(Bloomberg) -- Companies building roads, ports and airports are on traders' watchlist as Prime Minister Narendra Modi's administration is set to present its last budget before the national elections.

Shares linked to rural spending and state-owned firms are likely to be a focus area in Finance Minister Nirmala Sitharaman's budget speech on Thursday, as policymakers seek ways to boost demand in the vast rural hinterland.

Modi has made infrastructure building a cornerstone of his economic policy, helping India expand faster than any other major economy. The optimism seeped into the nation's stock markets, which have advanced in all but one year since Modi first came to power in 2014. The enthusiasm has waned a bit this month, with foreign investors taking out more than $2.6 billion from local equities.

Read More: India Tops Hong Kong as World's Fourth-Largest Stock Market

The Feb. 1 budget is an interim one until a new administration takes office. It will still be keenly followed as the proposals would provide an indication on the government's assessment of the economy, with Modi widely expected to win a third term in the elections due around April-May.

Here are some of the sectors and stocks that traders will be watching for in the budget:

Infrastructure Spending

Development of highways, tunnels and power plants is among the key focus areas for the government, which has more than doubled its capital spending over the last three years.

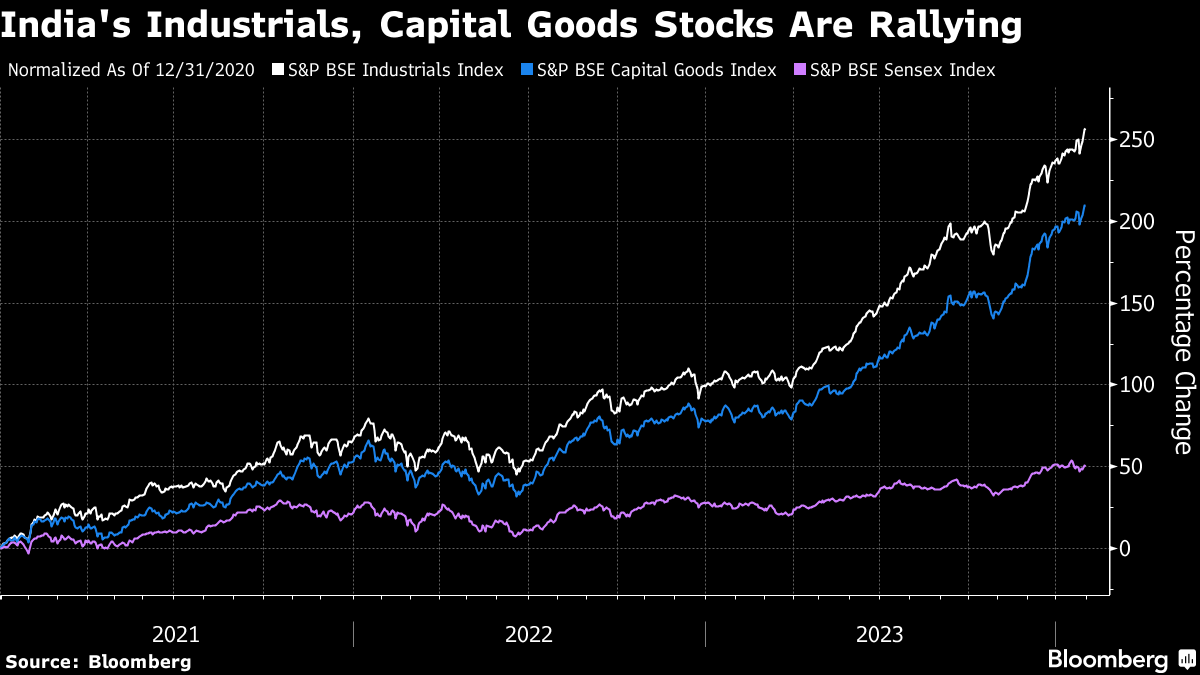

Read More: Modi's Nation-Building Push Spurs $125 Billion Industrials Rally

Shares of industrial and capital goods firms, from engineering behemoth Larsen & Toubro to billionaire Gautam Adani's eponymous conglomerate, have been the major beneficiaries of this policy push. BSE Ltd.'s sectoral gauges of industrial and capital goods firms have rallied more than 70% in the last one year, beating a 17% advance in the benchmark index.

“A lot of the market performance has come from the capex cycle, equity investors would want to see that momentum continue,” Vinit Sambre, head of equities at DSP Mutual Fund, said by phone. “Any guidance on the capex path will be closely watched.”

Watch: Larsen & Toubro, Adani Ports and Special Economic Zone, Gujarat Pipavav Port; Road developers: IRB Infrastructure Developers, PNC Infratech, KNR Constructions.

Rural Spending

The budget is also expected to include proposals to boost rural consumption and raise spending on welfare measures for farmers, women and the poor.

Read More: Modi's Last Budget Before Polls Gives Chance to Woo Voters

Consumption in the rural areas, where nearly two-third of the country's people live, has slowed, mainly due to scant rainfall in some provinces and as a ban on export of key farm produce also hurt farm incomes.

The interim budget may aim at providing more support to rural consumption as it has been a “weak spot”, said Mihir Vora, chief investment officer at Trust Asset Management Pvt.

Apart from income-boosting measures, economists expect the budget to consider higher subsidies for cooking gas and provide more funds for affordable housing.

Watch: Hindustan Unilever, ITC, Nestle India; two-wheeler makers Hero MotoCorp, TVS Motor Co.; tractor maker Mahindra & Mahindra.

Asset Sale

The government is set to miss its disinvestment target for a fifth straight year, raising expectations it may announce a new privatization strategy. Shares of state-run enterprises have seeing stellar gain in anticipation of a renewed push for asset sale after the polls.

“The government hasn't been able to meet much of its divestment target in the last two years. With some of these stocks rallying, divestment plan will be worth watching,” said Sonam Srivastava, a fund manager at Wright Research & Capital.

Read More: India State-Run Firms Seen Extending Dream Rally on Modi Bets

Watch: Container Corporation of India, BEML, IDBI Bank, Shipping Corporation of India; railway-linked state firms: RITES, Indian Railway Finance Corp., IRCON International.

--With assistance from Anup Roy and Alex Gabriel Simon.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.