(Bloomberg) -- India's plan to rein in its budget deficit should be enough to raise the nation's credit rating, the country's top economic adviser to the government said, even though the major rating companies said they're not ready to do so.

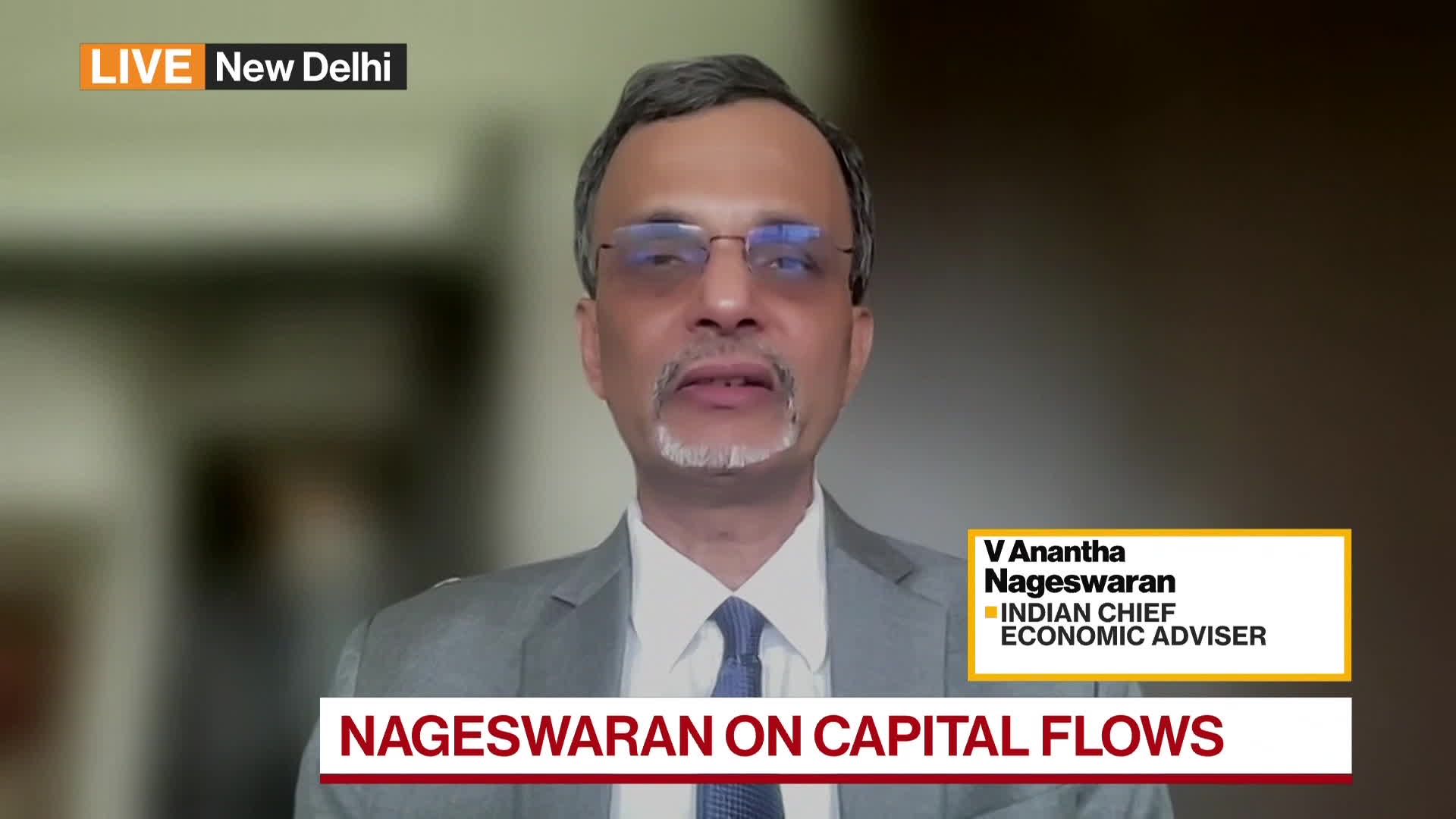

“We believe the measures are more than adequate to get a credit ratings upgrade,” Chief Economic Adviser V Anantha Nageswaran said in an interview Friday with Bloomberg TV's Yousef Gamal El-Din. “There is enough in the budget to signal the government's commitment to the path of fiscal prudence and stability and I hope the credit rating agencies will indeed take note of them.”

The government's budget for the coming fiscal year, released by the finance minister on Thursday, avoided populist spending measures before the election and projected a sharper-than-expected cut to the budget deficit to 5.1% of gross domestic product.

Curbing the deficit and reducing government debt are seen as key to raising India's credit rating and improving the allure of the nation's bonds to foreign investors ahead of India's inclusion in global bond indexes in June.

However, credit rating companies are taking a wait-and-see approach for now. Fitch Ratings Ltd. said on Friday a slightly faster pace of deficit reduction doesn't significantly change the nation's sovereign credit profile. Moody's Investors Service said Thursday it will assess India's rating after the full budget in July.

Both Fitch and Moody's have India on the lowest investment grade rating, with a stable outlook.

“There are no below the line items” in the budget, Nageswaran said, adding that the fiscal process has stood up to scrutiny of global investors.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.