(Bloomberg) -- Alibaba Group Holding Ltd. green-lit another $25 billion in stock repurchases, aiming to assuage investors worried about plateauing growth at a Chinese e-commerce and cloud pioneer struggling to fend off new rivals such as PDD Holdings Inc.

The internet company's board approved the expansion of an existing buyback program that was already among the country's largest, encompassing about $9.5 billion last year alone. But its shares fell more than 4%, giving up an initial spurt in part because investors remain concerned about crumbling Chinese consumption and a drop in per-user spending because of a nationwide downturn.

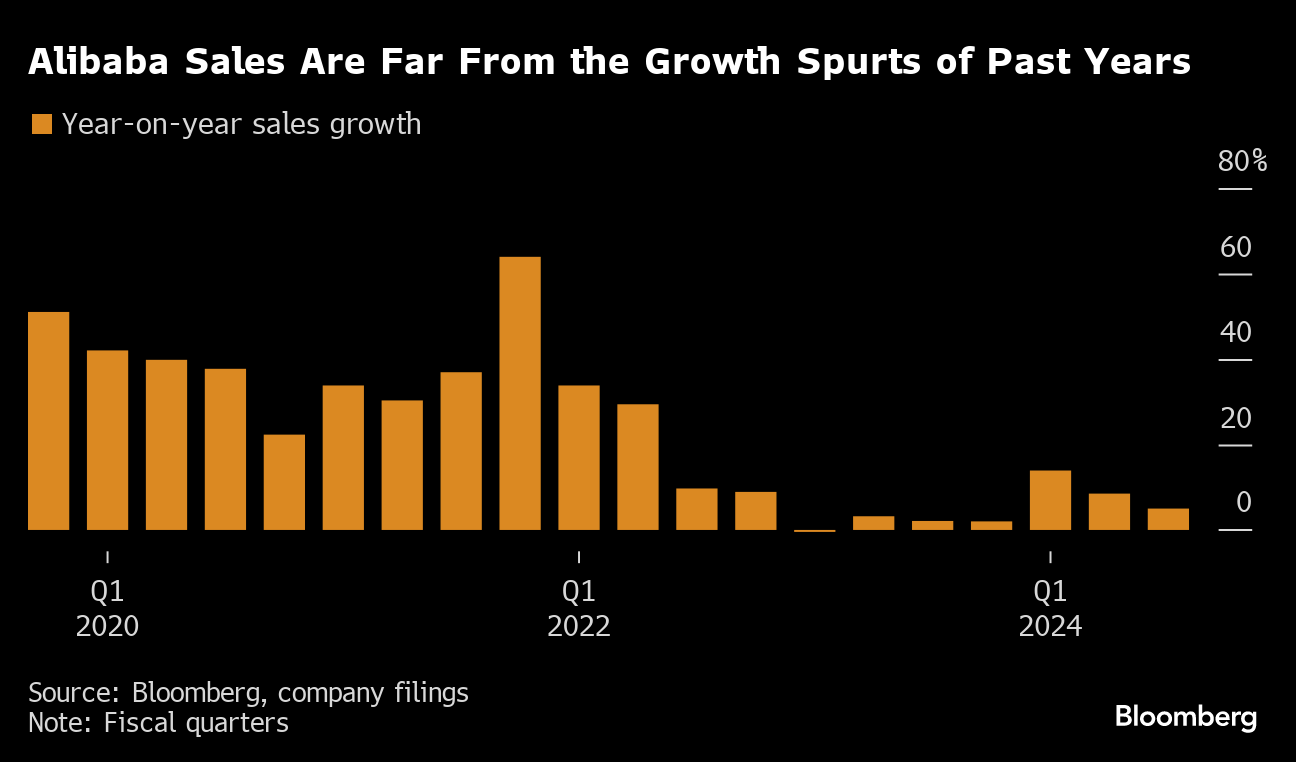

Alibaba is still grappling with fundamental questions surrounding the once-dominant internet company — a barometer of Chinese demand. Its performance underscored a loss of market share to rivals such as PDD and ByteDance Ltd. It posted a lower-than-projected 5% rise in December quarter revenue to 260.3 billion yuan ($36.2 billion), well off the pace of previous years. Net income fell 70%.

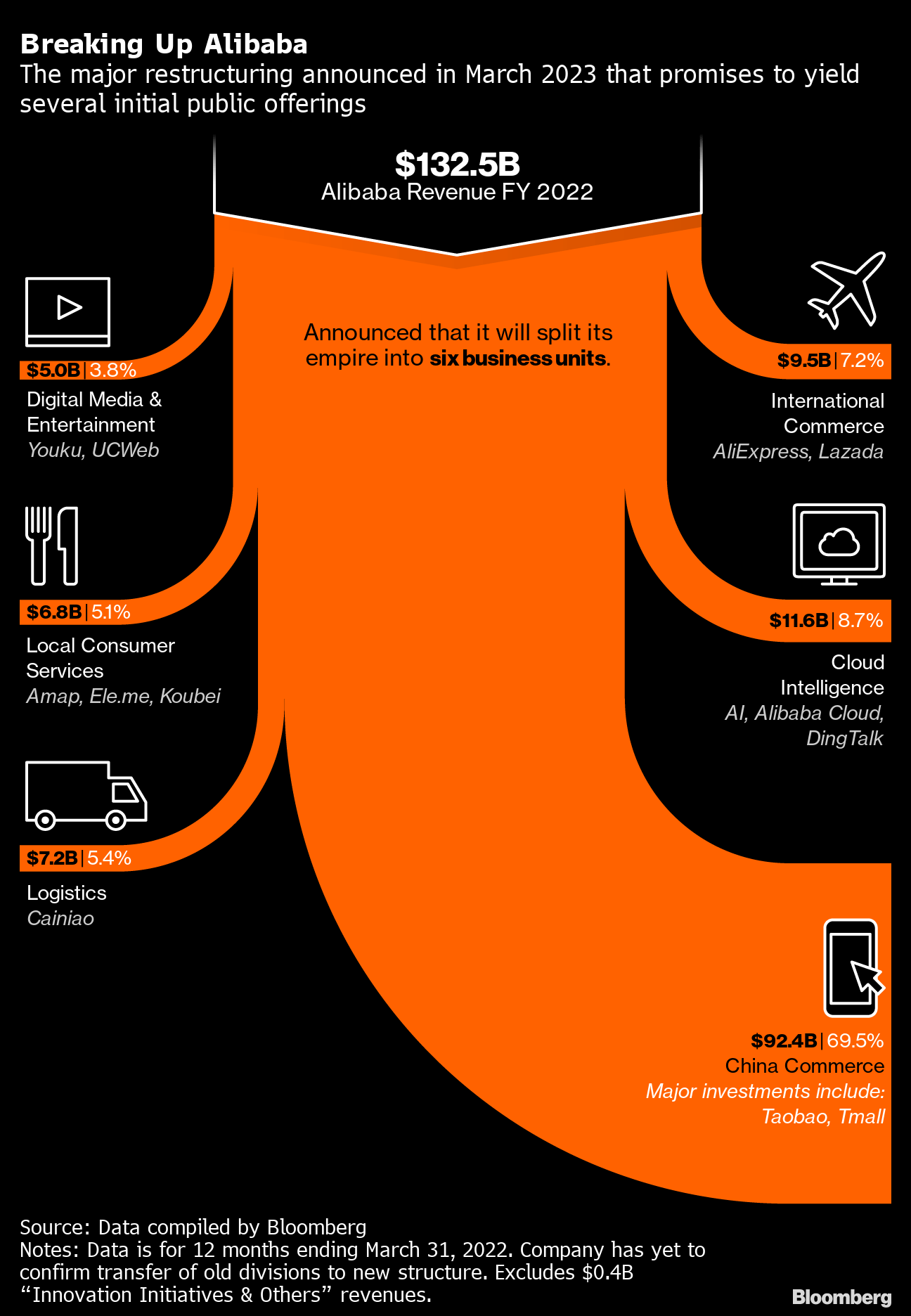

Fueling the uncertainty, the company is going through a complicated multi-way split intended to create several independent businesses and rejuvenate the national icon. The company last year outlined plans to float its Freshippo grocery chain and Cainiao logistics arm, but Chairman Joseph Tsai on Wednesday backed away from those plans because challenging market conditions would prevent it from reaping fair value for those businesses. Alibaba — which after years of frenetic investment now controls a vast portfolio of assets — is now actively looking to sell off some of those non-core holdings, he added. It's exploring ways to offload the InTime department store chain and other retail operations, Bloomberg News has reported.

“We have a number of traditional physical retail businesses on our balance sheet. And these are not our core focus. It will make sense for us to exit these businesses,” Tsai told analysts on a conference call. “This will take time given the challenging market conditions, but we'll continue to work on it.”

Alibaba is trying to stage a comeback from years of brutal government punishment and strategic missteps that cost the e-commerce operator its place as leader of the country's tech industry. Co-founder Jack Ma in November urged the company to correct its course.

It's going through a thorough retrenchment after its glory days. As it tries to sell off assets or spin off adjacent businesses, it will retreat to a much more modest strategy of focusing on its core e-commerce business and the cloud computing operation. Executives repeatedly stressed that dual focus on Wednesday's call.

“If you buy Alibaba stock, it's like you bought a 10-year Treasury bond with the upside of stock price appreciation,” Tsai said.

Click here for a liveblog of the numbers and conference call.

Chief Executive Officer Eddie Wu and Tsai, two of Ma's longest-standing confidantes, took the helm as former chief Daniel Zhang abruptly quit, and are now charged with effecting the multi-way split. The ultimate goal is to beat back upstarts like ByteDance's Douyin and PDD, while charting a new course for Alibaba to become a major player in artificial intelligence and the cloud.

That entails streamlining and big moves. Wu is promoting a younger cohort of executives to revive its core Taobao and Tmall platforms, while exploring ways to unload assets and dial back Zhang's years-long “new retail” ambition. At the same time, Alibaba must find an answer to Douyin, which has won shoppers over and grew sales faster during last year's Singles' Day shopping festival.

In addition to the latest buyback, Alibaba's executives pledged to aggressively return money to shareholders. They will target buying back 3% of outstanding stock every year — at a cost of roughly $12 billion annually. That will reduce the number of shares and push up the earnings per share.

“It's about buying time, as Alibaba figures out how to rejuvenate the core commerce business, and as it ramps up AIDC growth,” said Ivy Yang, founder of consultancy Wavelet Strategy and a former manager at Alibaba. “Especially after the news that the cloud business will not be spun out, investor confidence in the restructuring is shaken.”

Competition “is likely to continue to center on building market share at low prices,” Kenneth Fong, head of China internet research at UBS, said before the results. “Even if macroeconomic recovery occurs, price wars between platforms are likely to continue.”

What Bloomberg Intelligence Says

Alibaba's stronger-than-expected fiscal 3Q Taobao-Tmall Group margin, which slid 19 bps year over year vs. consensus for a drop of more than 2 percentage points, suggests the company won't sacrifice profit as it attempts to fend off e-commerce rivals in China this year. The unit's 3Q adjusted Ebita exceeded estimates by 2% even after a 3% revenue miss.

- Catherine Lim and Trini Tan, analysts

Click here for the research.

Alibaba is also keen to shore up its foothold in overseas markets. Units such as Lazada and Aliexpress underpin the global e-commerce operation, now among its fastest-growing divisions despite up-and-comers such as PDD's Temu and Shein.

As with most major tech firms, Alibaba counts AI among its longer-term priorities. It's developing its own ChatGPT-like services, while making multiple investments in startups such as Zhipu AI and Baichuan.

That AI effort has stuttered initially. Last year, Alibaba nixed the spinoff and IPO of its $11 billion cloud arm, surprising investors while citing US curbs that cut off access to Nvidia Corp.'s essential AI accelerator chips. It's unclear what steps executives plan to take to rejuvenate a business that once counted among its growth engines, but has lost market share to state-owned players in recent years.

“That's still in early testing but we see potential there,” Wu said on the call.

--With assistance from Vlad Savov, Sarah Zheng, Debby Wu and Peter Elstrom.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.