BSE Ltd.'s new derivatives products, brand building, and employee wellness are some of the key focus areas that helped boost its share price, according to Chief Executive Officer Sundararaman Ramamurthy.

"We want to make BSE more vibrant. All employees are aligned to it and are putting in their best efforts, showing success," Ramamurthy, managing director, told NDTV Profit.

Since taking over on Jan. 5, 2023, he said new talent has been added in place of bourse's retired senior workforce, giving existing employees confidence in their growth prospects.

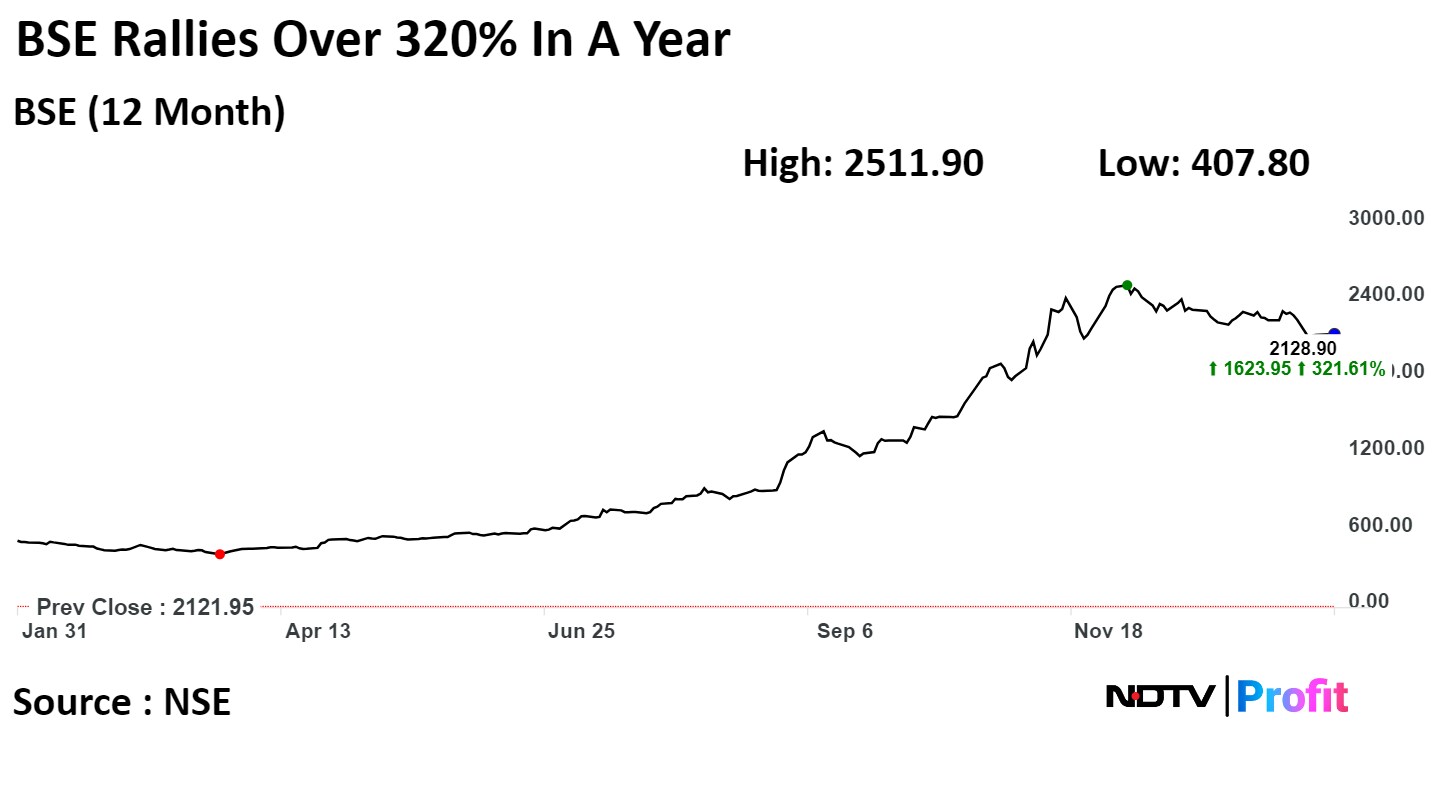

BSE has advanced over 320% in the last year, trouncing global platforms such as cryptocurrency major Coinbase Global Inc. and Cboe Global Markets Inc., as well as Multi Commodity Exchange of India Ltd.

Complimentary Product Offerings

Noting the fall in market share in both cash and derivates before he joined, Ramamurthy said the exchange introduced new contracts in the equity derivates segment with modified product specifications, which have worked well and attracted trades.

"We are positioning ourselves as a complimentary exchange and not competing with anybody. The two indices introduced by us—start of the week Bankex and end of the week Sensex—have all other prominently trading indices between them. The correlation coefficient is very high. Bankex correlation with Sensex and Nifty is 94%, and with Bank Nifty it is 99.9%, and with Nifty Fin it is 97%," he said.

Bankex can work in conjunction with other products, thus complementing them, he said. "When there are highly correlated products, people are able to do joint trading strategies."

Sundararaman Ramamurthy, managing director and chief executive officer, BSE. (Company website)

Product differentiation in the cash equity segment is limited, Ramamurthy said. "Tweaking tick size or transaction cost is not a scalable model. Only more participation (by investors) can bring scale," he said.

High-frequency trading—the key operators in stock markets—is slowly coming to the BSE through the derivatives segment, and the bourse hopes to make them more active players in the cash segment too as they build up their infrastructure, he said.

BSE reported a four-fold jump in net profit at Rs 118.4 crore for the quarter ended in September 2023. The bourse's revenue rose 53% to a record of Rs 367 crore.

The exchange will announce its third quarter results on Feb. 4.

Watch the full conversation here:

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.