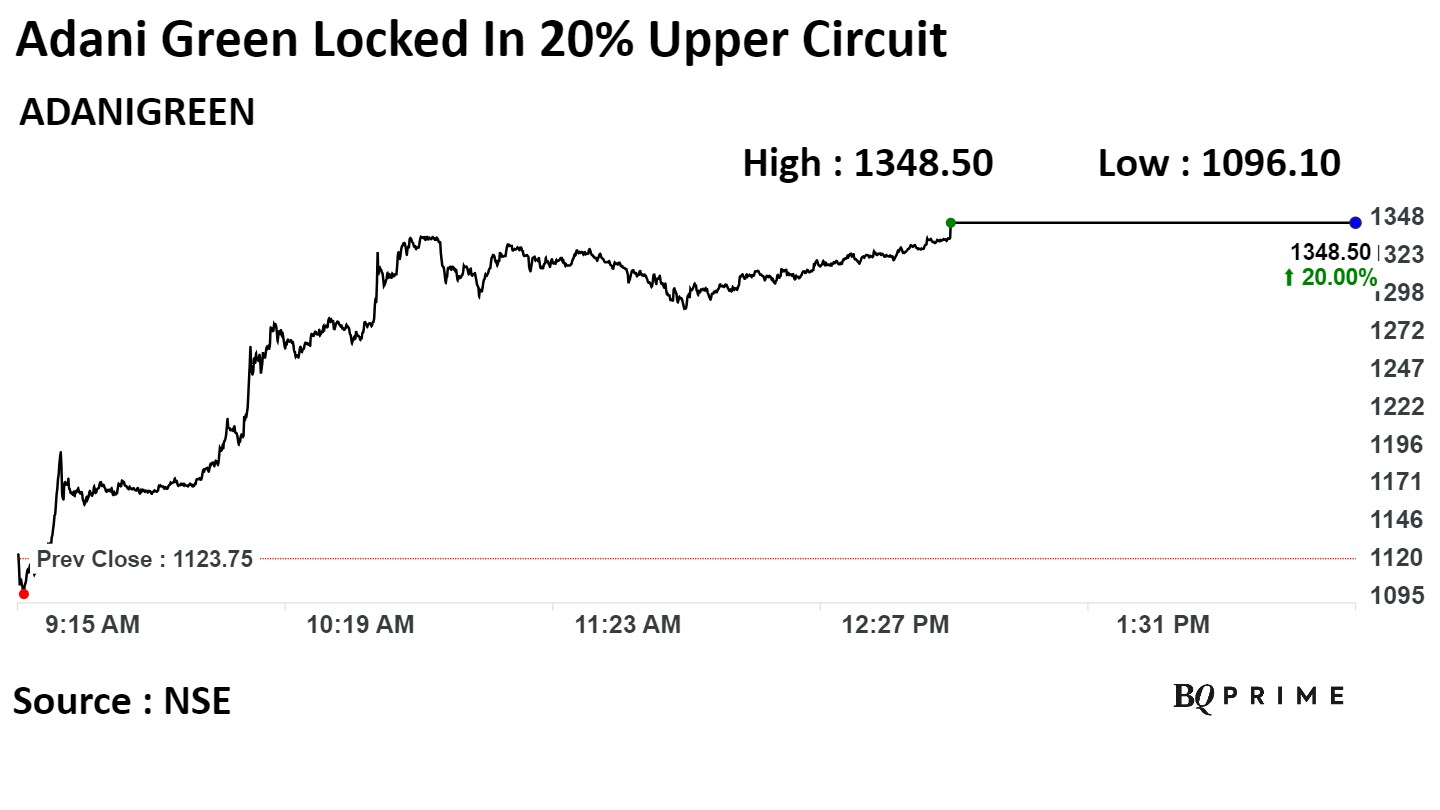

Adani Green Energy Ltd. shares extended gains to hit the upper circuit of 20% intraday on Tuesday. The rally came after the company secured a loan facility of $1.36 billion for its renewable energy park in Gujarat.

Adani Green stock was locked in 20% upper circuit as of 2:33 pm, compared with a rise of 0.62% rise in the NSE Nifty 50.

Adani Green Energy Ltd. raised $1.36 billion construction facility in the latest funding from international banks in one of the largest project finance deals in Asia, the company said in a statement on Tuesday. This is the company's largest project financing deal, as part of its planned $3 billion fundraise.

The senior debt facility is a green loan offered by a consortium of eight international banks including BNP Paribas, Coöperatieve Rabobank U.A., DBS Bank Ltd., Intesa Sanpaolo S.p.A., MUFG Bank, Ltd., Societe Generale, Standard Chartered Bank and Sumitomo Mitsui Banking Corp. The financing has been certified by second party opinion provider Sustainalytics.

The financing will be a key enabler for developing the world's largest renewable energy park at Khavda in Gujarat, the company said.

The funds will be used to develop 2,167 MW capacity at Khavda in the initial stage and shall be the stepping-stone for the future development of renewable site.

The world's largest green energy park at Khavda will not only "enable Adani Green Energy's vision of 45 GW operating renewable capacity by 2030, but will also play a critical role in India's net zero journey", the company said.

The latest funding marks the third round of participation from lenders for Adani Green Energy and provides the successful template for the fund raise in sync with our capital management plan, said Anupam Misra, head of group corporate finance (Adani portfolio).

"This is a historical moment for us alongside the 28th United Nations Climate Change Conference, as we stride in, accelerating development of sustainable infrastructure. We are incredibly proud to put forward the framework for our portfolio companies where in we have raised sustainable financing solutions for Adani Green, Adani Energy Solution to support the delivery of critical infrastructure projects," Misra said.

Disclaimer: AMG Media Networks Ltd. (AMNL) currently owns 49% stake in Quintillion Business Media Ltd. (QBML), the owner of BQ Prime Brand. AMNL has entered into an MOU to acquire the balance 51% stake in QBML. Post acquisition, QBML will become a wholly owned subsidiary of AMNL.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.