(Bloomberg) -- Adani Ports and Special Economic Zone Ltd. will buy back as much as $195 million of its 2024 bond, as the Indian conglomerate backed by billionaire Gautam Adani seeks to move on from the allegations levied by a US shortseller.

The 3.375% notes jumped the most since April on news the company would pay $975 for every $1,000 in principal for debt tendered by Oct. 11. Thereafter, the offer price drops to $965 per $1,000, it said in a statement on Wednesday.

Adani Ports said it would fund the purchase from its cash reserves and said the bond in question has $520 million in principal outstanding.

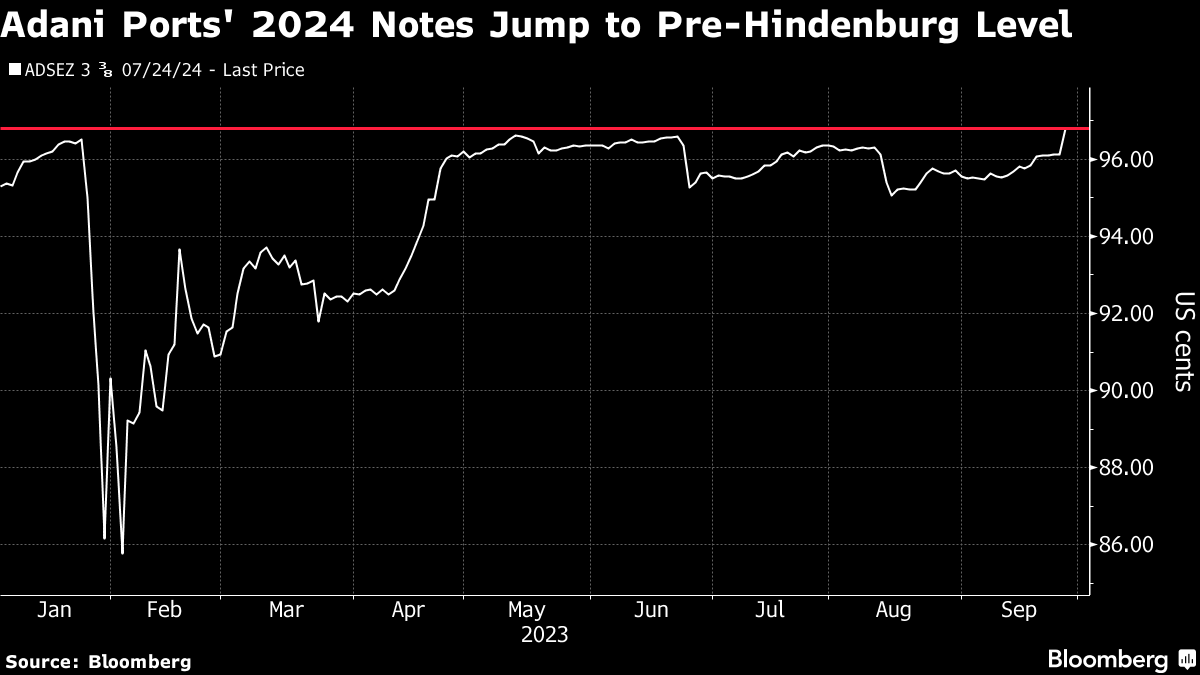

The announcement takes place just as Adani Group seeks to refinance $3.5 billion worth of debt taken out for an acquisition, having suffered a blow earlier this year after Hindenburg Research levied accusations of malfeasance that triggered a selloff in its bonds and shares. Adani repeatedly denied the claims.

Having plunged as low as 85.8 cents on the dollar in February after Hindenburg's allegations, the 2024 notes have recovered and were trading at 96.5 cents on the dollar on Wednesday, Bloomberg-compiled data show. The buyback offer constitutes a slight premium to the current price.

Bond buybacks allow companies to repurchase debt through tender offers to bondholders, enabling them to retire some or all of the securities ahead of their due date.

The announcement marks the Indian firm's second tender offer for its 2024 notes in just a few months. It intends to continue repurchasing notes in coming quarters.

Adani's announcement bucks the global trend. After interest rates rose sharply, companies have been repurchasing less debt. Keeping bonds with lower coupons for longer means they don't have to take out more expensive new debt instead.

The Adani tender offer expires at 5:00 p.m. in New York on Oct. 26.

--With assistance from Saikat Das.

(Updates with reference to refinancing in 4th, bond pricing in 5th paragraph)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Disclaimer: AMG Media Networks Ltd. (AMNL) currently owns 49% stake in Quintillion Business Media Ltd (QBML), the owner of BQ Prime Brand. AMNL has entered into an MOU to acquire the balance 51% stake in QBML. Post acquisition, QBML will become a wholly owned subsidiary of AMNL.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.