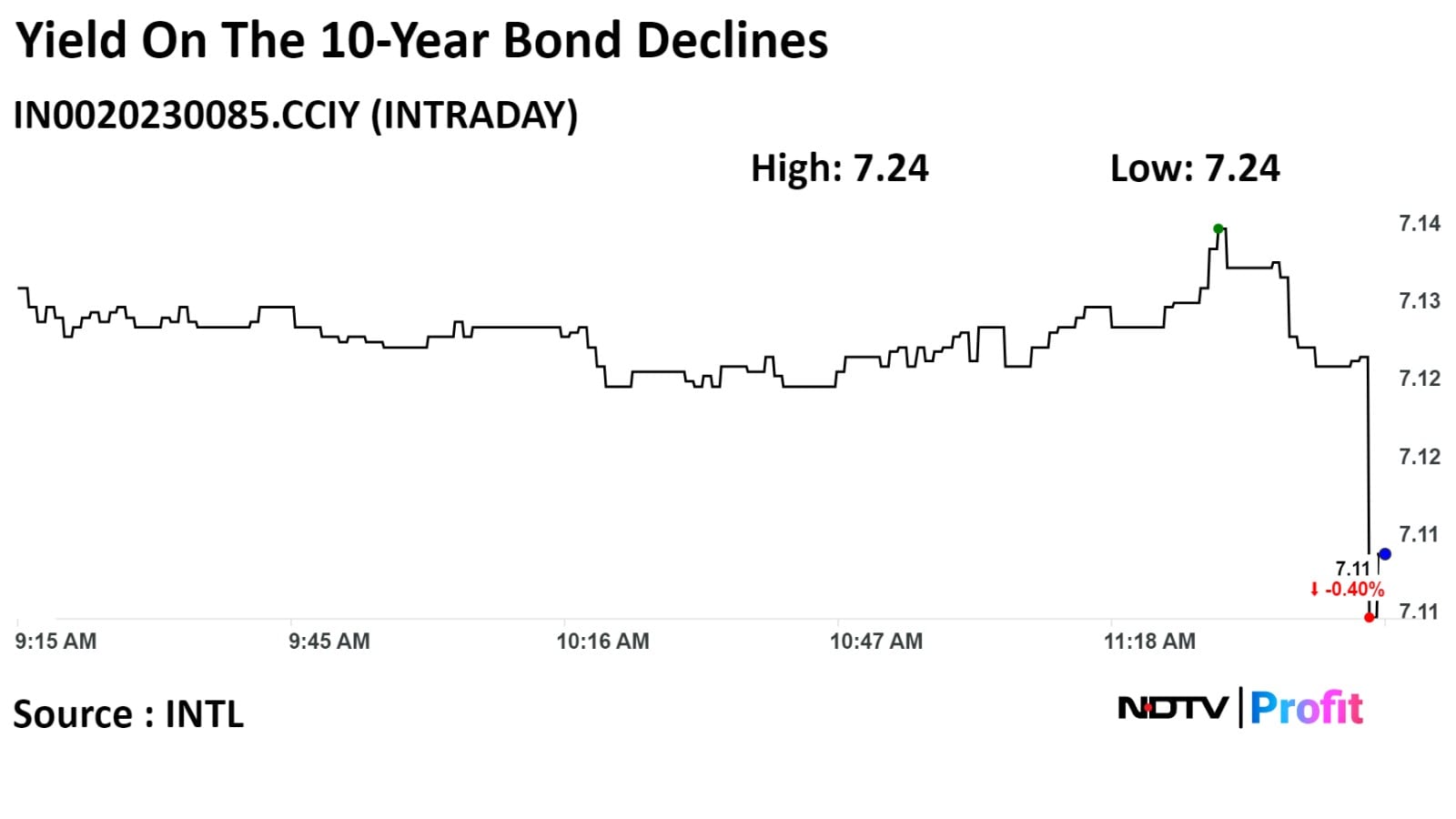

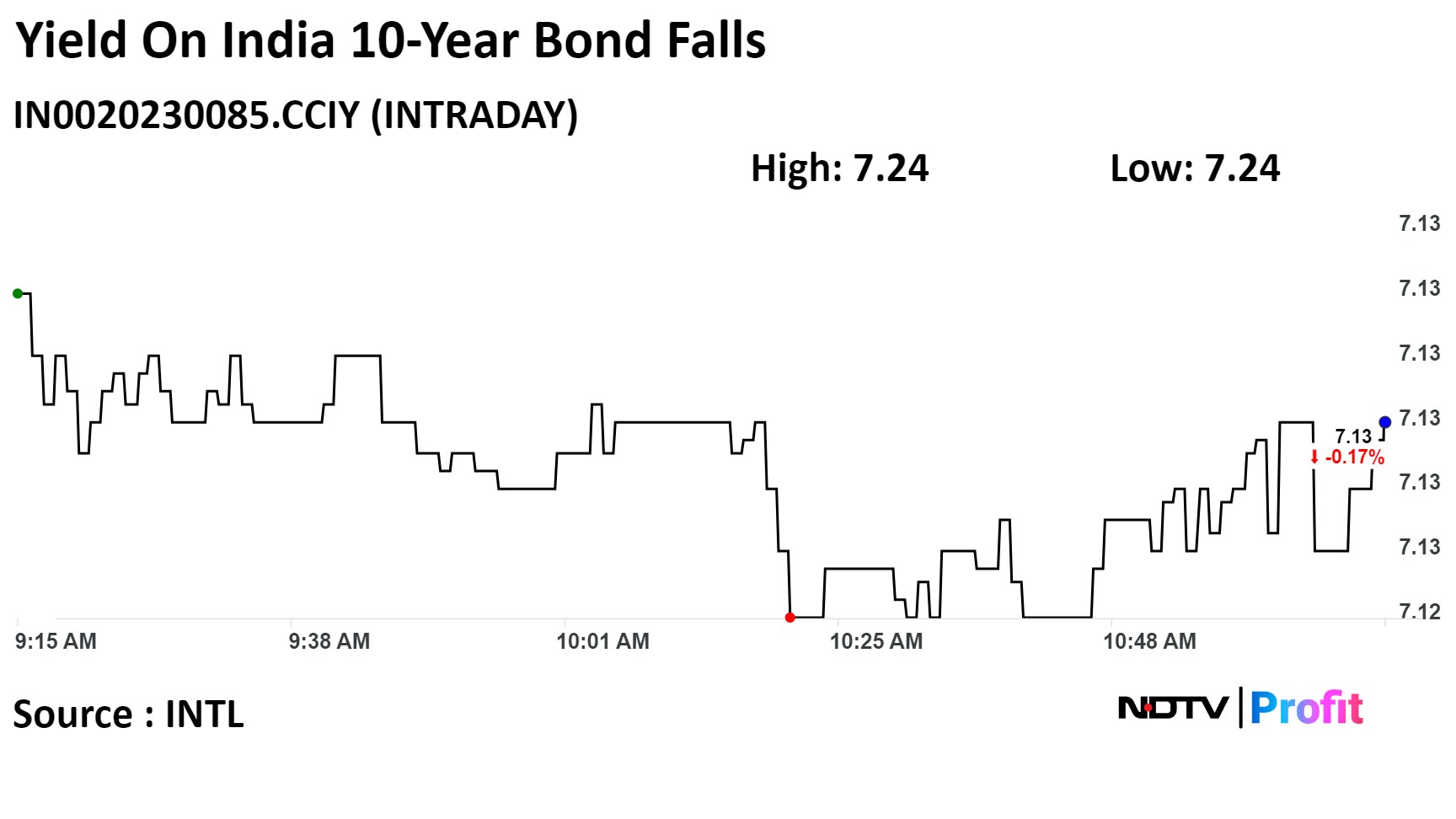

The yield on the 10-year bond closed 8 bps lower at 7.06 % on Thursday.

Source: Bloomberg

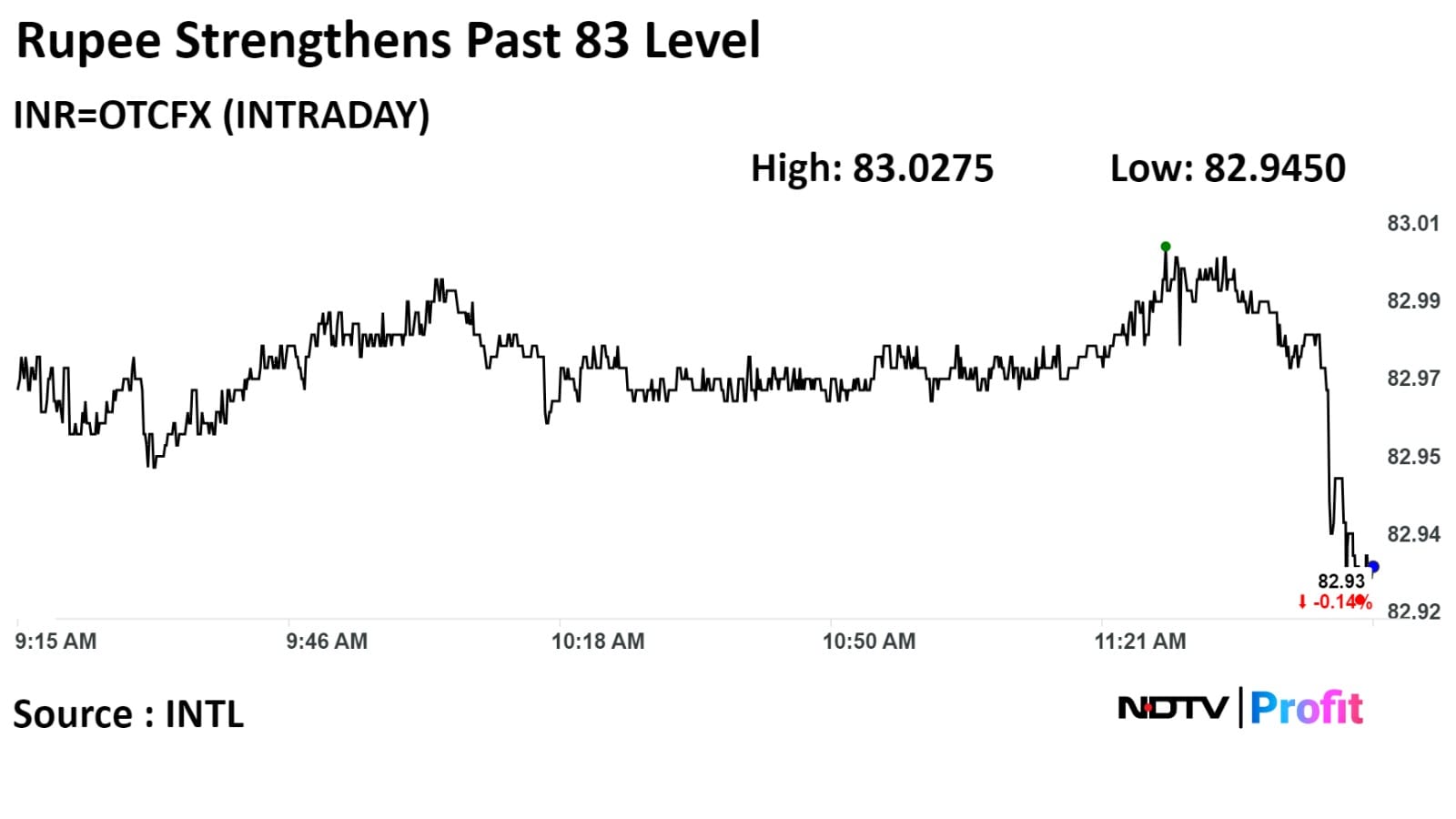

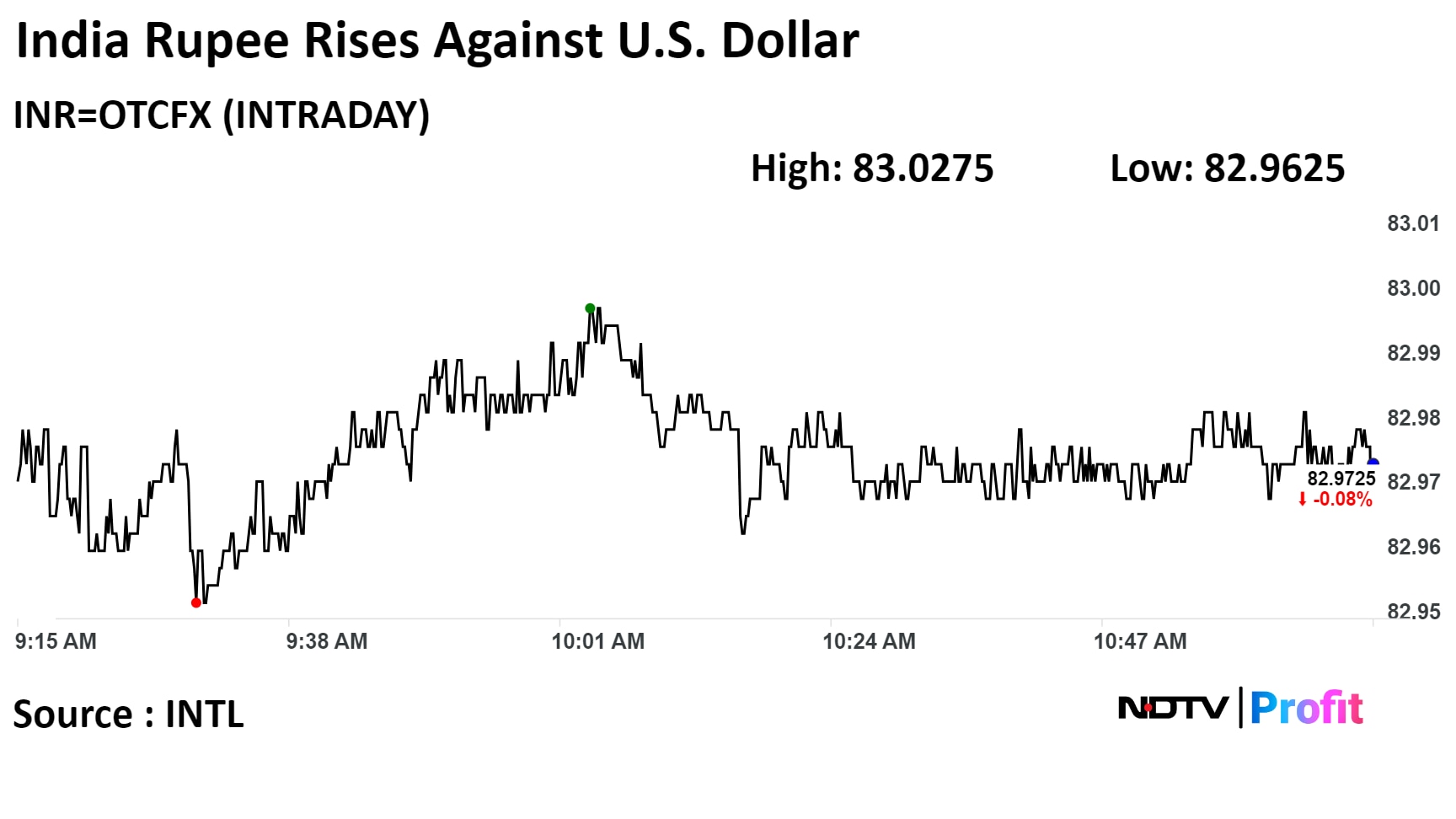

The local currency strengthened 6 paise to close at Rs 82.98 against the U.S dollar.

It closed at 83.04 on Wednesday.

Source: Bloomberg

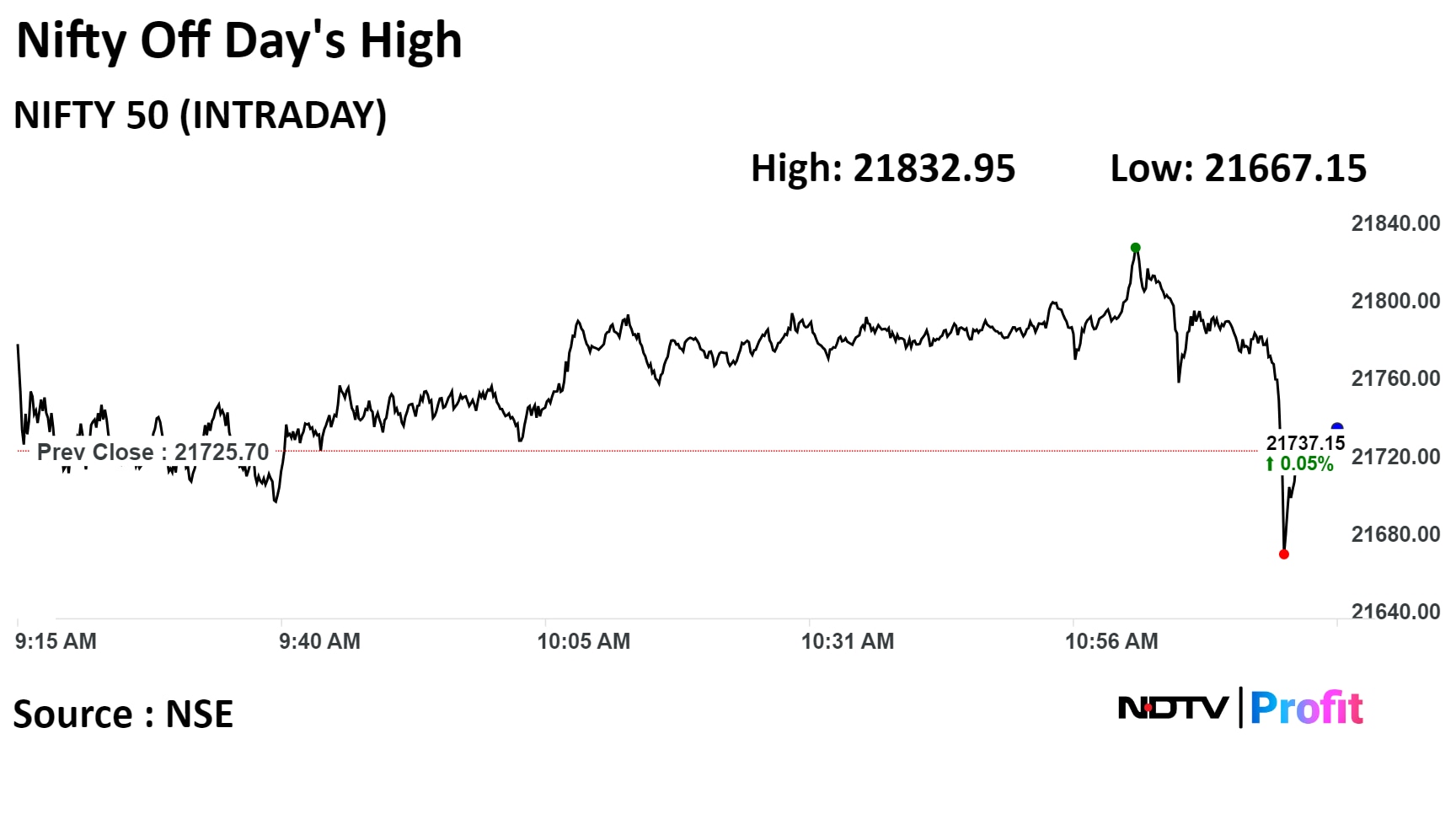

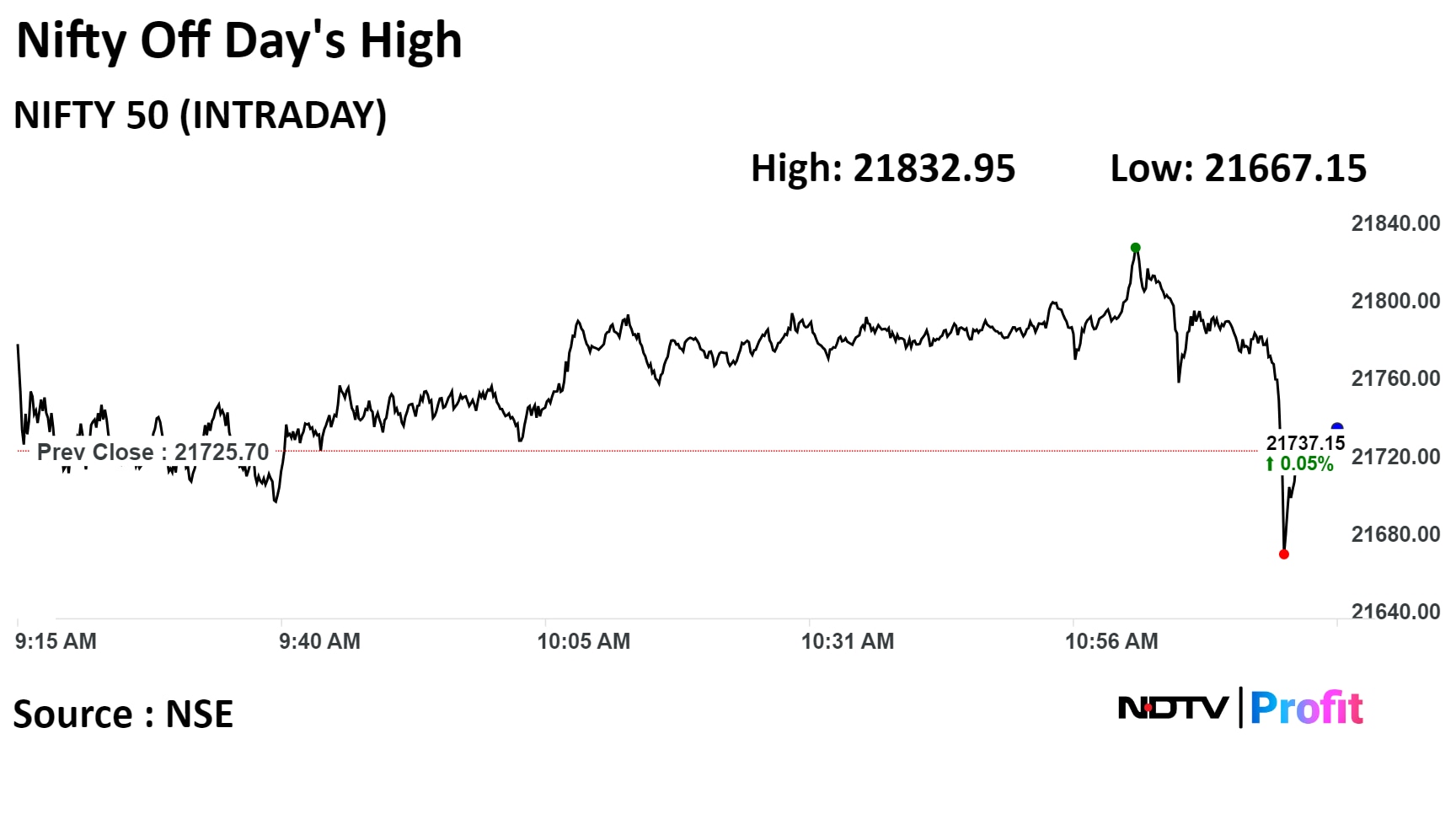

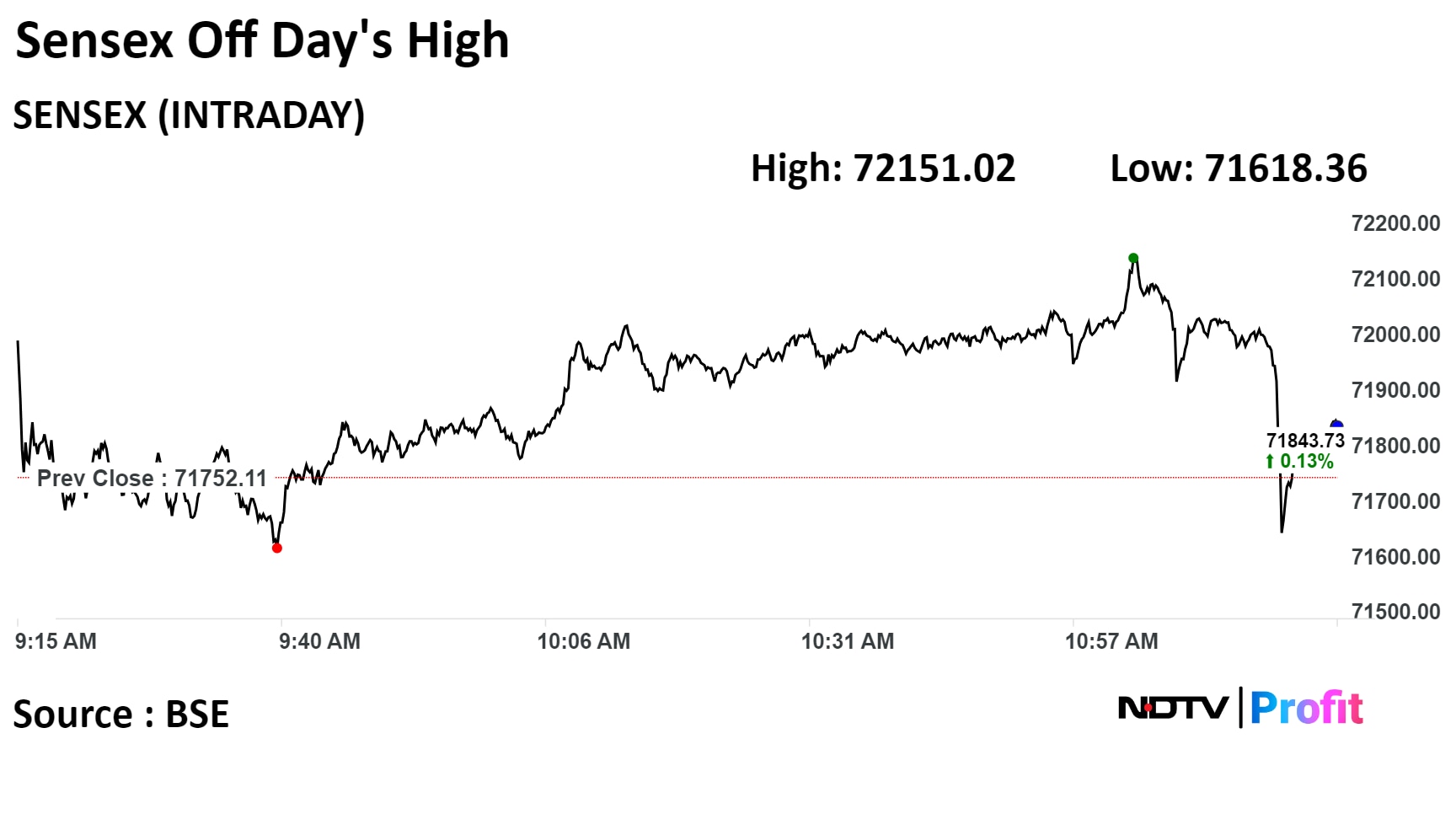

Indian markets ended the volatile trade session lower on Thursday as Larsen & Toubro Ltd, Bharti Airtel Ltd, and Bajaj Finance Ltd declined.

The NSE Nifty 50 settled 28.05 points or 0.13% lower at 21,689.65, and the S&P BSE Sensex ended 106.81 points or 0.15% lower at 71,645.30.

Intraday, the NSE Nifty 50 fell 0.31% to a low of 21,658.75, and the BSE Sensex declined 0.25% to a low of 71,574.89.

"Surprisingly, on the day of Interim Budget 2024, the benchmark indices saw range-bound activity, with Nifty closing 36 points lower while Sensex was down 107 points," Shrikant S. Chouhan, head of equity research at Kotak Securities said.

"The interim budget was the much anticipated non-event which was seen through tight market movements as the Index oscillated in a narrow range to settle the day lower at 21,697.45 with a loss of 28.25 points," Aditya Gaggar, director from Progressive Shares said.

Indian markets ended the volatile trade session lower on Thursday as Larsen & Toubro Ltd, Bharti Airtel Ltd, and Bajaj Finance Ltd declined.

The NSE Nifty 50 settled 28.05 points or 0.13% lower at 21,689.65, and the S&P BSE Sensex ended 106.81 points or 0.15% lower at 71,645.30.

Intraday, the NSE Nifty 50 fell 0.31% to a low of 21,658.75, and the BSE Sensex declined 0.25% to a low of 71,574.89.

"Surprisingly, on the day of Interim Budget 2024, the benchmark indices saw range-bound activity, with Nifty closing 36 points lower while Sensex was down 107 points," Shrikant S. Chouhan, head of equity research at Kotak Securities said.

"The interim budget was the much anticipated non-event which was seen through tight market movements as the Index oscillated in a narrow range to settle the day lower at 21,697.45 with a loss of 28.25 points," Aditya Gaggar, director from Progressive Shares said.

Indian markets ended the volatile trade session lower on Thursday as Larsen & Toubro Ltd, Bharti Airtel Ltd, and Bajaj Finance Ltd declined.

The NSE Nifty 50 settled 28.05 points or 0.13% lower at 21,689.65, and the S&P BSE Sensex ended 106.81 points or 0.15% lower at 71,645.30.

Intraday, the NSE Nifty 50 fell 0.31% to a low of 21,658.75, and the BSE Sensex declined 0.25% to a low of 71,574.89.

"Surprisingly, on the day of Interim Budget 2024, the benchmark indices saw range-bound activity, with Nifty closing 36 points lower while Sensex was down 107 points," Shrikant S. Chouhan, head of equity research at Kotak Securities said.

"The interim budget was the much anticipated non-event which was seen through tight market movements as the Index oscillated in a narrow range to settle the day lower at 21,697.45 with a loss of 28.25 points," Aditya Gaggar, director from Progressive Shares said.

Indian markets ended the volatile trade session lower on Thursday as Larsen & Toubro Ltd, Bharti Airtel Ltd, and Bajaj Finance Ltd declined.

The NSE Nifty 50 settled 28.05 points or 0.13% lower at 21,689.65, and the S&P BSE Sensex ended 106.81 points or 0.15% lower at 71,645.30.

Intraday, the NSE Nifty 50 fell 0.31% to a low of 21,658.75, and the BSE Sensex declined 0.25% to a low of 71,574.89.

"Surprisingly, on the day of Interim Budget 2024, the benchmark indices saw range-bound activity, with Nifty closing 36 points lower while Sensex was down 107 points," Shrikant S. Chouhan, head of equity research at Kotak Securities said.

"The interim budget was the much anticipated non-event which was seen through tight market movements as the Index oscillated in a narrow range to settle the day lower at 21,697.45 with a loss of 28.25 points," Aditya Gaggar, director from Progressive Shares said.

Indian markets ended the volatile trade session lower on Thursday as Larsen & Toubro Ltd, Bharti Airtel Ltd, and Bajaj Finance Ltd declined.

The NSE Nifty 50 settled 28.05 points or 0.13% lower at 21,689.65, and the S&P BSE Sensex ended 106.81 points or 0.15% lower at 71,645.30.

Intraday, the NSE Nifty 50 fell 0.31% to a low of 21,658.75, and the BSE Sensex declined 0.25% to a low of 71,574.89.

"Surprisingly, on the day of Interim Budget 2024, the benchmark indices saw range-bound activity, with Nifty closing 36 points lower while Sensex was down 107 points," Shrikant S. Chouhan, head of equity research at Kotak Securities said.

"The interim budget was the much anticipated non-event which was seen through tight market movements as the Index oscillated in a narrow range to settle the day lower at 21,697.45 with a loss of 28.25 points," Aditya Gaggar, director from Progressive Shares said.

Indian markets ended the volatile trade session lower on Thursday as Larsen & Toubro Ltd, Bharti Airtel Ltd, and Bajaj Finance Ltd declined.

The NSE Nifty 50 settled 28.05 points or 0.13% lower at 21,689.65, and the S&P BSE Sensex ended 106.81 points or 0.15% lower at 71,645.30.

Intraday, the NSE Nifty 50 fell 0.31% to a low of 21,658.75, and the BSE Sensex declined 0.25% to a low of 71,574.89.

"Surprisingly, on the day of Interim Budget 2024, the benchmark indices saw range-bound activity, with Nifty closing 36 points lower while Sensex was down 107 points," Shrikant S. Chouhan, head of equity research at Kotak Securities said.

"The interim budget was the much anticipated non-event which was seen through tight market movements as the Index oscillated in a narrow range to settle the day lower at 21,697.45 with a loss of 28.25 points," Aditya Gaggar, director from Progressive Shares said.

Indian markets ended the volatile trade session lower on Thursday as Larsen & Toubro Ltd, Bharti Airtel Ltd, and Bajaj Finance Ltd declined.

The NSE Nifty 50 settled 28.05 points or 0.13% lower at 21,689.65, and the S&P BSE Sensex ended 106.81 points or 0.15% lower at 71,645.30.

Intraday, the NSE Nifty 50 fell 0.31% to a low of 21,658.75, and the BSE Sensex declined 0.25% to a low of 71,574.89.

"Surprisingly, on the day of Interim Budget 2024, the benchmark indices saw range-bound activity, with Nifty closing 36 points lower while Sensex was down 107 points," Shrikant S. Chouhan, head of equity research at Kotak Securities said.

"The interim budget was the much anticipated non-event which was seen through tight market movements as the Index oscillated in a narrow range to settle the day lower at 21,697.45 with a loss of 28.25 points," Aditya Gaggar, director from Progressive Shares said.

Indian markets ended the volatile trade session lower on Thursday as Larsen & Toubro Ltd, Bharti Airtel Ltd, and Bajaj Finance Ltd declined.

The NSE Nifty 50 settled 28.05 points or 0.13% lower at 21,689.65, and the S&P BSE Sensex ended 106.81 points or 0.15% lower at 71,645.30.

Intraday, the NSE Nifty 50 fell 0.31% to a low of 21,658.75, and the BSE Sensex declined 0.25% to a low of 71,574.89.

"Surprisingly, on the day of Interim Budget 2024, the benchmark indices saw range-bound activity, with Nifty closing 36 points lower while Sensex was down 107 points," Shrikant S. Chouhan, head of equity research at Kotak Securities said.

"The interim budget was the much anticipated non-event which was seen through tight market movements as the Index oscillated in a narrow range to settle the day lower at 21,697.45 with a loss of 28.25 points," Aditya Gaggar, director from Progressive Shares said.

Larsen & Toubro Ltd, Bharti Airtel Ltd, Bajaj Finance Ltd, UltraTech Cements Ltd, and Titan Company Ltd weighed on the benchmark indices.

Maruti Suzuki India Ltd, Axis Bank Ltd, Tata Consultancy Services Ltd, HDFC Bank Ltd, and State Bank of India limited losses to the benchmark indices.

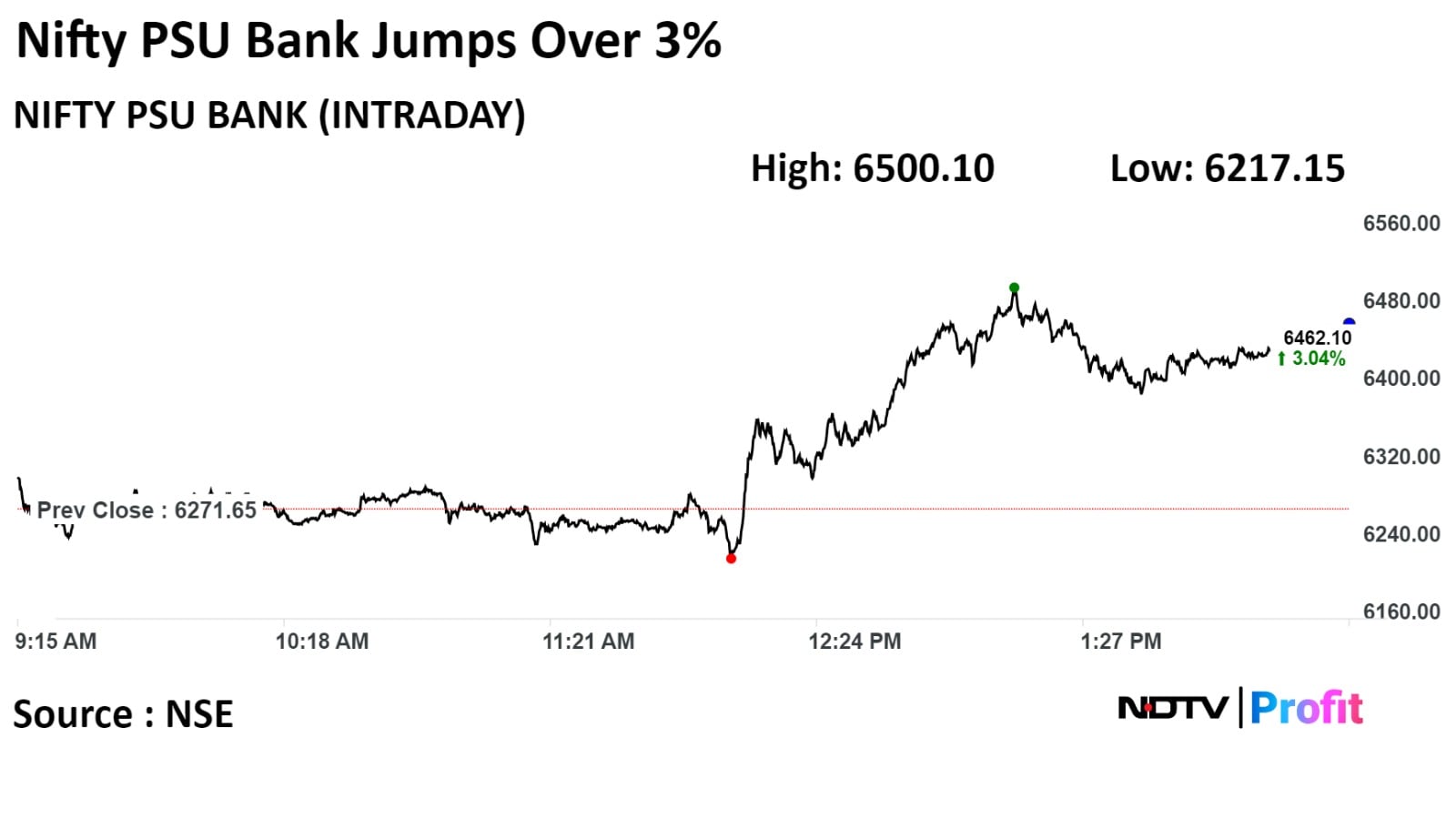

On NSE, six sectors ended in green, while six ended in red out of total 12 sectors. The Nifty PSU Bank surged 3.11% to become the top performer among its peer sectoral indices.

"Among sectors, the PSU Bank index was the biggest gainer, rising over 3 per cent, while profit-booking was seen in digital and metal stocks, resulting in a decline of over 1% in both indices," Chouhan said.

The Nifty Media shed 1.09% to become the worst performer among sectoral indices.

Broader markets underperformed benchmark indices. The S&P BSE Midcap Index declined 0.40%, and the S&P BSE Smallcap index was trading 0.22% lower. On BSE, 12 indices declined out of 20, and eight gained. The S&P BSE Telecommunication fell the most among sectoral indices.

"Divergence was seen in the Broader markets where Midcaps corrected and moved in tandem with the Benchmark Index while Smallcaps ended in green," Gaggar said.

Market breadth was skewed in favour of sellers. Around 2,020 stocks fell, 1,818 stocks rose, and 105 stocks remained unchanged on BSE.

Revenue rose 22% to Rs 14,164 crore from Rs 11,609 crore

Ebitda rose 16.18% to Rs 1,565 crore from Rs 1,347 crore

Margin fell 55 bps to 11.04% from 11.6%

Net profit rose 15.33% to Rs 1,053 crore from Rs 913 crore

Jewellery sales at Rs 12,742 crore from Rs 10,446 crore

Eyecare sales at Rs 168 crore from Rs 174 crore

Watches & wearable sales at Rs 986 crore from Rs 811 crore

Revenue rose 45% to Rs 620.8 crore from Rs 428.2 crore

Ebitda rose 74.4% at Rs 56.78 crore from Rs 32.56 crore

Margin rose 154 bps to 9.1% from 7.6%

Net profit fell 25.4% to Rs 26.87 crore from Rs 36.04 crore

Revenue fell 9.1% to Rs 828.6 crore from Rs 911.5 crore

Ebitda rose 13.1% Rs 96.41 crore from Rs 86.05 crore

Margin rose 219 bps to 11.6% from 9.4%

Net profit rose 13% to Rs 70.4 crore from Rs 62.3 crore

Jindal Steel & Power Ltd's Managing Director Bimlendra Jha resigns with effect from Jan 31.

Source: Exchange Filing

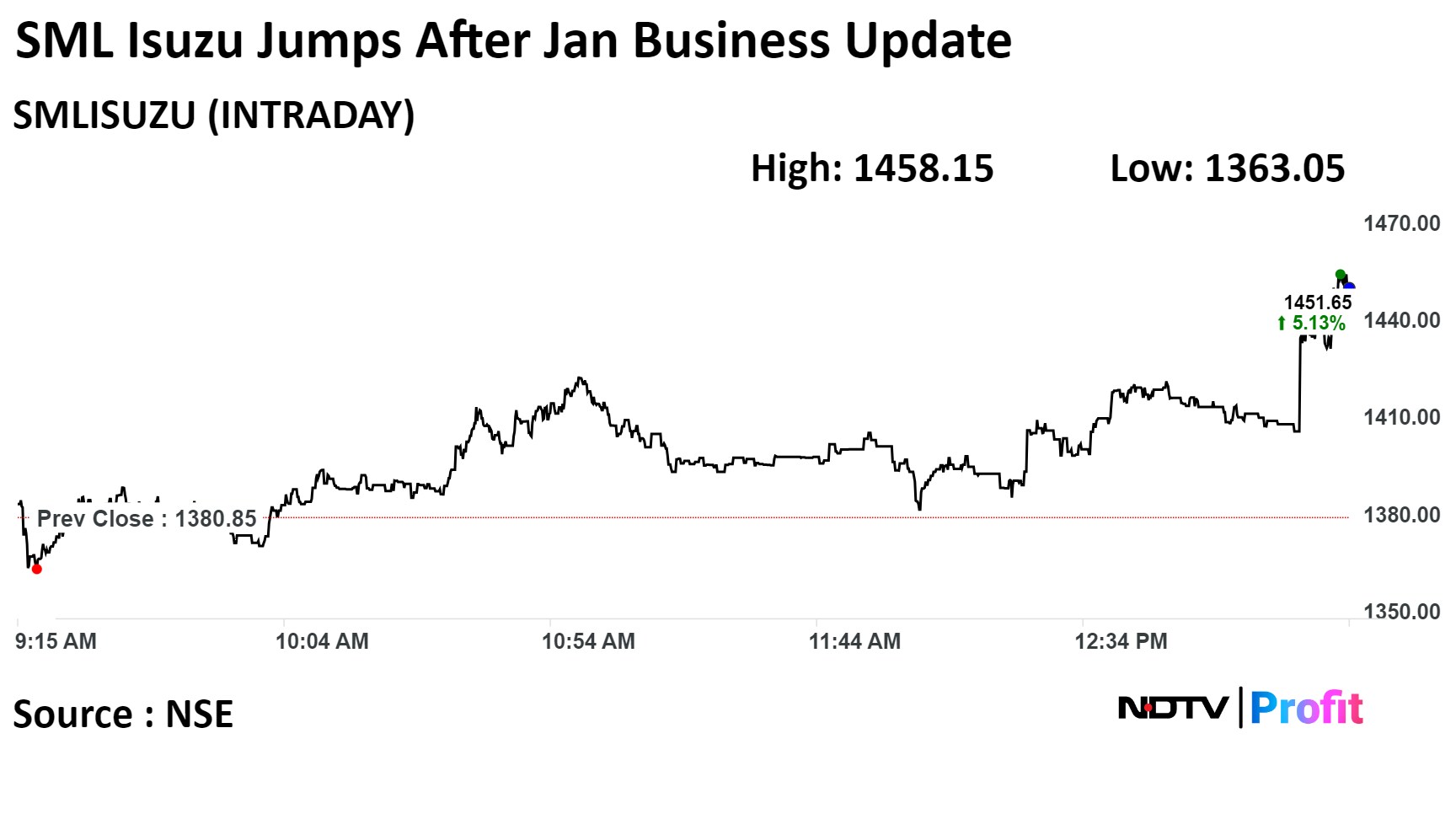

Jan vehicle sales rose 4.9% to 2,313 units

Source: Exchange Filing

Revenue rose 2.1% to Rs 706.7 crore from Rs 692.4 crore

Ebitda gained 84% at Rs 126.2 crore from Rs 68.58 crore

Margin rose 795 bps to 17.9% from 9.9%

Net profit fell 80.1% to Rs 79.92 crore from Rs 401.6 crore

Total income was Rs 48.59 crore from `Rs 9.63 crore

Net profit was at Rs 25.58 crore from loss of Rs 85 lakh

The index has risen consecutively in the last five sessions and has gained over 11% since January 23. All stocks were in the green with Punjab & Sind Bank gaining over 5% followed by Indian Overseas Bank and Indian Bank which were up more than 4%.

The index has risen consecutively in the last five sessions and has gained over 11% since January 23. All stocks were in the green with Punjab & Sind Bank gaining over 5% followed by Indian Overseas Bank and Indian Bank which were up more than 4%.

Jan coal production rose 9.1% to 78.4 MT.

Jan coal offtake grew 4.8% to 67.6 MT.

Source: Exchange Filing

Revenue rose 6.5% to Rs 28,336.4 crore from Rs 26,612.2 crore

Ebitda grew 106.7% to Rs 3,126.3 corer from Rs 1,512.2 crore

Margin rose 535 bps to 11.03% from 5.68%

Net profit rose 166.6% to Rs 1,972.8 crore from Rs 739.9 crore

Revenue rose 6.5% to Rs 28,336.4 crore from Rs 26,612.2 crore

Ebitda grew 106.7% to Rs 3,126.3 corer from Rs 1,512.2 crore

Margin rose 535 bps to 11.03% from 5.68%

Net profit rose 166.6% to Rs 1,972.8 crore from Rs 739.9 crore

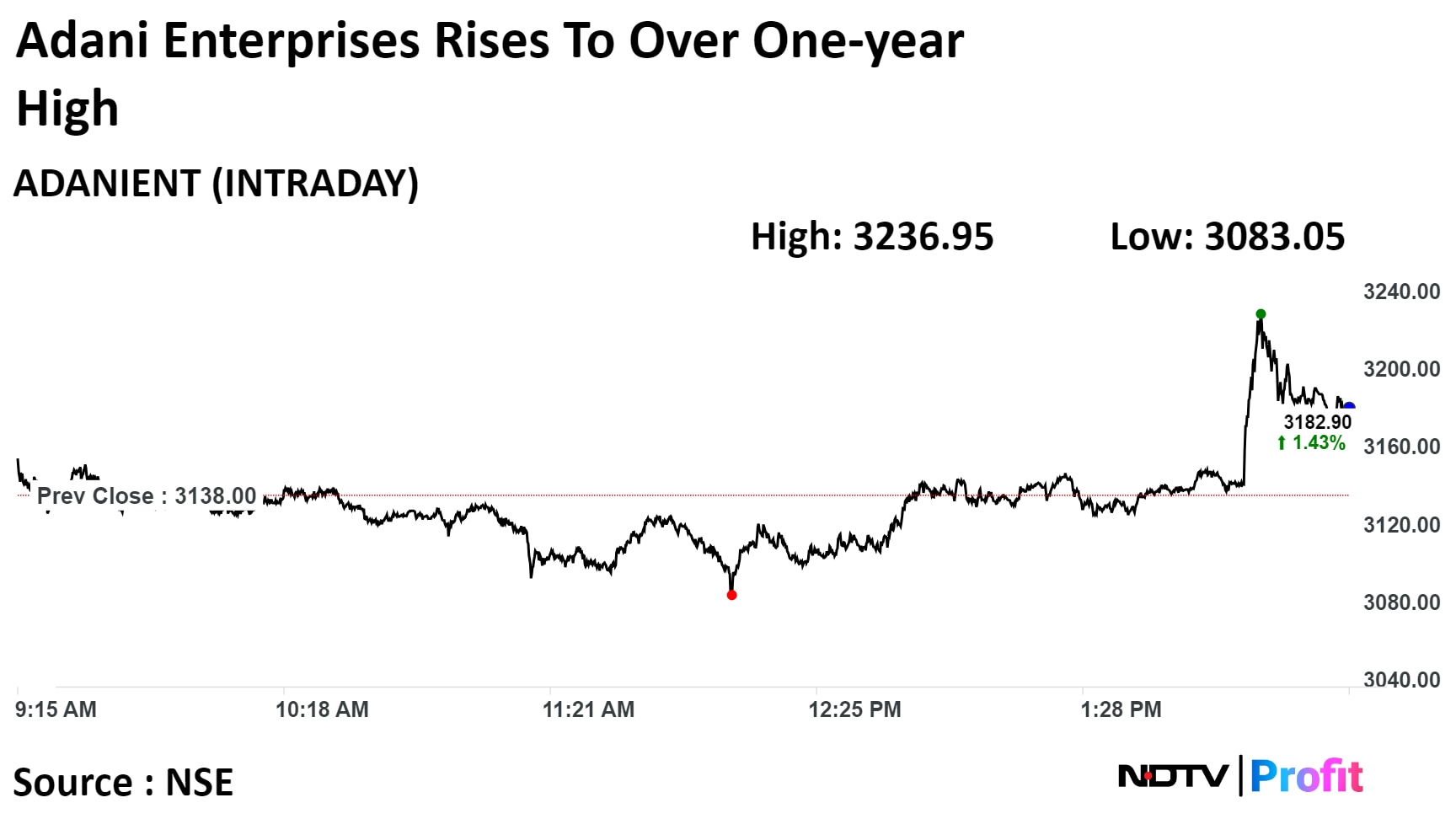

Scrips of Adani Enterprises Ltd rose as much 3.02% to 3,236.95, highest level since Jan 27, 2023. It was trading 1.27% higher at 3,181.75 as of 2:36 p.m. This compares to 0.05% decline on NSE Nifty index.

It has risen 46.06% in 12 months. The relative strength index was at 66.93.

One anayst tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 37.0%.

Total income rose 12.6% to Rs 284.6 crore from Rs 252.8 crore

Net profit up 13.5% to Rs 120.8 crore from Rs 106.4 crore

Revenue rose 18.2% to Rs 242.6 crore from Rs 205.3 crore

Ebitda up 19.1% at Rs 39.72 crore from Rs 33.35 crore

Margin up 12 bps at 16.4% from 16.2%

Net profit rose 48.9% to Rs 29.89 crore from Rs 20.07 crore

Revenue rose 18.6% to Rs 1,165.4 crore from Rs 982.3 crore

Ebitda rose 51.9% to Rs 101.6 crore from Rs 66.88 crore

Margin up 191 bps to 8.7% from 6.8%

Net profit rose 48.2% to Rs 58.24 crore from Rs 39.28 crore

Rolex Rings Ltd revenue fell 11.08% to Rs 273.3 crore from Rs 307.34 crore

Ebitda declined 23.07% to Rs 52.64 crore from Rs 68.42 crore

Margin down 300 bps to 19.26% from 22.26%

Net profit fell 29.89% to Rs 37.01 crore from Rs 52.79 crore

Shares of India Cements Ltd plunged over 9% to its over one-week low on Thursday after the company informed Enforcement Directorate has conducted search in its Chennai office.

The company said in an exchange filing ED has searched its premises in Chennai from Wednesday and Thursday to inspect if any irregularities regarding FEMA has been conducted or not.

The India Cements Ltd has complied and provided the regulator with all the relevant information, the exchange filing said

Shares of India Cements Ltd plunged over 9% to its over one-week low on Thursday after the company informed Enforcement Directorate has conducted search in its Chennai office.

The company said in an exchange filing ED has searched its premises in Chennai from Wednesday and Thursday to inspect if any irregularities regarding FEMA has been conducted or not.

The India Cements Ltd has complied and provided the regulator with all the relevant information, the exchange filing said

India Cements Ltd's stocks fell as much as 9.45% to Rs 236.00 apiece, the lowest level since Jan 24. It pared losses trade 6.27% lower at Rs 245.00 apiece, as of 1:50 p.m. This compares to a 0.03% decline in the NSE Nifty 50 Index.

It has risen in 26.39% in 12 months. Total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 43.73.

Seven analyst tracking the company suggest to 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 32.4%.

Revenue up 10.1% at Rs 538.9 crore vs Rs 489.4 crore

Ebitda up 24.4% at Rs 140.6 crore vs Rs 113 crore

Margin at 26.09% vs 23.08%

Net profit up 53.4% at Rs 82.2 crore vs Rs 53.6 crore

Revenue up 24.4% at Rs 878.3 crore vs Rs 705.9 crore

EBITDA up 54.1% at Rs 74.24 crore vs Rs 48.18 crore

Margin at 8.5% vs 6.8%

Net profit up 72.7% at Rs 31.78 crore vs Rs 18.4 crore

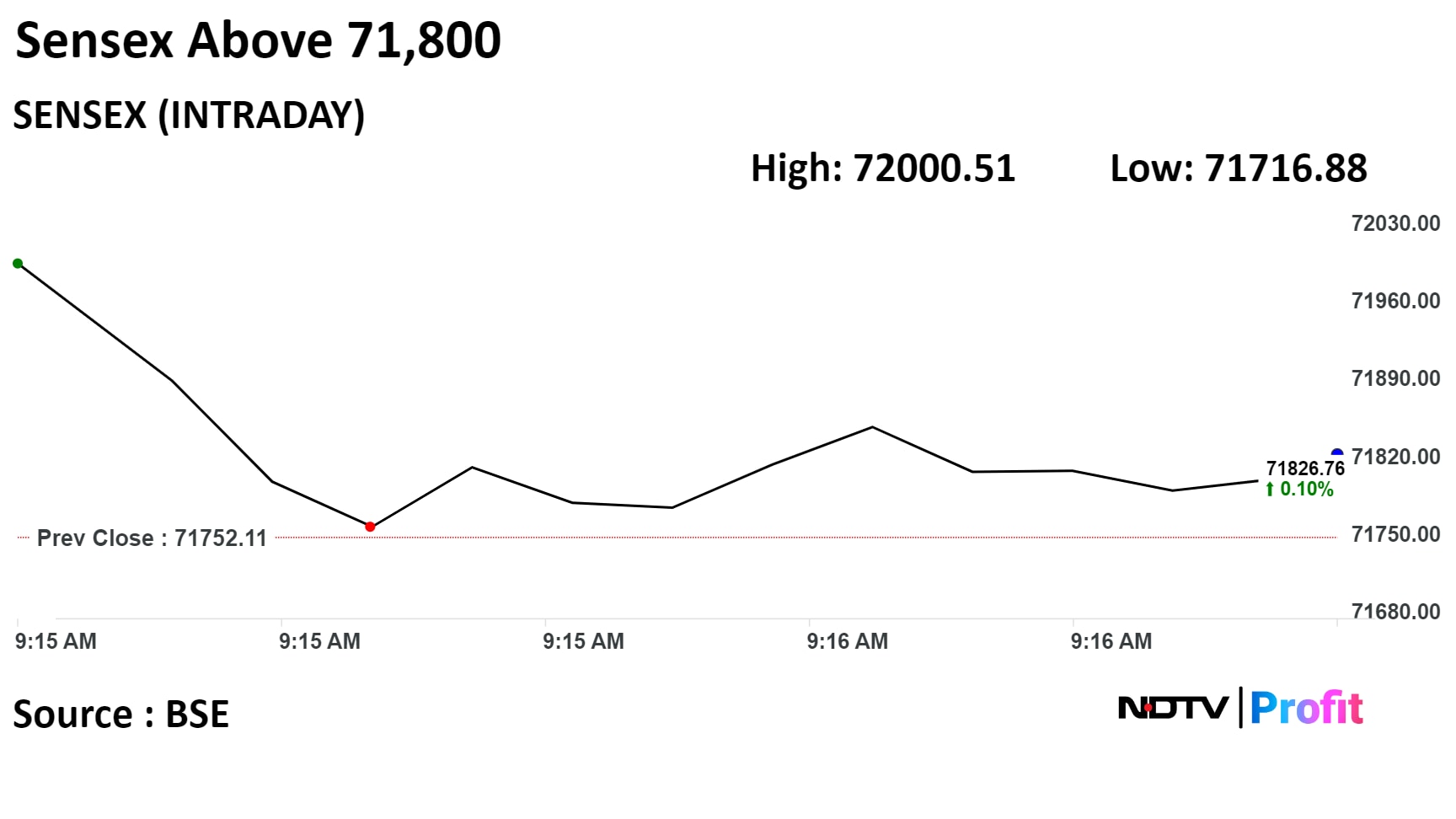

India's benchmark stock indices gave up most of their earlier gains to turn volatile after the Finance Minister failed to make any major announcements in the interim budget for 2024.

Indices were marginally higher due to gains in Tata Consultancy Services Ltd. and Maruti Suzuki India Ltd.

At 12:08 p.m., the Nifty 50 were up 20.60 points, or 0.09%, at 21,746.30, and the Sensex rose 98.03 points, or 0.14%, to 71,850.14.

"With expectations for the interim budget to be mainly a vote-on-account, lacking significant announcements, the index is likely to maintain a narrow range," said Shrey Jain, founder and chief executive officer at SAS Online. "Traders are advised to stick to their stop-loss strategies and closely monitor price movements for guidance."

India's benchmark stock indices gave up most of their earlier gains to turn volatile after the Finance Minister failed to make any major announcements in the interim budget for 2024.

Indices were marginally higher due to gains in Tata Consultancy Services Ltd. and Maruti Suzuki India Ltd.

At 12:08 p.m., the Nifty 50 were up 20.60 points, or 0.09%, at 21,746.30, and the Sensex rose 98.03 points, or 0.14%, to 71,850.14.

"With expectations for the interim budget to be mainly a vote-on-account, lacking significant announcements, the index is likely to maintain a narrow range," said Shrey Jain, founder and chief executive officer at SAS Online. "Traders are advised to stick to their stop-loss strategies and closely monitor price movements for guidance."

India's benchmark stock indices gave up most of their earlier gains to turn volatile after the Finance Minister failed to make any major announcements in the interim budget for 2024.

Indices were marginally higher due to gains in Tata Consultancy Services Ltd. and Maruti Suzuki India Ltd.

At 12:08 p.m., the Nifty 50 were up 20.60 points, or 0.09%, at 21,746.30, and the Sensex rose 98.03 points, or 0.14%, to 71,850.14.

"With expectations for the interim budget to be mainly a vote-on-account, lacking significant announcements, the index is likely to maintain a narrow range," said Shrey Jain, founder and chief executive officer at SAS Online. "Traders are advised to stick to their stop-loss strategies and closely monitor price movements for guidance."

India's benchmark stock indices gave up most of their earlier gains to turn volatile after the Finance Minister failed to make any major announcements in the interim budget for 2024.

Indices were marginally higher due to gains in Tata Consultancy Services Ltd. and Maruti Suzuki India Ltd.

At 12:08 p.m., the Nifty 50 were up 20.60 points, or 0.09%, at 21,746.30, and the Sensex rose 98.03 points, or 0.14%, to 71,850.14.

"With expectations for the interim budget to be mainly a vote-on-account, lacking significant announcements, the index is likely to maintain a narrow range," said Shrey Jain, founder and chief executive officer at SAS Online. "Traders are advised to stick to their stop-loss strategies and closely monitor price movements for guidance."

India's benchmark stock indices gave up most of their earlier gains to turn volatile after the Finance Minister failed to make any major announcements in the interim budget for 2024.

Indices were marginally higher due to gains in Tata Consultancy Services Ltd. and Maruti Suzuki India Ltd.

At 12:08 p.m., the Nifty 50 were up 20.60 points, or 0.09%, at 21,746.30, and the Sensex rose 98.03 points, or 0.14%, to 71,850.14.

"With expectations for the interim budget to be mainly a vote-on-account, lacking significant announcements, the index is likely to maintain a narrow range," said Shrey Jain, founder and chief executive officer at SAS Online. "Traders are advised to stick to their stop-loss strategies and closely monitor price movements for guidance."

India's benchmark stock indices gave up most of their earlier gains to turn volatile after the Finance Minister failed to make any major announcements in the interim budget for 2024.

Indices were marginally higher due to gains in Tata Consultancy Services Ltd. and Maruti Suzuki India Ltd.

At 12:08 p.m., the Nifty 50 were up 20.60 points, or 0.09%, at 21,746.30, and the Sensex rose 98.03 points, or 0.14%, to 71,850.14.

"With expectations for the interim budget to be mainly a vote-on-account, lacking significant announcements, the index is likely to maintain a narrow range," said Shrey Jain, founder and chief executive officer at SAS Online. "Traders are advised to stick to their stop-loss strategies and closely monitor price movements for guidance."

India's benchmark stock indices gave up most of their earlier gains to turn volatile after the Finance Minister failed to make any major announcements in the interim budget for 2024.

Indices were marginally higher due to gains in Tata Consultancy Services Ltd. and Maruti Suzuki India Ltd.

At 12:08 p.m., the Nifty 50 were up 20.60 points, or 0.09%, at 21,746.30, and the Sensex rose 98.03 points, or 0.14%, to 71,850.14.

"With expectations for the interim budget to be mainly a vote-on-account, lacking significant announcements, the index is likely to maintain a narrow range," said Shrey Jain, founder and chief executive officer at SAS Online. "Traders are advised to stick to their stop-loss strategies and closely monitor price movements for guidance."

India's benchmark stock indices gave up most of their earlier gains to turn volatile after the Finance Minister failed to make any major announcements in the interim budget for 2024.

Indices were marginally higher due to gains in Tata Consultancy Services Ltd. and Maruti Suzuki India Ltd.

At 12:08 p.m., the Nifty 50 were up 20.60 points, or 0.09%, at 21,746.30, and the Sensex rose 98.03 points, or 0.14%, to 71,850.14.

"With expectations for the interim budget to be mainly a vote-on-account, lacking significant announcements, the index is likely to maintain a narrow range," said Shrey Jain, founder and chief executive officer at SAS Online. "Traders are advised to stick to their stop-loss strategies and closely monitor price movements for guidance."

Shares of Tata Consultancy Services Ltd., Maruti Suzuki Ltd., ITC Ltd., Reliance Industries Ltd., Power Grid Corp. Of India contributed the most to the Nifty 50.

Meanwhile, those of Larsen & Toubro Ltd., Bharti Airtel Ltd., UltraTech Cement Ltd., Bajaj Finance Ltd., and Dr. Reddy's Laboratories Ltd. weighed on the index.

Most sectoral indices fell with Nifty Realty and Nifty Media falling over 1%. Nifty Auto, Nifty FMCG, and Nifty Energy gained.

The broader markets underperformed the benchmark indices, with the S&P BSE Midcap falling 0.49% and the S&P BSE Smallcap declining 0.39% through midday on Thursday.

Eleven out of the 20 stocks declined and nine stocks gained on the BSE. The S&P BSE Telecommunication fell the most among sectoral indices.

Market breadth was skewed in favour of the sellers. Around 1,995 stocks fell, 1,648 stocks rose, and 143 stocks remained unchanged on BSE.

Total vehicle sales up 71% YoY at 1,320 units

PV sales up 93% YoY at 886 units

Cargo Vehicle sales up 39% YoY at 434 units

Source: Exchange Filing

Total vehicle sales up 71% YoY at 1,320 units

PV sales up 93% YoY at 886 units

Cargo Vehicle sales up 39% YoY at 434 units

Source: Exchange Filing

Revenue down 32.8% at Rs 1,852.6 crore vs Rs 2,754.8 crore

EBITDA down 38.8% at Rs 282.2 crore vs Rs 461.2 crore

Margin at 15.2% vs 16.7%

Net profit down 76% at Rs 60.53 crore vs Rs 252.3 crore

Revenue up 20.3% at Rs 895.9 crore vs Rs 744.5 crore

EBITDA up 72.6% at Rs 51.01 crore vs Rs 29.56 crore

Margin at 5.7% vs 4%

Net profit at Rs 28 crore vs Rs 13.77 crore

Revenue up 15.2% at Rs 4,196.9 crore vs Rs 3,643.2 crore

EBITDA down 0.9% at Rs 469 crore vs Rs 473.3 crore

Ebitda margin at 11.2% vs 13%

Net profit at Rs 823.9 crore vs Rs 324.2 crore

Board approves interim dividend of Rs 2/share

Aurobindo Pharma has issued a clarification on news regarding the U.S. Food and Drug Administration's inspection at Eugia-III facility.

The pharma company clarified that the US FDA inspection at facility is under progress from January 22, not been concluded yet

Source: Exchange Filing

Ion Exchanges Ltd signed a contract worth Rs 152.5 crore with Material Construction Trading FZCO, UAE.

The contract is for desalinated water unit for project in North Africa.

Source: Exchange filing

Revenue rose 44.6% to Rs 6,920.1 crore from Rs 4,786.2 crore

Ebitda rose 59.21% to Rs 4,185.9 crore from Rs 3,011.4 crore

Margin down 242 bps to 60.48% from 62.91%

Net profit rose 65.22% Rs 2,208.21 crore from Rs 1,336.51 crore

Revenue rose 44.6% to Rs 6,920.1 crore from Rs 4,786.2 crore

Ebitda rose 59.21% to Rs 4,185.9 crore from Rs 3,011.4 crore

Margin down 242 bps to 60.48% from 62.91%

Net profit rose 65.22% Rs 2,208.21 crore from Rs 1,336.51 crore

Scrip of Adani Ports and Special Economic Zones Ltd rose as much as 2.17% to Rs 1,233.80 apiece, the highest level since Jan 29. It trading 1.46% higher at Rs 1,225.30 apiece, as of 12:56 p.m. This compares to a 1.4% advance in the NSE Nifty 50 Index.

It has risen 147.46% in 12 months. The relative strength index was at 66.1.

Out of XXX analysts tracking the company, 19 maintain a 'buy' rating, two recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies a downside of 6.0%.

Total income rose 46.6% to Rs 570 crore from Rs 388.7 crore.

Net profit rose 43.6% to Rs 216.8 crore from Rs 151 crore.

Revenue down 10.7% at Rs 1,144.5 crore vs Rs 1,281 crore

EBITDA at Rs 48.79 crore vs loss of Rs 59.57 crore

Margin at 4.3%

Net profit down 99.5% at Rs 67 lakh vs Rs 133.3 crore

Revenue down 6% at Rs 1,728.3 crore vs Rs 1,837.8 crore

Net loss of Rs 11.47 crore vs loss of Rs 63.35 crore

Ebitda up 8% at Rs 133.5 crore vs Rs 123.7 crore

Ebitda margin at 7.7% vs 6.7%

Railways stocks erased earlier gains and was trading lower as the initial reaction to the announcement of building three new railway corridors faded.

Finance Minister Nirmala Sitharaman announced to build three railway corridor in the interim budget for FY25.

UCO Bank Ltd had 12.5 lakh shares or 0.01% equity changed hands in a large trade.

Buyers and sellers are not not known immediately.

Source: Bloomberg

FDI inflow during FY14-23 was $596 billion, Sitharaman said. The government to encourage FDI, negotiating bilateral trade treaties with partner countries.

The local currency strengthened 11 paise to trade at Rs 82.93 against the U.S dollar.

It closed at 83.04 on Wednesday.

Source: Bloomberg

FDI inflow during FY14-23 was $596 billion, Sitharaman said. The government to encourage FDI, negotiating bilateral trade treaties with partner countries.

The local currency strengthened 11 paise to trade at Rs 82.93 against the U.S dollar.

It closed at 83.04 on Wednesday.

Source: Bloomberg

India Government has set fiscal deficit target at 5.1% for FY25, announced Finance Minister Nirmala Sitharaman. Indian Government has set gross market borrowing target at 14.13 lakh crore, and net borrowing target at 11.75 lakh crore.

The yield on the 10-year bond trades 3 bps lower at 7.11%.

It closed at 7.14% on Wednesday

Source: Bloomberg

India Government has set fiscal deficit target at 5.1% for FY25, announced Finance Minister Nirmala Sitharaman. Indian Government has set gross market borrowing target at 14.13 lakh crore, and net borrowing target at 11.75 lakh crore.

The yield on the 10-year bond trades 3 bps lower at 7.11%.

It closed at 7.14% on Wednesday

Source: Bloomberg

Coal gasification and liquefaction capacity of 100 million tonnes to be set up by 2030, announced Sitharaman.

Greater adoption of e-buses to be encouraged, new scheme of bio manufacturing, bio foundry to be launched, and Blending of CNG and biogas will be mandated in phased manner.

KPI Green Energy Ltd 8.28% up

Waaree Renewable Technologies up 5%

Suzlon Energy up 4.9%

Borosil Renewables up 4.49%

Power Grid Corp up 3.28% Sterling And Wilson Renewable Energy up 2.59%

Gensol Engineering up 2.17%

Tata Power Co up 0.99%

Inox Wind Energy up 0.29%

Inox Wind down 0.81%

Interglobe Aviation up 1.38%

Spicejet down 0.31%

IRFC up 2.17%

Jupiter Wagons up 1.97%

Texmaco Rail & Engineering up 1.5%

RVNL up 1.04%

Ircon International up 0.78%

IRCTC up 0.8%

Titagarh Rail Systems down 0.06%

Container Corporation Of India down 0.17%

Railtel Corporation Of India down 1.74%

Rites down 2.21%

Fisheries stocks gain on Thursday as the FM said the government will set up five integrated aquaparks in the backdrop of seafood exports doubling since 2013

Avanti Feeds up 4.1%

Godrej Agrovet up 3.2%

The Nifty Realty index declined over 1% as Macrotech Developers, Godrej Properties, and Prestige Estate drags.

Indiabulls Real Estate up 0.92%

Sunteck Realty up 0.81%

The Phoenix Mills up 0.5%

Mahindra Lifespace Developers down 0.27%

DLF down 0.72%

Godrej Properties down 1.41%

Sobha down 1.63%

Oberoi Realty down 1.64%

Brigade Enterprises down 1.75%

Prestige Estates Projects down 1.8%

D B Realty down 2.26%

Macrotech Developers down 2.23%

The Nifty Realty index declined over 1% as Macrotech Developers, Godrej Properties, and Prestige Estate drags.

Indiabulls Real Estate up 0.92%

Sunteck Realty up 0.81%

The Phoenix Mills up 0.5%

Mahindra Lifespace Developers down 0.27%

DLF down 0.72%

Godrej Properties down 1.41%

Sobha down 1.63%

Oberoi Realty down 1.64%

Brigade Enterprises down 1.75%

Prestige Estates Projects down 1.8%

D B Realty down 2.26%

Macrotech Developers down 2.23%

Maruti Suzuki India up 3.95%

Eicher Motors up 1.7%

Escorts Kubota up 0.59%

Hero MotoCorp up 0.26%

Bajaj Auto up 0.96%

Ashok Leyland down 0.57%

Infrastructure stocks gained following the announcement that the Indian Govt will spend Rs 11.11 lakh crore in FY25 in the sector.

GVK Power & Infrastructure Ltd up 4.45%

PSP Projects up 2.54%

IRB Infrastructure Developers up 2.34%

Engineers India up 0.83%

G R Infraprojects up 0.37%

Aavas Financiers Ltd up 1.45%

PNB Housing Finance Ltd up 1.17%

Can Fin Homes Ltd up 0.21% %

Direct financial assistance provided to 11.8 crore farmers per year under PM Kisan Samman Yojana, says Sitharaman.

Madras Fertilizers up 2.31%

Zuari Agro Chemicals up 1.98%

Chambal Fertilisers & Chemicals up 1.68%

National Fertilizers up 1.59%

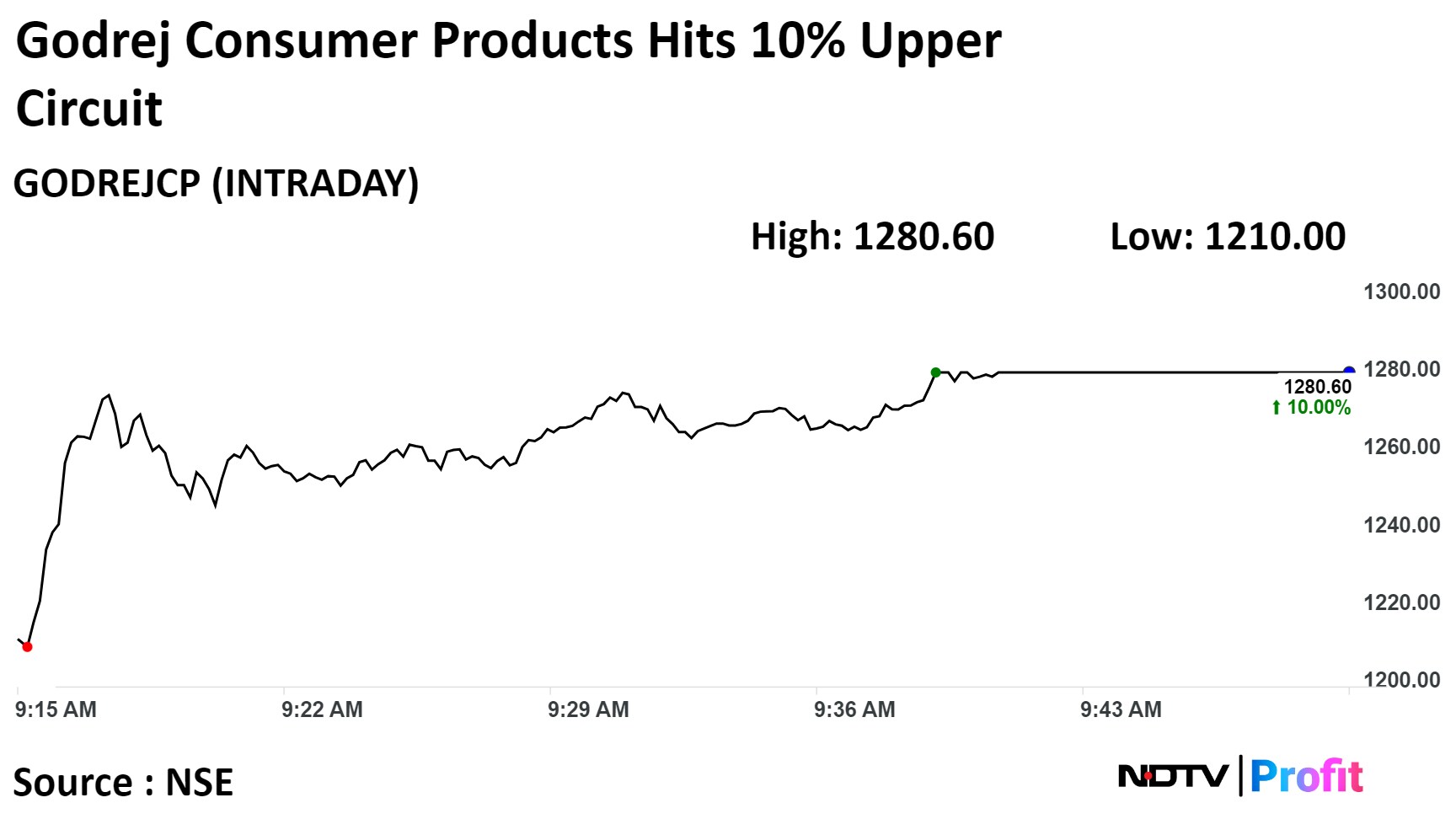

In FMCG sectoral index, Godrej Consumer Products Ltd., ITC, Hindustan Unilever contributed the most to the gains.

Godrej Consumer Products Ltd up 10.44%

Dabur India Ltd up 5.72%

Marico Ltd up 4.4%

Hindustan Unilever Ltd up 0.94%

Emami Ltd up 0.83%

ITC Ltd up 0.41%

In FMCG sectoral index, Godrej Consumer Products Ltd., ITC, Hindustan Unilever contributed the most to the gains.

Godrej Consumer Products Ltd up 10.44%

Dabur India Ltd up 5.72%

Marico Ltd up 4.4%

Hindustan Unilever Ltd up 0.94%

Emami Ltd up 0.83%

ITC Ltd up 0.41%

The yield on the 10-year bond trades 2 bps lower at 7.12%.

It closed at 7.14% on Wednesday.

Source: Bloomberg

The yield on the 10-year bond trades 2 bps lower at 7.12%.

It closed at 7.14% on Wednesday.

Source: Bloomberg

The local currency strengthened 7 paise to trade at 82.97 against the U.S dollar.

It closed at 83.04 on Wednesday.

Source: Bloomberg

The local currency strengthened 7 paise to trade at 82.97 against the U.S dollar.

It closed at 83.04 on Wednesday.

Source: Bloomberg

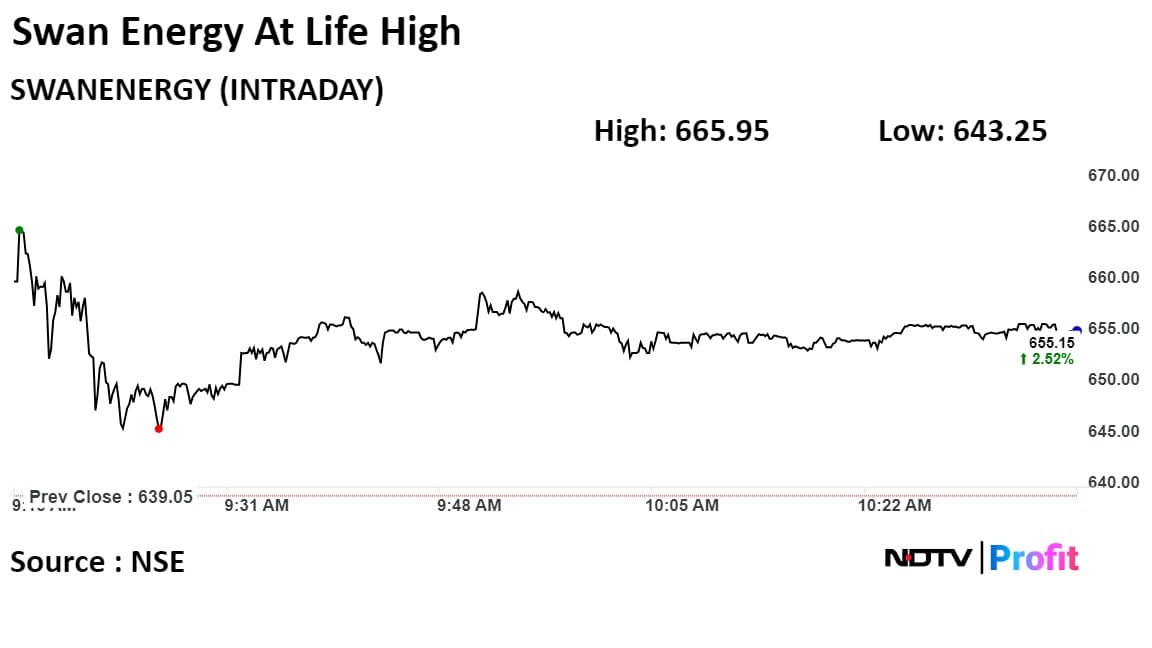

The shares of Swan Energy Ltd. rose to life high on Thursday after it reported consolidated net profit of Rs 220 crore in the third quarter.

The scrip rose as much as 4.21% to 665.95 apiece, to touch fresh life high. It last high was on Jan. 31. It pared gains to trade 2.43% higher at Rs 654.60 apiece, as of 10:34 a.m. This compares to a 0.27% advance in the NSE Nifty 50 Index.

It has risen 110.25% in the last 12 months. Total traded volume so far in the day stood at 2.2 times its 30-day average. The relative strength index was at 77 indicating it was overbought.

The one analysts tracking the company maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 110.1%.

The shares of Swan Energy Ltd. rose to life high on Thursday after it reported consolidated net profit of Rs 220 crore in the third quarter.

The scrip rose as much as 4.21% to 665.95 apiece, to touch fresh life high. It last high was on Jan. 31. It pared gains to trade 2.43% higher at Rs 654.60 apiece, as of 10:34 a.m. This compares to a 0.27% advance in the NSE Nifty 50 Index.

It has risen 110.25% in the last 12 months. Total traded volume so far in the day stood at 2.2 times its 30-day average. The relative strength index was at 77 indicating it was overbought.

The one analysts tracking the company maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 110.1%.

Indian Renewable Energy Development Agency Ltd

Urja Global Ltd

Waaree Renewable Technologies Ltd

Borosil Renewables Ltd

KPI Green Energy Ltd

Gensol Engineering Ltd

ICICI Prudential MF reduced stake in Zee Entertainment to 5.09% from 7.24% via open market.

It has reduced stake in Zee Entertainment by 2.15% during Jan 20, 2023, to Jan 30, 2024.

Source: Exchange Filing

Suzlon Energy Ltd had 2.69 crore shares or 0.2% equity changed hands in multiple large trades.

Buyers and sellers are not known immediately.

Source: Bloomberg

Indus Towers Ltd had its19.8 crore shares or 7.3% equity changed hands in multiple large trades.

Buyers and sellers are not known immediately.

Source: Bloomberg

The scrip was locked in10.00% upper circuit . It rose to Rs 1,280.60 apiece, the highest level since its listing on Jun 20, 2001 This compares to a 0.25% advance in the NSE Nifty 50 Index.

It has risen 37.74% in 12 months. Total traded volume so far in the day stood at 20 times its 30-day average. The relative strength index was at 74.41, which implied the stock is overbought.

Out of 37 analysts tracking the company, 28 maintain a 'buy' rating, six recommend a 'hold,' and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 3.4%.

The scrip was locked in10.00% upper circuit . It rose to Rs 1,280.60 apiece, the highest level since its listing on Jun 20, 2001 This compares to a 0.25% advance in the NSE Nifty 50 Index.

It has risen 37.74% in 12 months. Total traded volume so far in the day stood at 20 times its 30-day average. The relative strength index was at 74.41, which implied the stock is overbought.

Out of 37 analysts tracking the company, 28 maintain a 'buy' rating, six recommend a 'hold,' and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 3.4%.

Financial Services

Bank of Baroda at Rs 251

Multi Commodity Exchange of India at Rs 3459

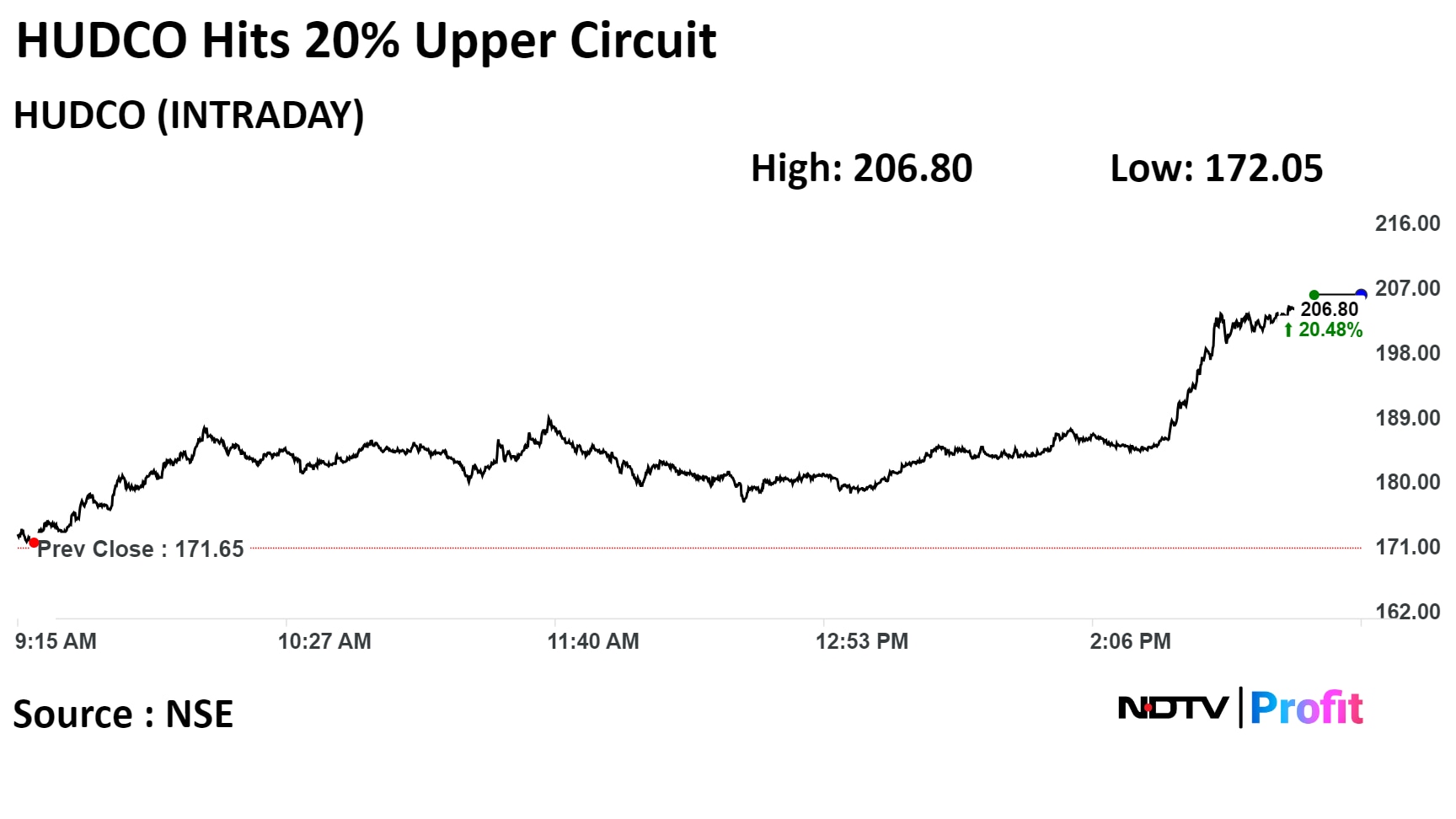

Housing & Urban Development Corporation at Rs 181.8

Kfin Technologies at Rs 636.75

Healthcare

Dr Reddy Laboratories at Rs 6149.4

Zydus Lifesciences at Rs 766.95

Automobile and Auto Components:

Bajaj Auto at Rs 7732.05

Tata Motors at Rs 900.15

Hero Motorcorp at Rs 4717.85

FMCG

Colgate- Palmolive (India) at Rs 2604.05

Godrej Consumer Products at Rs 1280.62

Construction

Kalpataru Projects International at Rs 801.5

IRB Infrastructure Developers at Rs 69.6

PNC Infratech at Rs 462.8

Power

Tata Power at Rs 395.25

Power Grid Corporation of India at Rs 264.85

NHPC at Rs 93.2

Torrent Power at Rs 1080

Construction Materials

J.K Cement at Rs 4441.1

Metals & Mining:

National Aluminum at Rs 151.35

Capital Goods

Rites at Rs 766

Swan Energy at Rs 665.95

Oil & Gas

Mahanagar Gas at Rs 1514.65

Services

Transport Corporation of India at Rs 1079.5

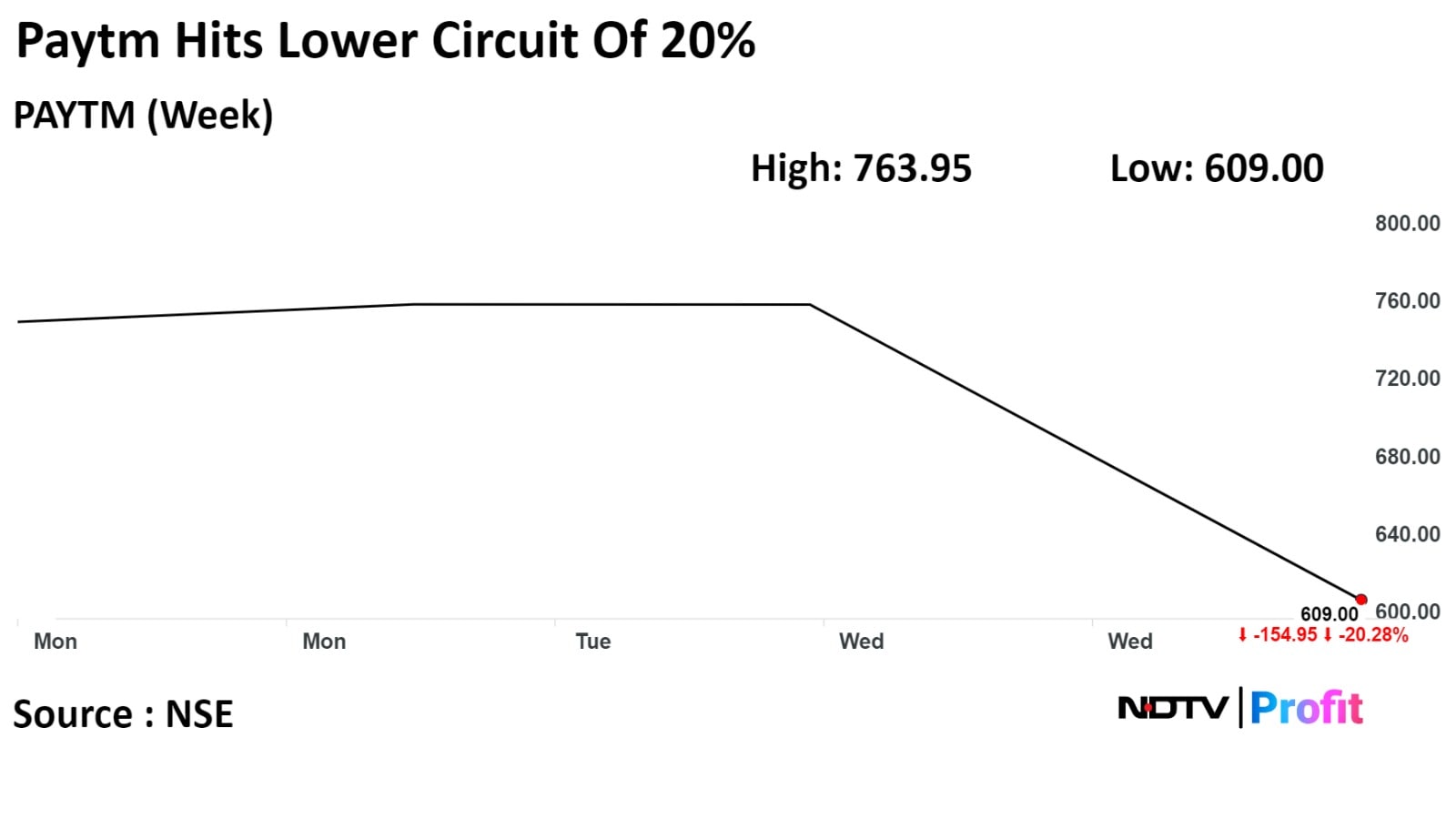

Shares of One97 Communications Ltd. were locked in 20% lower circuit after the RBI barred Paytm Payments Bank from accepting fresh deposits, top-ups or credit transactions after Feb. 29.

The crackdown came as the regulator found persistent non-compliance and major supervisory concerns at the payments bank.

One97, in an exchange filing, said that from now on it will be working only with other banks and not its own payments bank.

Paytm's was locked in 20% to Rs 609 apiece, the lowest level since Dec 23, on Thursday morning. The scrip has risen 16.22 in the last twelve months.

The total traded volume so far in the day stood at 120 times its 30-day average. The relative strength index was at 30.16.

Of the 14 analysts tracking the company, seven maintain a 'buy' rating, four recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average of 12-month analyst price targets implies an upside of 39.1%.

Shares of One97 Communications Ltd. were locked in 20% lower circuit after the RBI barred Paytm Payments Bank from accepting fresh deposits, top-ups or credit transactions after Feb. 29.

The crackdown came as the regulator found persistent non-compliance and major supervisory concerns at the payments bank.

One97, in an exchange filing, said that from now on it will be working only with other banks and not its own payments bank.

Paytm's was locked in 20% to Rs 609 apiece, the lowest level since Dec 23, on Thursday morning. The scrip has risen 16.22 in the last twelve months.

The total traded volume so far in the day stood at 120 times its 30-day average. The relative strength index was at 30.16.

Of the 14 analysts tracking the company, seven maintain a 'buy' rating, four recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average of 12-month analyst price targets implies an upside of 39.1%.

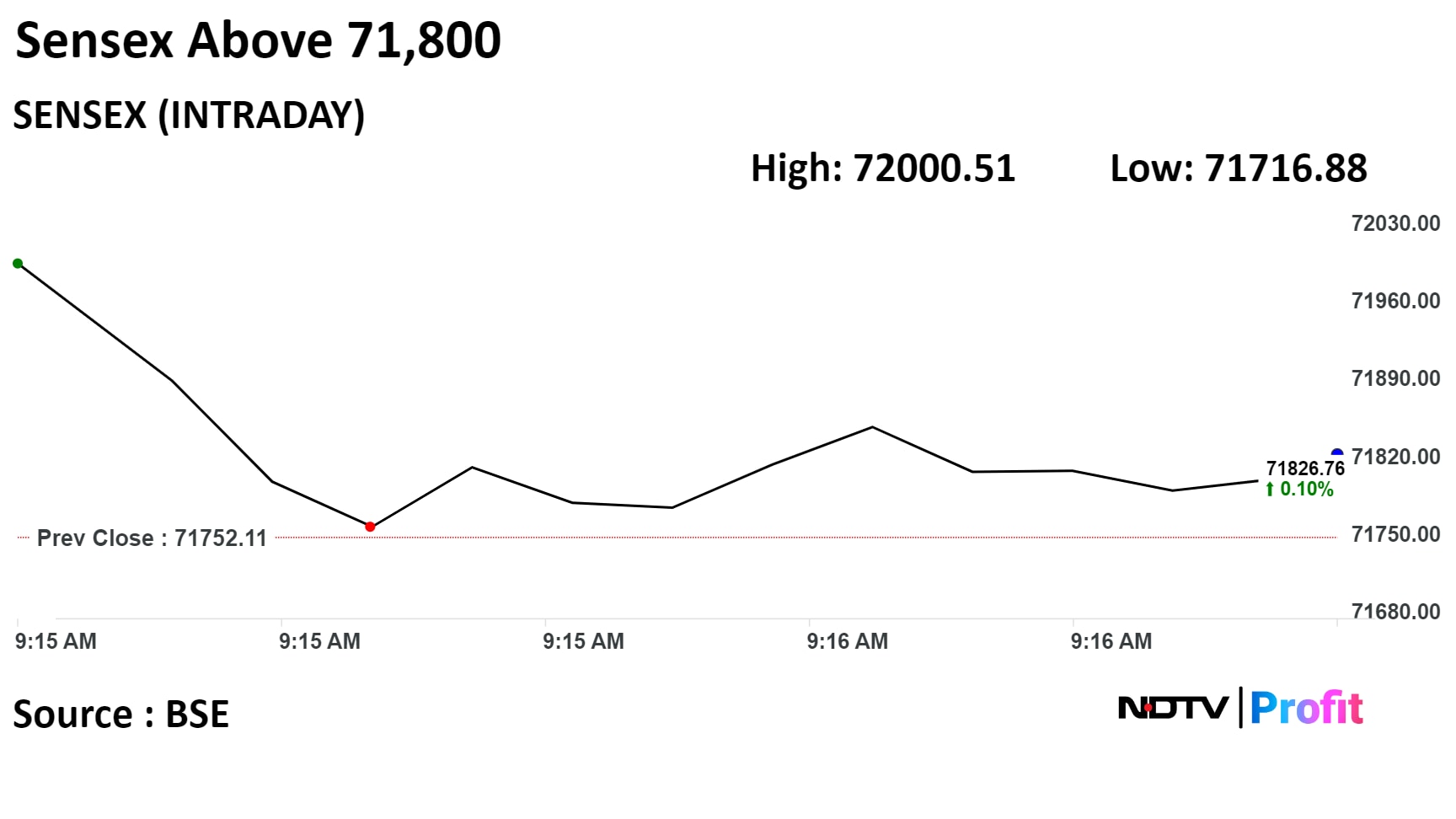

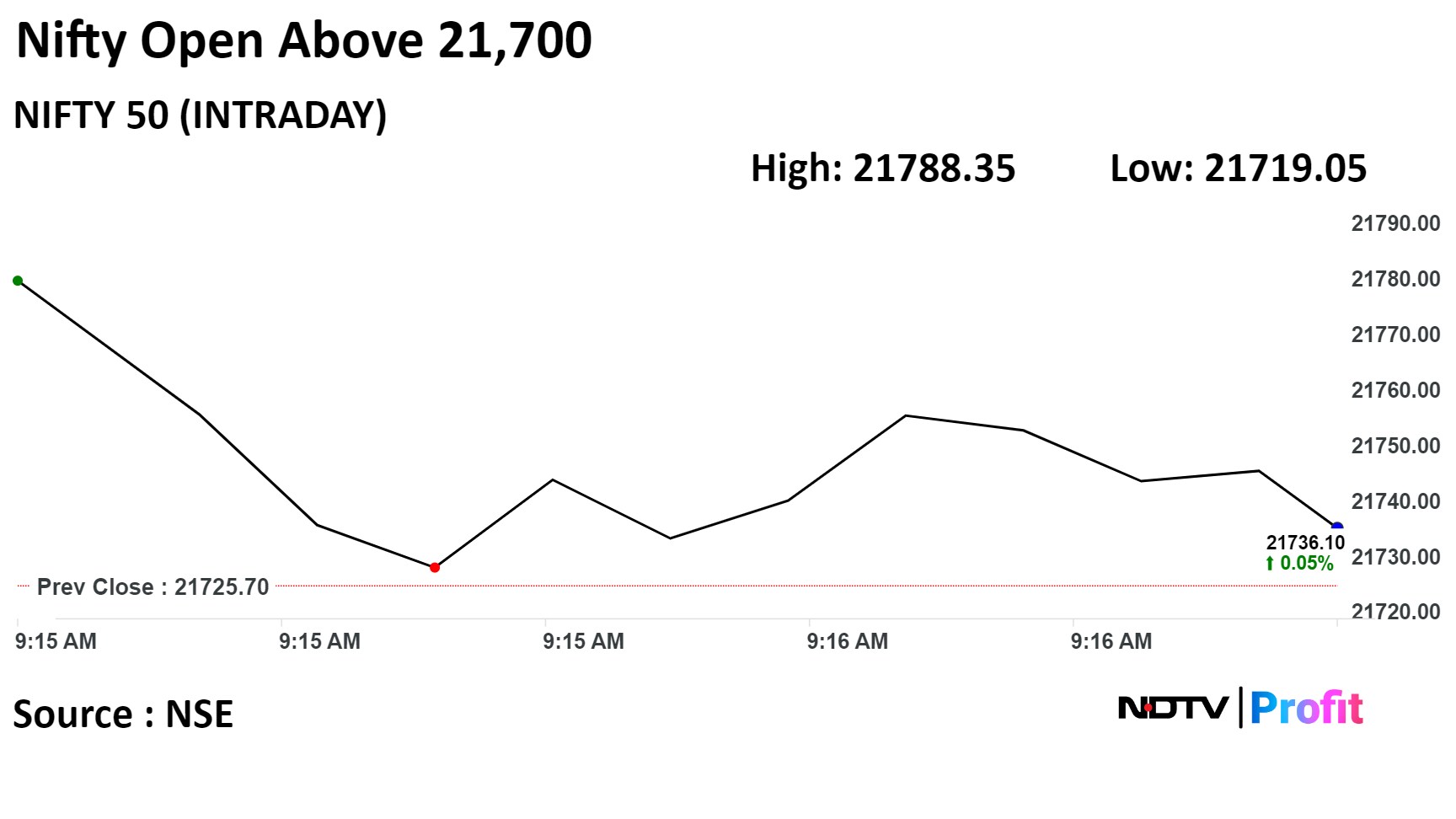

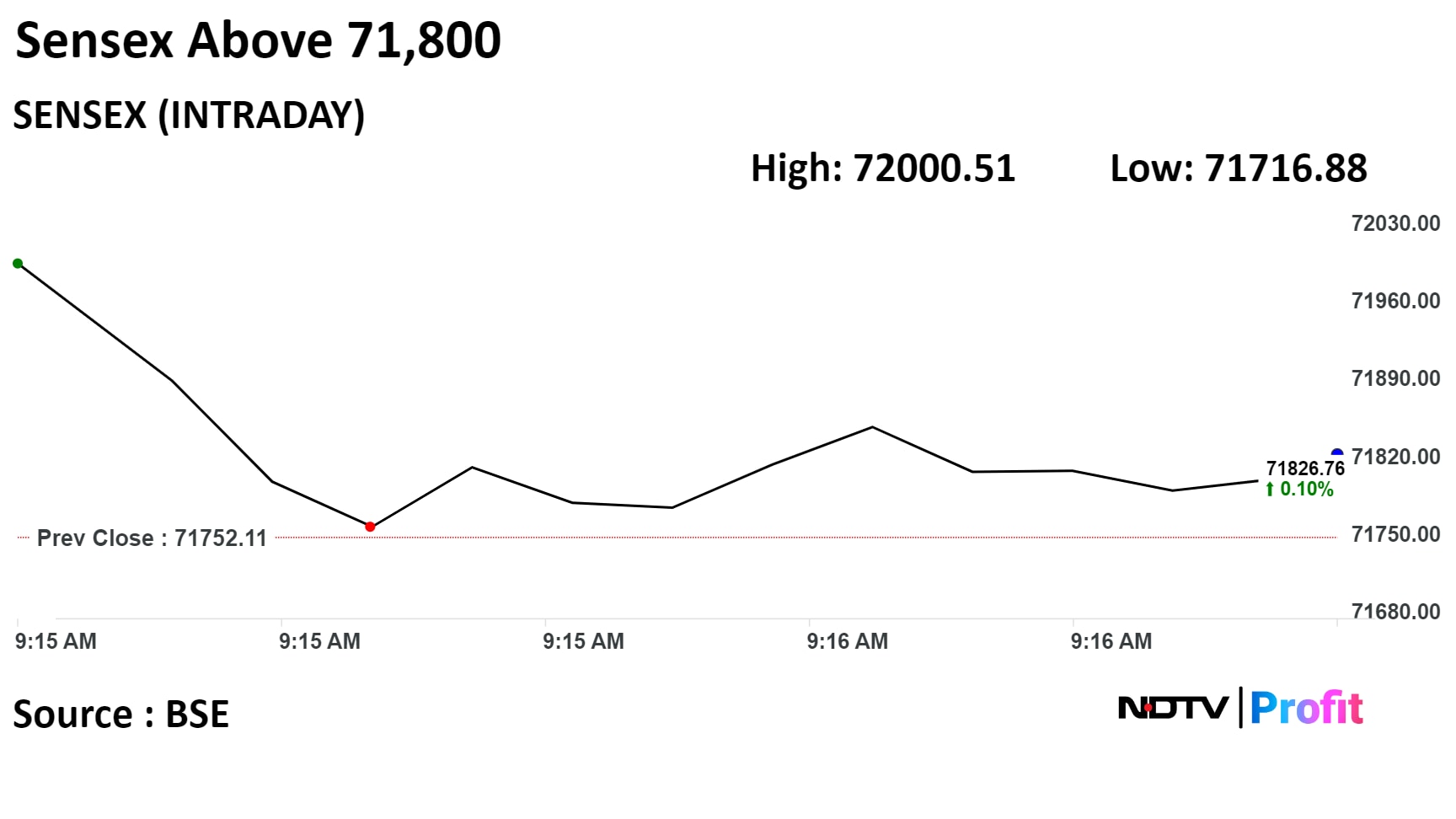

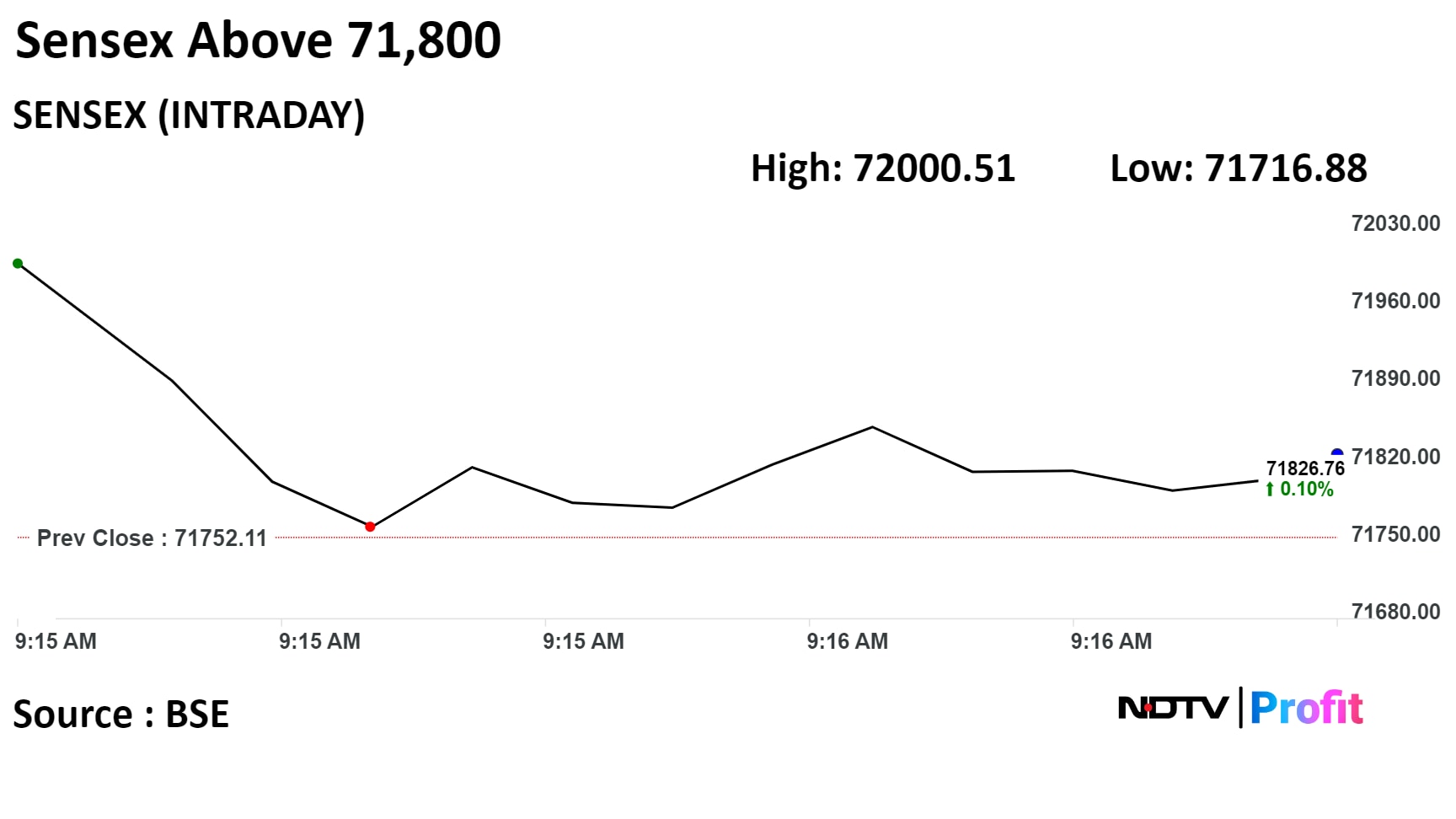

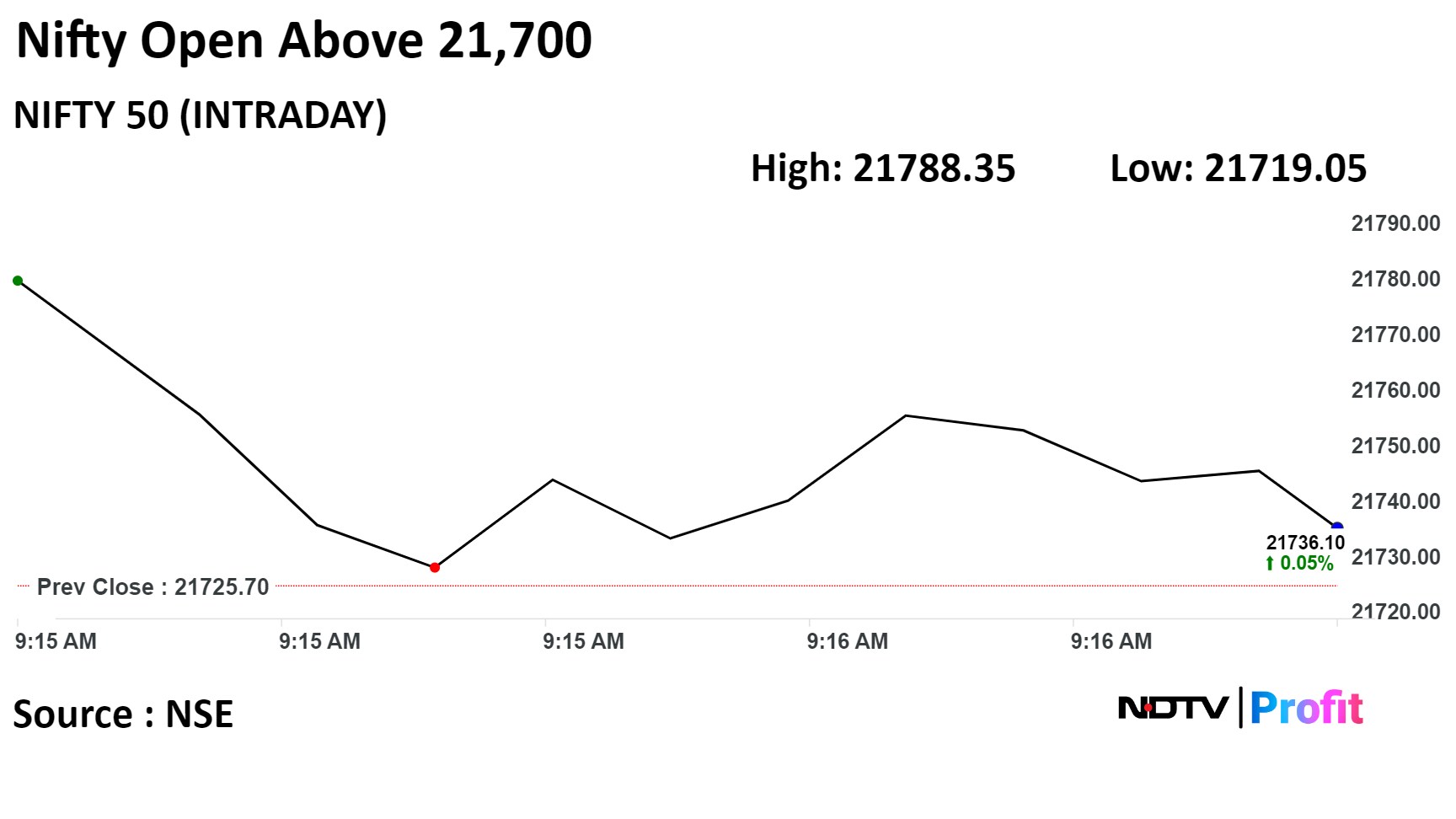

Indian markets opened higher on Thursday ahead of the announcement of the FY25 Interim Budget as Reliance Industries Ltd, HDFC Bank Ltd, and ICICI Bank Ltd rose.

As of 09:20 a.m., the NSE Nifty 50 was 5.95 points or 0.03% higher at 21,731.65, and the S&P BSE Sensex was 6.75 points or 0.01% up at 71,758.86.

"Equity benchmarks Sensex and Nifty 50 rallied by a percent each on January 31, supported by across-the-board buying on the budget eve and ahead of the US Federal Reserve meeting outcome," said Mandar Bhojane, research analyst at Choice Broking.

On the daily chart, the Nifty 50 formed a piercing candlestick pattern indicating bullishness. The Nifty 50 may find support at 21,450, followed by 21,200 and 21,000. On the higher side, 21,900 can be an immediate resistance, followed by 22,000 and 22,150, Bhojane added.

Indian markets opened higher on Thursday ahead of the announcement of the FY25 Interim Budget as Reliance Industries Ltd, HDFC Bank Ltd, and ICICI Bank Ltd rose.

As of 09:20 a.m., the NSE Nifty 50 was 5.95 points or 0.03% higher at 21,731.65, and the S&P BSE Sensex was 6.75 points or 0.01% up at 71,758.86.

"Equity benchmarks Sensex and Nifty 50 rallied by a percent each on January 31, supported by across-the-board buying on the budget eve and ahead of the US Federal Reserve meeting outcome," said Mandar Bhojane, research analyst at Choice Broking.

On the daily chart, the Nifty 50 formed a piercing candlestick pattern indicating bullishness. The Nifty 50 may find support at 21,450, followed by 21,200 and 21,000. On the higher side, 21,900 can be an immediate resistance, followed by 22,000 and 22,150, Bhojane added.

Indian markets opened higher on Thursday ahead of the announcement of the FY25 Interim Budget as Reliance Industries Ltd, HDFC Bank Ltd, and ICICI Bank Ltd rose.

As of 09:20 a.m., the NSE Nifty 50 was 5.95 points or 0.03% higher at 21,731.65, and the S&P BSE Sensex was 6.75 points or 0.01% up at 71,758.86.

"Equity benchmarks Sensex and Nifty 50 rallied by a percent each on January 31, supported by across-the-board buying on the budget eve and ahead of the US Federal Reserve meeting outcome," said Mandar Bhojane, research analyst at Choice Broking.

On the daily chart, the Nifty 50 formed a piercing candlestick pattern indicating bullishness. The Nifty 50 may find support at 21,450, followed by 21,200 and 21,000. On the higher side, 21,900 can be an immediate resistance, followed by 22,000 and 22,150, Bhojane added.

Indian markets opened higher on Thursday ahead of the announcement of the FY25 Interim Budget as Reliance Industries Ltd, HDFC Bank Ltd, and ICICI Bank Ltd rose.

As of 09:20 a.m., the NSE Nifty 50 was 5.95 points or 0.03% higher at 21,731.65, and the S&P BSE Sensex was 6.75 points or 0.01% up at 71,758.86.

"Equity benchmarks Sensex and Nifty 50 rallied by a percent each on January 31, supported by across-the-board buying on the budget eve and ahead of the US Federal Reserve meeting outcome," said Mandar Bhojane, research analyst at Choice Broking.

On the daily chart, the Nifty 50 formed a piercing candlestick pattern indicating bullishness. The Nifty 50 may find support at 21,450, followed by 21,200 and 21,000. On the higher side, 21,900 can be an immediate resistance, followed by 22,000 and 22,150, Bhojane added.

Indian markets opened higher on Thursday ahead of the announcement of the FY25 Interim Budget as Reliance Industries Ltd, HDFC Bank Ltd, and ICICI Bank Ltd rose.

As of 09:20 a.m., the NSE Nifty 50 was 5.95 points or 0.03% higher at 21,731.65, and the S&P BSE Sensex was 6.75 points or 0.01% up at 71,758.86.

"Equity benchmarks Sensex and Nifty 50 rallied by a percent each on January 31, supported by across-the-board buying on the budget eve and ahead of the US Federal Reserve meeting outcome," said Mandar Bhojane, research analyst at Choice Broking.

On the daily chart, the Nifty 50 formed a piercing candlestick pattern indicating bullishness. The Nifty 50 may find support at 21,450, followed by 21,200 and 21,000. On the higher side, 21,900 can be an immediate resistance, followed by 22,000 and 22,150, Bhojane added.

Indian markets opened higher on Thursday ahead of the announcement of the FY25 Interim Budget as Reliance Industries Ltd, HDFC Bank Ltd, and ICICI Bank Ltd rose.

As of 09:20 a.m., the NSE Nifty 50 was 5.95 points or 0.03% higher at 21,731.65, and the S&P BSE Sensex was 6.75 points or 0.01% up at 71,758.86.

"Equity benchmarks Sensex and Nifty 50 rallied by a percent each on January 31, supported by across-the-board buying on the budget eve and ahead of the US Federal Reserve meeting outcome," said Mandar Bhojane, research analyst at Choice Broking.

On the daily chart, the Nifty 50 formed a piercing candlestick pattern indicating bullishness. The Nifty 50 may find support at 21,450, followed by 21,200 and 21,000. On the higher side, 21,900 can be an immediate resistance, followed by 22,000 and 22,150, Bhojane added.

Indian markets opened higher on Thursday ahead of the announcement of the FY25 Interim Budget as Reliance Industries Ltd, HDFC Bank Ltd, and ICICI Bank Ltd rose.

As of 09:20 a.m., the NSE Nifty 50 was 5.95 points or 0.03% higher at 21,731.65, and the S&P BSE Sensex was 6.75 points or 0.01% up at 71,758.86.

"Equity benchmarks Sensex and Nifty 50 rallied by a percent each on January 31, supported by across-the-board buying on the budget eve and ahead of the US Federal Reserve meeting outcome," said Mandar Bhojane, research analyst at Choice Broking.

On the daily chart, the Nifty 50 formed a piercing candlestick pattern indicating bullishness. The Nifty 50 may find support at 21,450, followed by 21,200 and 21,000. On the higher side, 21,900 can be an immediate resistance, followed by 22,000 and 22,150, Bhojane added.

Indian markets opened higher on Thursday ahead of the announcement of the FY25 Interim Budget as Reliance Industries Ltd, HDFC Bank Ltd, and ICICI Bank Ltd rose.

As of 09:20 a.m., the NSE Nifty 50 was 5.95 points or 0.03% higher at 21,731.65, and the S&P BSE Sensex was 6.75 points or 0.01% up at 71,758.86.

"Equity benchmarks Sensex and Nifty 50 rallied by a percent each on January 31, supported by across-the-board buying on the budget eve and ahead of the US Federal Reserve meeting outcome," said Mandar Bhojane, research analyst at Choice Broking.

On the daily chart, the Nifty 50 formed a piercing candlestick pattern indicating bullishness. The Nifty 50 may find support at 21,450, followed by 21,200 and 21,000. On the higher side, 21,900 can be an immediate resistance, followed by 22,000 and 22,150, Bhojane added.

Reliance Industries Ltd, Mahindra and Mahindra Ltd, Tata Consultancy Services Ltd, Maruti Suzuki India Ltd, and HDFC Bank Ltd contributed positively to the benchmark NSE Nifty 50 index.

Larsen & Toubro Ltd, ICICI Bank Ltd, Bharti Airtel Ltd, Titan Co. Ltd., and Grasim Industries Ltd capped gains to the benchmark index.

On NSE, six sectoral indices gained, while six logged losses out of 12 sectors. The Nifty Auto rose nearly 1% to emerge as the top gainer among peer sectoral indices. The Nifty Realty index fell the most among sectoral indices.

Broader markets were trading marginally higher on BSE. The S&P BSE Midcap index rose 0.10%, and Smallcap gained 0.26%.

On BSE, 11 sectors out of 20 were trading in a positive territory, while nine were trading in negative. The S&P BSE Utilities rose the most among the sectoral indices.

Market breadth was skewed in favour of buyers in early trade on Thursday. Around 1,751 stocks rose, 1,234 stocks fell, and 103 remained unchanged on BSE.

At pre-open, the NSE Nifty 50 was trading 54.95 points or 0.25% at 21,780.65, and the S&P BSE Sensex was 246.67 points or 0.34% higher at 71,998.78.

The yield on the 10-year bond opened flat at 7.13%.

Source: Bloomberg

The local currency opened flat at 83.03 against the U.S dollar.

Source: Bloomberg

The brokerage remained 'Overweight' on Maruti Suzuki India Ltd, and reduced the price target of Rs 11,228 from Rs 11,396.

The auto company's Q3 margin print points to upside risks to FY25 consensus estimates, Morgan Stanley said.

The brokerage said MSIL best placed to benefit from FTB recovery.

Morgan Stanley raised FY24 Ebitda margin estimate by 40 bps and 20 bps for FY25, FY26 each.

The brokerage raised FY24 net profit forecast by 5%, EPS by 1%.

FY25 and FY26 EPS estimates decline by 2% each.

Citi Research revised price target to Rs 14,200 from Rs 14,500.

Maruti Suzuki India Ltd's Q3FY24 Ebitda in line with estimates, and PAT boosted by higher non-operating income, Citi Research said.

The brokerage cut volume estimates by 6% given slowdown in small car sales.

Management expects capacity to reach 4mn units by FY31 (vs 2.2 mn now), Citi Research said.

Elara Securities reduces Rating on Jubilant FoodWorks with a price target of Rs 500.

Jubilant FoodWorks's below par Q3FY24 results with like-for-like declining 2.9% YoY.

Easing inflationary pressure could boost the company's Ebitda margin by 180bp over FY24-26e.

Expect same sales store contraction of 3% in FY24e, flat SSSG in FY25e and 3% in FY26e.

Jubilant FoodWorks on track to open 200 stores in FY24.

The manganese ore mining company increased prices for ore with below Mn 44% manganese content, fines by 5%.

Source: Exchange Filing

Raises commercial LPG price 14 /19-kg cylinder to `1,769.5 in Delhi

Cuts jet fuel price by 1.2% to Rs 100,772.17 per KL in Delhi

Keeps petrol price unchanged at Rs 96.72/litre in Delhi

Keeps diesel price unchanged at Rs 89.62 /litre in Delhi

RBI restrictions on Paytm Payments Bank maybe in preparation for full cancellation of license.

Immediate cancellation of license may have resulted in excessive disruption to customers.

RBI likely waiting to ascertain impact on payments ecosystem.

Bank can approach RBI for remedial measures.

Source: People In The Know To NDTV Profit

Nuvama kept 'Buy' rating on Sun Pharmaceutical Industries Ltd and raised target price to Rs 1,635 from Rs 1,330.

The company's Q3FY24 revenue in line, but beat consensus on PAT by 5%, the brokerage said.

Sun Pharmaceutical Industries Ltd's Ebitda margin (26.1%) is in line driven by higher gross margin (77.9%).

The brokerage anticipated 15% core EPS CAGR over FY23-26e

India on growth path (+11% YoY); US generics to witness recovery, Nuvama said

Nuvama retained 'Buy' on Ambuja Cements, and raised price target Rs 609 from Rs 481.

Nuvama anticipates an announcement on plans for a new set of clinker lines soon.

The brokerage raised the target EV/EBITDA raised to 17x from 15x.

The company aims to achieve EBITDA/t of Rs 1,450–1500 over next three years

Capex shall increase to Rs 4,000–5,000 core each over the next three–four years, Nuvama said.

U.S. Dollar Index at 103.56

U.S. 10-year bond yield at 4.50%

Brent crude down 1.16% at $81.71 per barrel

Nymex crude up 0.32% at $76.17 per barrel

GIFT Nifty was trading flat at 21,796.00 as of 07:19 a.m.

Bitcoin was up 0.30% at $41,901.47

Nifty January futures up by 0.72% to 21,808.6 at a premium of 82.9 points.

Nifty January futures open interest down by 0.07%.

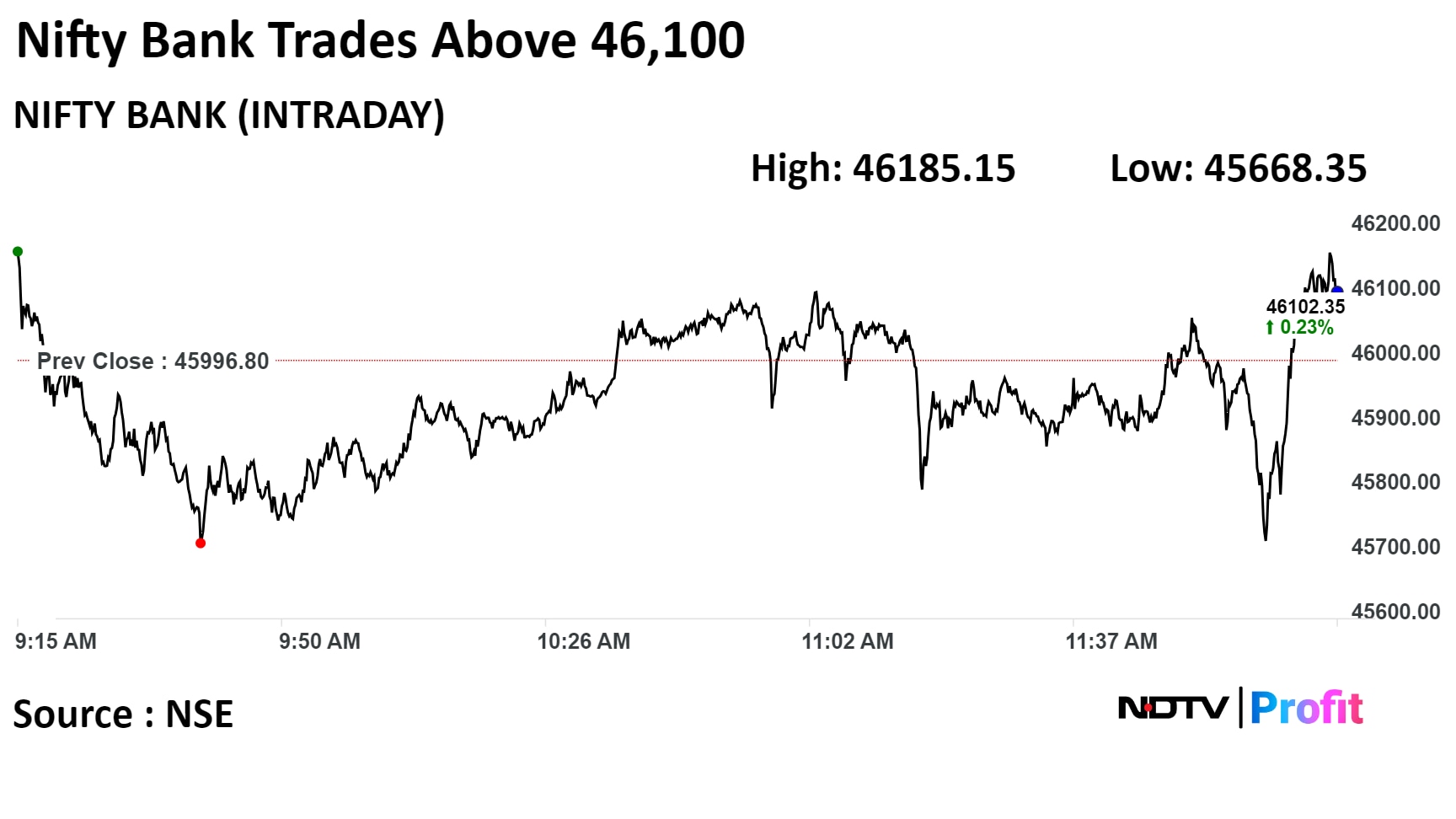

Nifty Bank January futures up by 1.39% to 46,324.25 at a premium of 327.45 points.

Nifty Bank January futures open interest down by 5.87%.

Nifty Options Feb. 1 Expiry: Maximum Call open interest at 22,500 and Maximum Put open interest at 21,500.

Bank Nifty Options Feb. 7 Expiry: Maximum Call Open Interest at 48,000 and Maximum Put open interest at 42,000.

Securities in the ban period: Zee Entertainment Enterprise, Steel Authority of India.

Price band revised from 20% to 10%: Shakti Pumps, Vakrangee, Mahanagar Telephone Nigam, Hindustan Construction, Crest Ventures, Azad Engineering.

Price band revised from 10% to 5%: IFCI, Transformers and Rectifiers.

Ex/record date dividend: CESC, Route Mobile, Havells, Tips Industries, Wendt (India), Puravankara.

Ex/record date bonus: Salasar Techno Engineering.

Ex/record date rights: Indiabulls Housing Finance.

Moved into short-term ASM framework: Azad Engineering, IFB Industries, VLS Finance, Websol Energy System.

Moved out of short-term ASM framework: Bajel Projects.

Jindal Stainless: Promoter JSL Overseas bought 39 lakh shares between Jan. 24 and 25.

JB Chemicals and Pharmaceuticals: To meet analysts and investors on Feb. 7.

UltraTech Cement: To meet analysts and investors on Feb. 1.

ICICI Lombard General Insurance: To meet analysts and investors on Feb. 5 and 6.

South Indian Bank: To meet analysts and investors on Jan. 31.

Syngene: To meet analysts and investors on Feb. 26.

BLS E-Services: The public issue was subscribed to 42.78 times on day 2. The bids were led by retail investors (125.46 times), non-institutional investors (94.09 times), and institutional investors (2.68 times).

Religare Enterprises: Mahesh Udhav Buxani sold 45.19 lakh shares (1.37%) at Rs 234.51 apiece while M B Finmart bought 39.55 lakh shares (1.2%) at Rs 233.99 apiece, Puran Associates bought 39.55 lakh shares (1.2%) at Rs 233.98 apiece, VIC Enterprises bought 39.49 lakh shares (1.2%) at Rs 233.94 apiece.

Eris Lifesciences: Bhikhalal Chimanlal Shah sold 12.8 lakh shares (0.94%) at Rs 913.09 apiece and sold 8.2 lakh shares (0.6%) at Rs 912.5 apiece.

Indian Pesticides: Quant Mutual Fund Quant Active Fund sold 5.76 lakh shares (0.5%) at Rs 376.12 apiece.

M K Proteins: Singla Ashok bought 10 lakh shares (0.8%) at Rs 49.5 apiece.

Share India Securities: Parveen Gupta sold 2.3 lakh shares (0.7%) at Rs 1,922.46 apiece.

Skipper: Skipper Plastics sold 20 lakh shares (1.95%) at Rs 43.46 apiece while Chartered Finance and Leasing bought 19.82 lakh shares (1.93%) at Rs 43.45 apiece.

One 97 Communications: The Reserve Bank of India introduced further restrictions against Paytm Payments Bank. No further deposits or credit transactions are allowed in any customer account after Feb. 29. No other banking services, apart from withdrawal or utilisation of balances, are to be allowed after Feb. 29.

Infosys: The IT major signed a seven-year strategic collaboration with Musgrave to automate Musgrave’s IT operations by leveraging its industry-leading AI and cloud offerings.

UltraTech Cement: Moody's Investors Service Inc. affirmed the company's 'Baa3' issuer rating as well as its 'Baa3' senior unsecured rating, citing a solid balance sheet and substantially strong credit metrics.

Paras Defence and Space Technologies: The company received an optical periscope contract from the Ministry of Defense.

Deepak Nitrite: The company’s unit, Deepak Chem Tech, signed a Memorandum of Understanding worth Rs 9,000 crore with the Gujarat government.

Kaynes Technologies: Nanotech company Digi Lens announced a partnership with the company for scaling waveguide manufacturing.

Havells India: The company launched for the first time a 'Made in India' heat pump water heater to meet the demands of residential applications.

Federal-Mogul Goetze: The company appointed T. Kannan as managing director for three years, effective Feb. 1.

HG Infra Engineering: The company was declared an L-1 bidder for the Rs 440 crore South Central Railway project.

Gujarat Gas: The company signed a Memorandum of Understanding with HPCL for liquid fuels and CNG facilities.

Lux Industries: The company has completed its project of setting up a manufacturing and warehousing facility and commenced commercial operation at Jagadishpur, West Bengal, Kolkata.

Prestige Estates: The company completed the Rs 1,000 crore Hyderabad Residential Project.

Balaji Amines: The company's unit received mega project status from the Industries, Energy and Labour Department, Government of Maharashtra, with a proposed investment of Rs 750 crore.

Triveni Engineering: The company will buy a 26% stake in Sir Shadi Lal Enterprises via an open offer for Rs 262.1 per share.

Aavas Financiers, Abbott India, Aditya Birla Capital, Adani Enterprises, Adani Ports and Special Economic Zone, Aether Industries, Aptus Value Housing Finance India, Avalon Technologies, Bata India, Bayer Cropscience, Castrol India, City Union Bank, Deepak Fertilisers & Petrochemicals Corporation, Five-Star Business Finance, GMM PFaudler, Godrej Agrovet, Gokaldas Exports, Goodluck India, Greenply Industries, HFCL, Indian Hotels, India Cements, Jupiter Wagons, Dr. Lal Path Labs, Minda Corporation, Mphasis, Orient Electric, Praj Industries, Pricol, Prism Johnson, Raymond, Rites, Rolex Rings, Rpg Life Sciences, Somany Ceramics, Sonata Software, Sumitomo Chemical India, T D Power Systems, Texmaco Rail & Engineering, Thangamayil Jewellery, Thyrocare Technologies, Tube Investments of India, Titan Company, V-Guard Industries, V.S.T.TILLERS Tractors, and Welspun Enterprises.

Shree Cement Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 21.5% at Rs 5,223.2 crore vs Rs 4,299.3 crore (Bloomberg estimate: Rs 4,988 crore).

Ebitda up 73.9% at Rs 1,263.9 crore vs Rs 726.7 crore (Bloomberg estimate: Rs 1,090.4 crore).

Margin up 729 bps at 24.2% vs 16.9% (Bloomberg estimate: 21.9%).

Net profit at Rs 701.9 crore vs Rs 281.8 crore (Bloomberg estimate: Rs 572.1 crore).

Godrej Consumer Products Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 1.7% at Rs 3,659.6 crore vs Rs 3,598.9 crore (Bloomberg estimate: Rs 3,734.5 crore).

Ebitda up 15.7% at Rs 840.7 crore vs Rs 726.6 crore (Bloomberg estimate: Rs 803.3 crore).

Margin up 278 bps at 22.97% vs 20.19% (Bloomberg estimate: 21.5%).

Net profit up 6.4% at Rs 581.06 crore vs Rs 546.34 crore (Bloomberg estimate: Rs 555.9 crore).

Motherson Sumi Wiring Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 25.5% at Rs 2,117.3 crore vs Rs 1,686.8 crore (Bloomberg estimate: Rs 2,104.6 crore).

Ebitda up 46.4% at Rs 262 crore vs Rs 179 crore (Bloomberg estimate: Rs 248.1 crore).

Margin up 176 bps at 12.4% vs 10.6% (Bloomberg estimate 11.8%).

Net profit up 58.1% at Rs 167.9 crore vs Rs 106.2 crore (Bloomberg estimate: Rs 155.9 crore).

Ajanta Pharma Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 13.7% at Rs 1,105.2 crore vs Rs 971.8 crore.

Ebitda up 85.2% at Rs 314.1 crore vs Rs 169.6 crore.

Margin at 28.4% vs 17.5%.

Net profit up 56.1% at Rs 210 crore vs Rs 134.5 crore.

Dixon Technologies Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 100.4% at Rs 4,818.3 crore vs Rs 2,404.7 crore (Bloomberg estimate: Rs 4,568.4 crore).

Ebitda up 66% at Rs 184.4 crore vs Rs 111.1 crore (Bloomberg estimate: Rs 185 crore).

Margin down 79 bps at 3.82% vs 4.62% (Bloomberg estimate: 3.43%).

Net profit up 87.1% at Rs 97.1 crore vs Rs 51.9 crore (Bloomberg estimate: Rs 103.6 crore).

Westlife Foodworld Q3 Earnings FY24 (Consolidated, YoY)

Revenue down 1.8% at Rs 600.3 crore vs Rs 611.5 crore (Bloomberg estimate: Rs 657.8 crore).

Ebitda down 10% at Rs 92.02 crore vs Rs 102.2 crore (Bloomberg estimate: Rs 110 crore).

Margin down 138 bps at 15.3% vs 16.7% (Bloomberg estimate: 16.7%).

Net profit down 52.6% at Rs 17.24 crore vs Rs 36.37 crore (Bloomberg estimate: Rs 30 crore).

DB Realty Q3 Earnings FY24 (Consolidated, YoY)

Revenue down 77.1% at Rs 142.8 crore vs Rs 622.8 crore.

Ebitda at Rs 80.61 crore vs Ebitda loss of Rs 646.69 crore.

Margin at 56.44%.

Net profit at Rs 462.6 crore vs loss of Rs 622.7 crore.

Company had income worth Rs 403.2 crore through divestment of stake in subsidiaries in the quarter under review.

Great Eastern Shipping Co. Q3 Earnings FY24 (Consolidated, YoY)

Revenue down 12.4% at Rs 1,245.1 crore vs Rs 1,421 crore.

Ebitda down 18.4% at Rs 642.5 crore vs Rs 763 crore.

Margin down 209 bps at 51.6% vs 53.7%.

Net profit down 14.2% at Rs 538.2 crore vs Rs 627.2 crore.

Board approves interim dividend of Rs 6.3 per share.

Nilkamal Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 6.5% at Rs 803.5 crore vs Rs 754.3 crore (Bloomberg estimate: Rs 811.9 crore).

Ebitda down 4.5% at Rs 72.9 crore vs Rs 76.3 crore (Bloomberg estimate: Rs 77.4 crore).

Margin down 104 bps at 9.07% vs 10.11% (Bloomberg estimate: 9.5%).

Net profit down 11.4% at Rs 29.4 crore vs Rs 33.2 crore (Bloomberg estimate: Rs 33.8 crore).

Relaxo Footwears Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 4.7% at Rs 712.7 crore vs Rs 681 crore (Bloomberg estimate: Rs 766.3 crore).

Ebitda up 20.7% at Rs 87.16 crore vs Rs 72.22 crore (Bloomberg estimate: Rs 104.1 crore).

Margin up 162 bps at 12.2% vs 10.6% (Bloomberg estimate: 13.6%).

Net profit up 28.1% at Rs 38.57 crore vs Rs 30.1 crore (Bloomberg estimate: Rs 54.8 crore).

DCM Shriram Q3 Earnings FY24 (Consolidated, YoY)

Revenue down 7.3% at Rs 3,137.54 crore vs Rs 3,383.7 crore.

Ebitda down 19.7% at Rs 445.3 crore vs Rs 554.2 crore.

Margin down 218 bps at 14.19% vs 16.37%.

Net profit down 29.7% at Rs 240.5 crore vs Rs 342.1 crore.

Data Patterns (India) Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 24.8% at Rs 139.5 crore vs Rs 111.8 crore (Bloomberg estimate: Rs 138.7 crore).

Ebitda up 27.6% at Rs 60.04 crore vs Rs 47.04 crore (Bloomberg estimate: Rs 55.1 crore).

Margin up 96 bps at 43% vs 42.1% (Bloomberg estimate: 39.7%).

Net profit up 53% at Rs 50.97 crore vs Rs 33.32 crore (Bloomberg estimate: Rs 43.9 crore).

Jindal Steel and Power Q3 Earnings FY24 (Consolidated, YoY)

Revenue down 6% at Rs 11,701.3 crore vs Rs 12,452.4 crore

(Bloomberg estimate: Rs 12,311.4 crore).

Ebitda up 19.6% at Rs 2,842.5 crore vs Rs 2,377.5 crore (Bloomberg estimate: Rs 2,396 crore).

Margin up 520 bps at 24.3% vs 19.1% (Bloomberg estimate: 19.5%).

Net profit at Rs 1,928 crore vs Rs 518.3 crore (Bloomberg estimate: Rs 1,115.7 crore).

Company had exceptional loss worth Rs 378.4 crore in the corresponding quarter last year.

Lux Industries Q3 Earnings FY24 (Consolidated, YoY)

Revenue down 2.7% at Rs 446.9 crore vs Rs 459.1 crore.

Ebitda up 5.4% at Rs 34.32 crore vs Rs 32.56 crore.

Margin up 58 bps at 7.7% vs 7.1%.

Net profit up 17.7% at Rs 19.49 crore vs Rs 16.56 crore.

Balaji Amines Q3 Earnings FY24 (Consolidated, YoY)

Revenue down 34.6% at Rs 383.4 crore vs Rs 586 crore.

Ebitda down 41.9% at Rs 74.2 crore vs Rs 127.8 crore.

Margin down 245 bps at 19.4% vs 21.8%.

Net profit down 33.4% at Rs 55.77 crore vs Rs 83.79 crore.

Thomas Cook Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 24.2% at Rs 1,940.8 crore vs Rs 1,562.4 crore.

Ebitda up 82.6% at Rs 164.2 crore vs Rs 89.9 crore.

Margin up 270 bps at 8.5% vs 5.8%.

Net profit at Rs 90.5 crore vs Rs 26.5 crore.

Mankind Pharma Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 24.7% at Rs 2,607 crore vs Rs 2,090.9 crore (Bloomberg estimate: Rs 2,374.1 crore).

Ebitda up 38.8% at Rs 606.5 crore vs Rs 437 crore (Bloomberg estimate: Rs 592.3 crore).

Margin up 236 bps at 23.26% vs 20.9% (Bloomberg estimate: 24.9%).

Net profit up 55.5% at Rs 459.8 crore vs Rs 295.7 crore (Bloomberg estimate: Rs 425.2 crore).

GMR Airports Infra Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 20.2% at Rs 2,116.7 crore vs Rs 1,761.5 crore.

Ebitda up 6.6% at Rs 560.1 crore vs Rs 525.5 crore.

Margin down 337 bps at 26.46% vs 29.83%.

Net loss of Rs 486.4 crore vs profit of Rs 103.1 crore.

Swan Energy Q3 Earnings FY24 (Consolidated, YoY)

Revenue at Rs 1,591.7 crore vs Rs 101.1 crore.

Ebitda at Rs 255.8 crore vs Ebitda loss of Rs 13.6 crore.

Margin at 16.07%.

Net profit at Rs 220 crore vs loss of Rs 15.7 crore.

IRB Infra Developers Q3 FY24 (Consolidated, YoY)

Revenue up 30% at Rs 1,968.5 crore vs Rs 1,514.1 crore (Bloomberg estimate: Rs 1,871.7 crore).

Ebitda up 16.8% at Rs 869.4 crore vs Rs 744.5 crore (Bloomberg estimate: Rs 850.5 crore).

Margin down 500 bps at 44.16% vs 49.17% (Bloomberg estimate: 45.40%).

Net profit up 32.5% at Rs 187.4 crore vs Rs 141.4 crore (Bloomberg estimate: Rs 153.5 crore).

The company appointed Satinder Singh Rana as the Chief Executive Officer with immediate effect.

Punjab and Sind Bank Q3 Earnings FY24

NII down 8.2% at Rs 739.3 crore vs Rs 805 crore.

Net profit down 69.4% at Rs 114.3 crore vs Rs 373.2 crore.

GNPA at 5.70% vs 6.23% (QoQ).

NNPA at 1.80% vs 1.88% (QoQ).

Amara Raja Energy and Mobility Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 15.4% at Rs 3,043.9 crore vs Rs 2,637.8 crore.

Ebitda up 9.1% at Rs 430.55 crore vs Rs 394.6 crore.

Margin down 81 bps at 14.14% vs 14.95%.

Net profit up 14.8% at Rs 254.8 crore vs Rs 221.9 crore (Bloomberg estimate: Rs 330 crore).

Markets in Japan and Australia declined in early trade on Wednesday following overnight losses in tech stocks on Wall Street as the Federal Reserve Chair Jerome Powell said the central bank is unlikely to start cutting interest rates in March.

The Nikkei 225 was trading 217.04 points or 0.60% lower at 36,069.67, and the S&P ASX 200 was 96.90 points or 1.26% down at 7,583.80 as of 07:03 a.m.

The Federal Market Open Committee has kept its benchmark rate steady at 5.25-5.50% after its two day policy meeting in line with market expectation, reported Bloomberg.

However Powell's comment suggested the policy makers in the world's largest economy is in no hurry to ease monetary condition anytime soon.

The S&P 500 index and Nasdaq 100 fell by 1.61% and 1.94%, respectively, as on Wednesday. The Dow Jones Industrial Average fell by 0.82%.

Brent crude was trading 1.40% lower at $81.71 a barrel. Gold was higher by 0.13% at $2,042.17 an ounce.

The GIFT Nifty was trading flat at 21,796.00 as of 07:19 a.m.

Indian benchmark equity indices ended higher a day before the budget, led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

Investors also await the outcome of the U.S. Federal Reserve's meeting, due later on Wednesday.

The NSE Nifty 50 closed 186 points, or 0.86%, higher at 21,708.10, while the S&P BSE Sensex gained 544.86 points, or 0.77%, to end at 71,752.11.

Overseas investors became net buyers of Indian equities after a day on Wednesday.

Foreign portfolio investors mopped up stocks worth Rs 1,660.7 crore, while domestic institutional investors remained net buyers and bought equities worth Rs 2,542.9 crore, the NSE data showed.

The Indian rupee strengthened by 7 paise to close at Rs 83.04 against the U.S. dollar.

Markets in Japan and Australia declined in early trade on Wednesday following overnight losses in tech stocks on Wall Street as the Federal Reserve Chair Jerome Powell said the central bank is unlikely to start cutting interest rates in March.

The Nikkei 225 was trading 217.04 points or 0.60% lower at 36,069.67, and the S&P ASX 200 was 96.90 points or 1.26% down at 7,583.80 as of 07:03 a.m.

The Federal Market Open Committee has kept its benchmark rate steady at 5.25-5.50% after its two day policy meeting in line with market expectation, reported Bloomberg.

However Powell's comment suggested the policy makers in the world's largest economy is in no hurry to ease monetary condition anytime soon.

The S&P 500 index and Nasdaq 100 fell by 1.61% and 1.94%, respectively, as on Wednesday. The Dow Jones Industrial Average fell by 0.82%.

Brent crude was trading 1.40% lower at $81.71 a barrel. Gold was higher by 0.13% at $2,042.17 an ounce.

The GIFT Nifty was trading flat at 21,796.00 as of 07:19 a.m.

Indian benchmark equity indices ended higher a day before the budget, led by gains in index heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

Investors also await the outcome of the U.S. Federal Reserve's meeting, due later on Wednesday.

The NSE Nifty 50 closed 186 points, or 0.86%, higher at 21,708.10, while the S&P BSE Sensex gained 544.86 points, or 0.77%, to end at 71,752.11.

Overseas investors became net buyers of Indian equities after a day on Wednesday.

Foreign portfolio investors mopped up stocks worth Rs 1,660.7 crore, while domestic institutional investors remained net buyers and bought equities worth Rs 2,542.9 crore, the NSE data showed.

The Indian rupee strengthened by 7 paise to close at Rs 83.04 against the U.S. dollar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.