Shares of Adani Energy Solutions Ltd. surged 2.18% on Friday, buoyed by expectations of substantial inflows following its inclusion in the MSCI Index. Brokerage houses estimate that the company could see inflows of around $250 million by the end of August.

On Tuesday, MSCI had announced it had lifted the 'embargo' on Adani Group stocks, making them eligible for inclusion in the MSCI India Index. This follows the removal of Adani stocks from the index in late January 2023 due to concerns over free float.

With the embargo lifted, any recent changes in free float and equity raises now qualify for index inclusion. Consequently, previously excluded stocks can be added back to the index.

Earlier this month, Adani Energy Solutions completed a $1 billion qualified institutional placement, significantly increasing its free float. Additionally, Adani Enterprises is planning to raise nearly $2 billion, which could potentially attract $110 million in inflows, according to brokerage firms.

Conversely, Adani Total Gas, another group stock previously removed from the MSCI Index, is unlikely to be included soon due to its current trading levels being significantly below last year's highs.

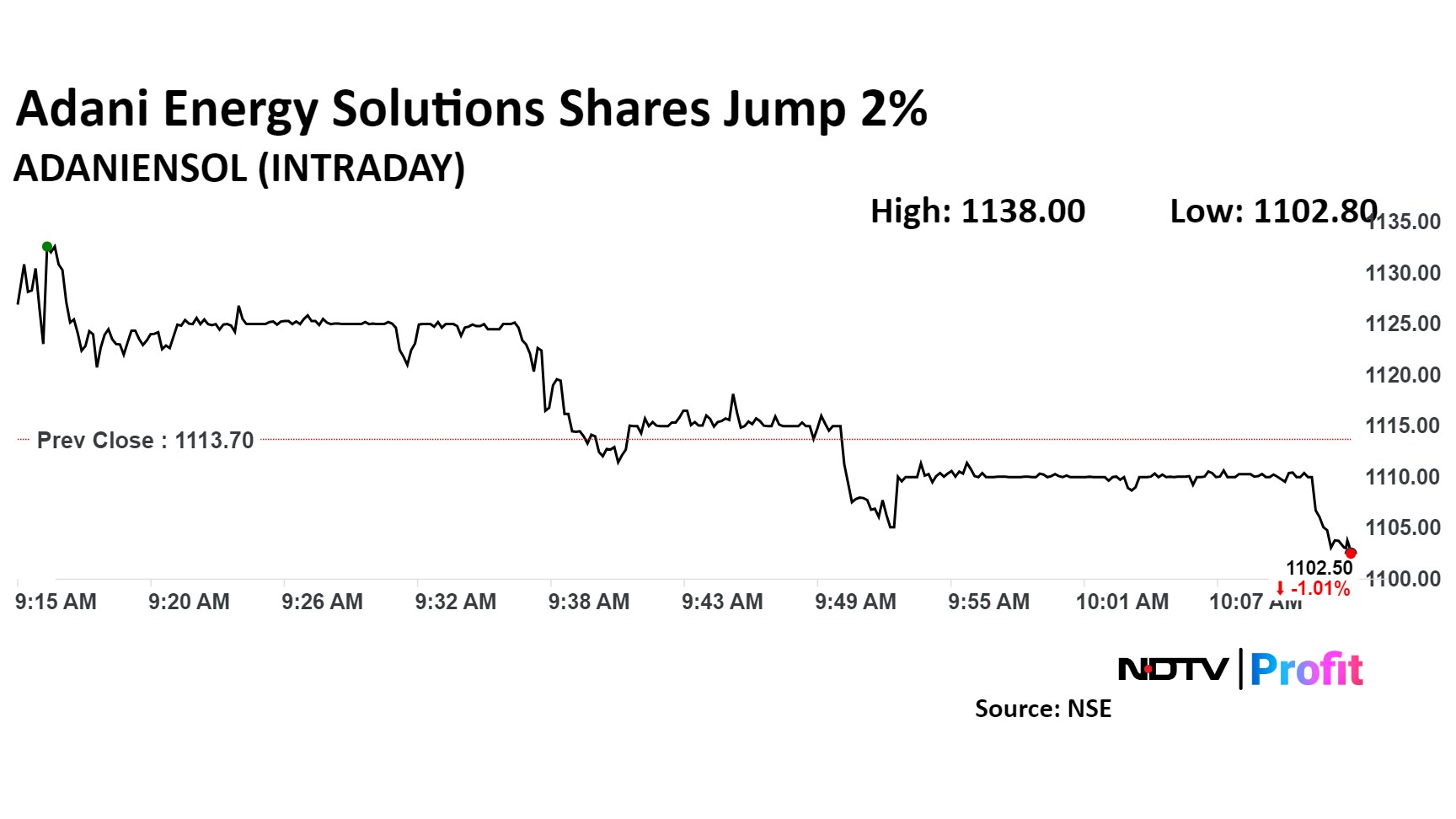

Shares of the company rose as much as 2.18% to Rs 1,138 apiece, the highest level since Aug. 7. It pared gains to trade 0.30% lower at Rs 1,110 apiece, as of 10:10 a.m. This compares to a 0.63% advance in the NSE Nifty 50 Index.

The stock has risen 6.14% on a year-to-date basis. Total traded volume so far in the day stood at 0.16 times its 30-day average. The relative strength index was at 52.71.

Out of two analysts tracking the company, both maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 22.4%.

(With inputs from PTI)

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.