The Adani Group will continue to focus on infra businesses as the margins in FMCG business are much lower, the conglomerate's chief financial officer said.

The combined wealth of Adani Group's top seven companies is way more than the consumer goods industry, and the conglomerate is focusing on "extraordinary" wealth creation, CFO Jugeshinder Singh said while addressing the India Debt Capital Market Summit 2023, organised by the Trust Group in Mumbai.

While Singh didn't make any direct reference to Adani Wilmar Ltd., his comments come amid media reports that the group is planning to sell a stake in Adani Wilmar Ltd. It is a joint venture between Adani Enterprises Ltd. and Wilmar International Ltd., with both partners holding 44% each. The rest is owned by the public. According to norms, the promoter stake in the listed entity also has to be brought down to 75%.

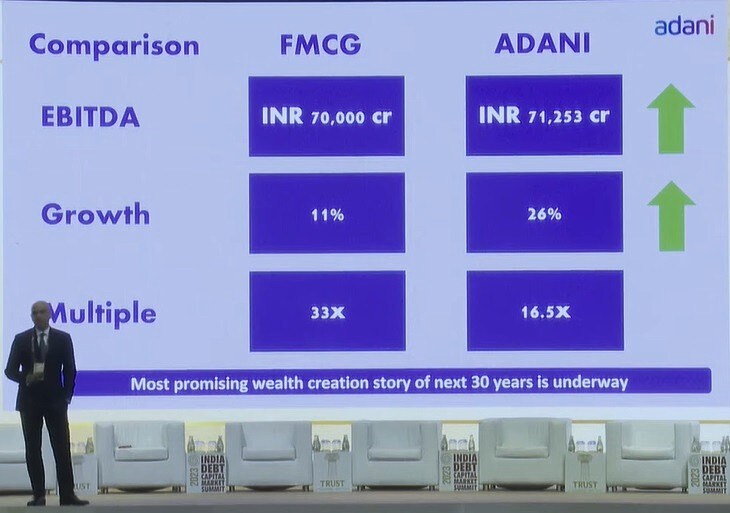

"FMCG, as a sector, grows at about 11% and the FMCG index trades at a multiple of 33 times," Singh said. "The Ebitda of Adani Group of companies trailing 12 months this year, however, exceeds the Ebitda of every single company combining the FMCG industry. The entire industry makes less cash than us [Adani Group]. And this is the story of Indian infrastructure."

The group has seven companies in the infrastructure sector: Adani Enterprises Ltd., Adani Power Ltd., Adani Green Energy Ltd., Adani Ports and Special Economic Zone Ltd., Adani Energy Solutions Ltd., Adani Total Gas Ltd. and Ambuja Cements Ltd.

Adani Group Chief Financial Officer, Jugeshinder Singh during his presentation in Mumbai on Friday. (Source: YouTube)

"Infra is nothing but the FMCG of services," Singh said. "The infra story over the next 25–30 years in India will be a story of extraordinary wealth creation. And this story has just started."

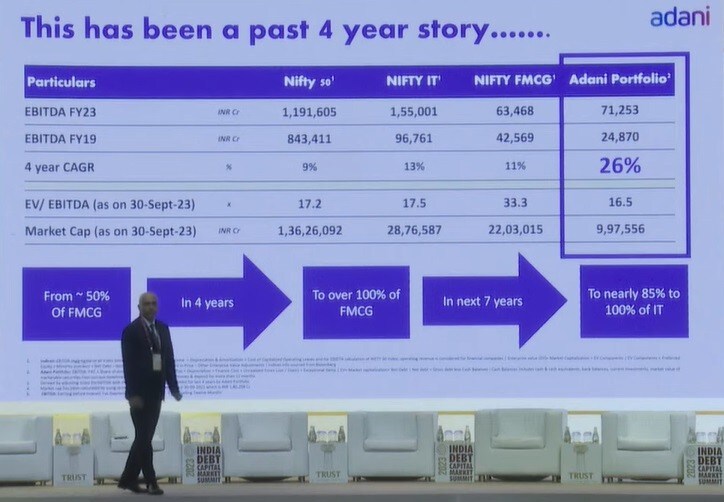

In the next seven years, Singh expects that the Adani Group could become a bigger wealth creator than India's technology sector. "In 2019, the infra story of Adani started at about 50% of the FMCG index, and in four years' time, we are now over 100% of the FMCG index in terms of cash flow," he said.

"In the next seven years, we will be almost equal, if not more, to the IT index—Wipro, Infosys, everyone put together. And as a platform, you'll see us trade at the least multiple of all, including Nifty 50."

Adani Group Chief Financial Officer, Jugeshinder Singh during his presentation in Mumbai on Friday. (Source: YouTube)

Disclaimer: AMG Media Networks Ltd. (AMNL) currently owns a 49% stake in Quintillion Business Media Ltd. (QBML), the owner of BQ Prime Brand. AMNL has entered into an MOU to acquire the balance 51% stake in QBML. Post acquisition, QBML will become a wholly owned subsidiary of AMNL.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.