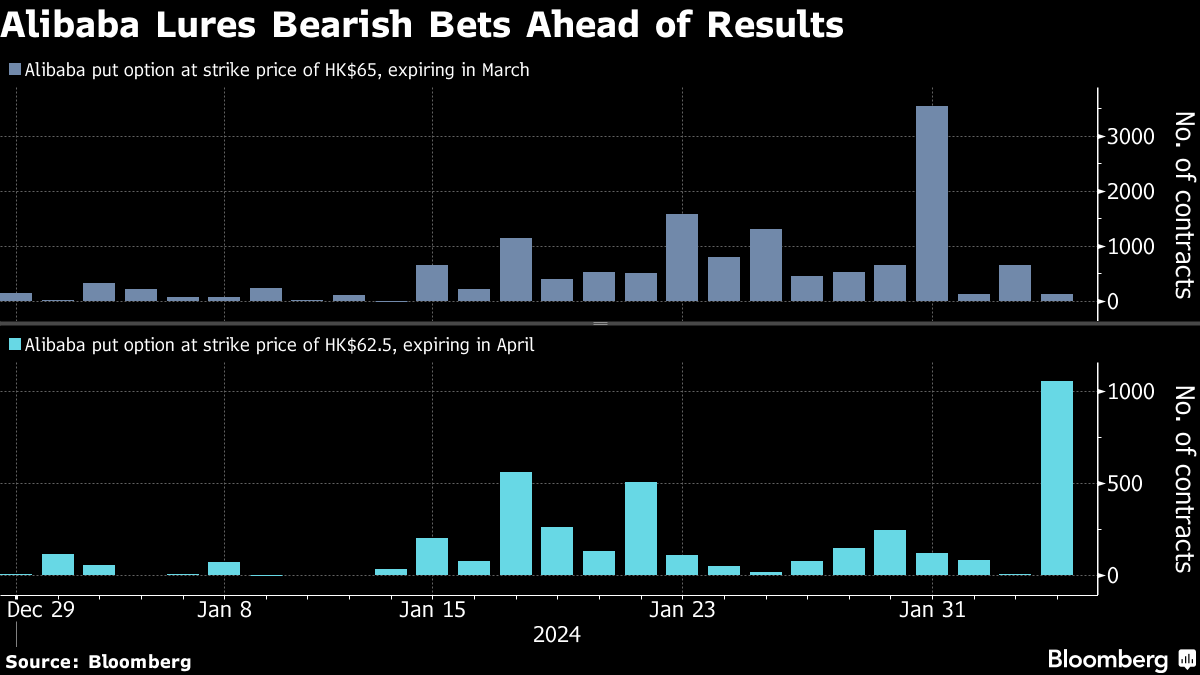

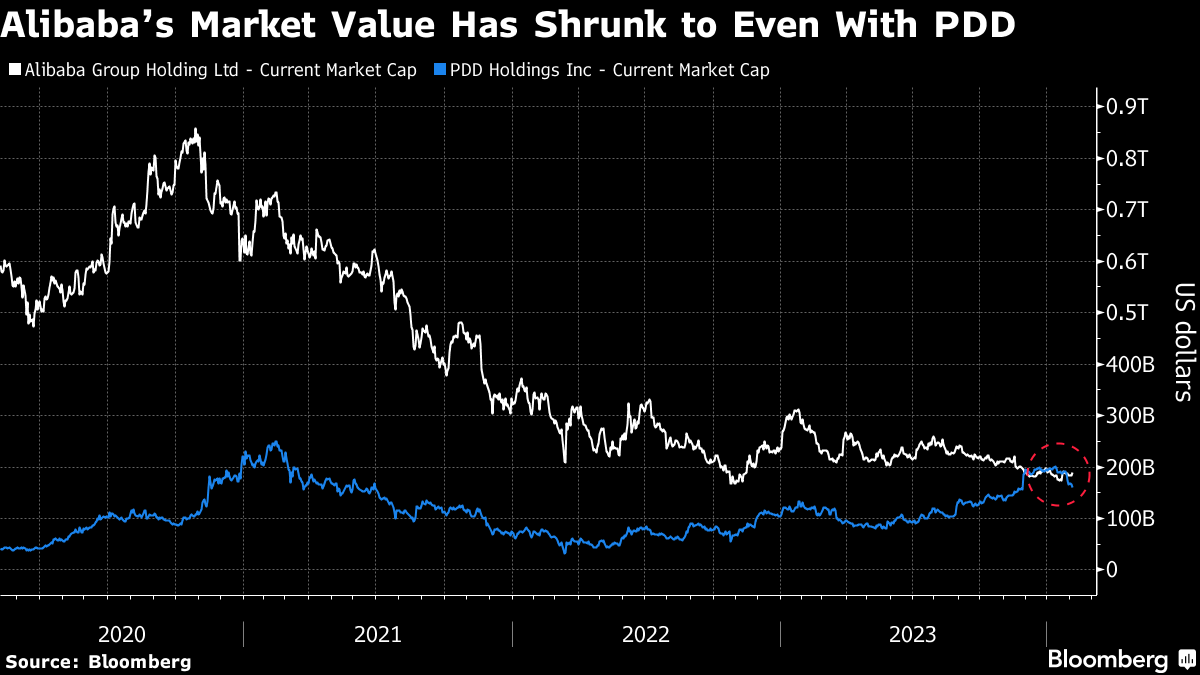

The stock's nearly 80% tumble from a 2020 record high has driven its valuation to an all-time low and put its market capitalization on a par with upstart rival PDD Holdings Inc. The derivatives market indicates further pain, with the options skew showing increased bearishness ahead of Alibaba's earnings report due Wednesday. A put contract betting the stock will drop 14% by the end of April was the most traded on Monday in Hong Kong.

Alibaba's revenue for the three months through December is expected to have risen 5.6% from a year ago, the slowest growth in three quarters amid difficult economic conditions and steep discounting. Forward earnings estimates for the company have fallen about 4% over the past month.

China's online retail market has grown crowded, with stalwarts Alibaba and JD.com Inc. facing new entrants including Douyin Mall, run by TikTok owner ByteDance Ltd. At the same time, persistent deflationary pressure and declining wages have driven a price war that is being won by discounters like Pinduoduo, the local equivalent of PDD's Temu.

“The focus is whether Alibaba can survive the macro weakness,” said Tam Tsz-Wang, analyst at DBS Vickers Hong Kong Ltd. “The market is expecting it to lose market share as they face fierce competition from rivals like Douyin and PDD. Another focus would be whether they are able to import new drivers to maintain their overall growth.”

The stock is trading at 8 times forward earnings, near its lowest valuation ever and making it one of the cheapest technology stocks in China. In comparison, Hong Kong-listed utility CLP Holdings Ltd. is trading at around 13 times expected earnings, as is the Hang Seng Tech Index.

Alibaba spent $9.5 billion on share buybacks last year, a record high, according to data compiled by Bloomberg, and says it still has about $12 billion remaining through 2025 to spend on repurchases. The firm may spend half of its free cash flow on buybacks and could also announce special dividends after business divestments, according to Goldman Sachs Group Inc. analyst Ronald Keung. He maintains a buy rating on Alibaba, citing its attractive valuation.

Options traders are less sanguine, with the trading volume of put options spiking in recent days. These include a contract betting the stock will drop more than 3% before the end of April. The market is pricing in a 5.6% share move in either direction in the immediate aftermath of Wednesday's results, which would be one of the biggest post-earnings moves for the stock in two years.

Revamp efforts led by the company's new management include scaling down non-core business while stepping up investment in global expansion and artificial intelligence. It's focusing on improving core operations, including moving resources from its Tmall site to Taobao in order to better meet demand for cheaper products, though it may take time to see results.

This focus on lower prices will lead to weaker revenue growth, which “is certainly negative to near-term sentiment and share price,” said JPMorgan Chase & Co. analysts including Alex Yao, who cut his estimate for Alibaba's profit for the current year by 3% last month. The company's core business growth will likely “remain lackluster in the next four quarters.”

(Updates as of Tuesday morning trading)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.