(Bloomberg Opinion) -- The biggest problem facing the global energy transition over the next decade isn't technology or politics. It's money.

Reconfiguring the world's power systems to eliminate carbon emissions is going to be a multi-trillion dollar investment project. Over the past few years, clean energy has overtaken fossil fuels in terms of global spending, but one place is still falling short: developing economies. Rich nations tempted to rest on their laurels, now that a promise to mobilize $100 billion a year for climate in such countries appears to have finally been met, should watch out. The real fight is just beginning.

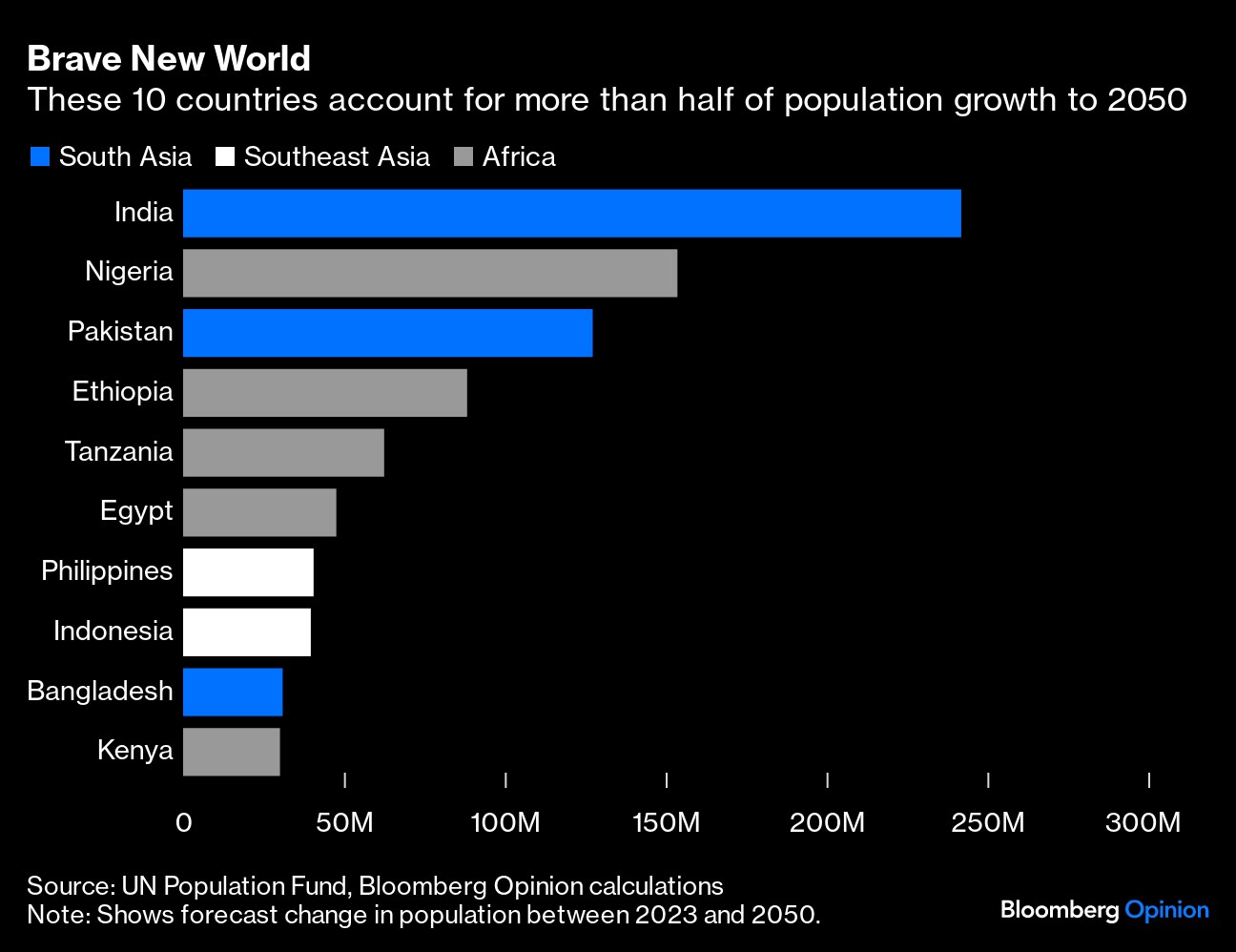

That's because the world's fossil fuel exporters aren't about to take the challenge lying down. At stake are the energy policies of 10 emerging countries in Asia and Africa that will account for more than half the world's additional population between now and 2050, and a concomitant share of its energy. They have economies highly dependent on foreign capital, either because of their rapid pace of development, or the fragility of their currencies. If rich nations don't provide the funding for clean energy to fuel their growth, oil producers and their allies stand with checkbooks at the ready for the dirty alternative.

Flush with profits from high oil prices, Gulf monarchies — in particular Saudi Arabia and the United Arab Emirates — have been busy building ties. Billions have been deposited with the central banks of Egypt and Pakistan to stabilize their currencies as energy import bills rose in the wake of the Ukraine war, an unusual move that leaves the recipients deeply in hock to donors. Saudi businesses signed $4.3 billion of deals with Philippine counterparts at an investment forum in October, plus a contract this month to run a new container port in Bangladesh. Indonesia is also seeking Riyadh's help in funding its planned new capital city, Nusantara.

The UAE, meanwhile, has been trailing only China lately as the second-largest bilateral investor in Africa, where Ethiopia, Kenya, Nigeria and Tanzania face particularly rapid growth. In India, Saudi Arabia and the UAE are looking to invest $100 billion and $50 billion, respectively, with half of the first figure earmarked for a long-delayed oil refinery that would be one of the world's biggest.

That spending underpins existing soft power. Bangladesh, Egypt, India, Indonesia, Pakistan, and the Philippines are the biggest source countries for the foreign workers who provide much of the labor force in Gulf monarchies, and in turn send remittances back home. Trading ties with East Africa, where the traditional Swahili is partially derived from Arabic, date back hundreds of years.

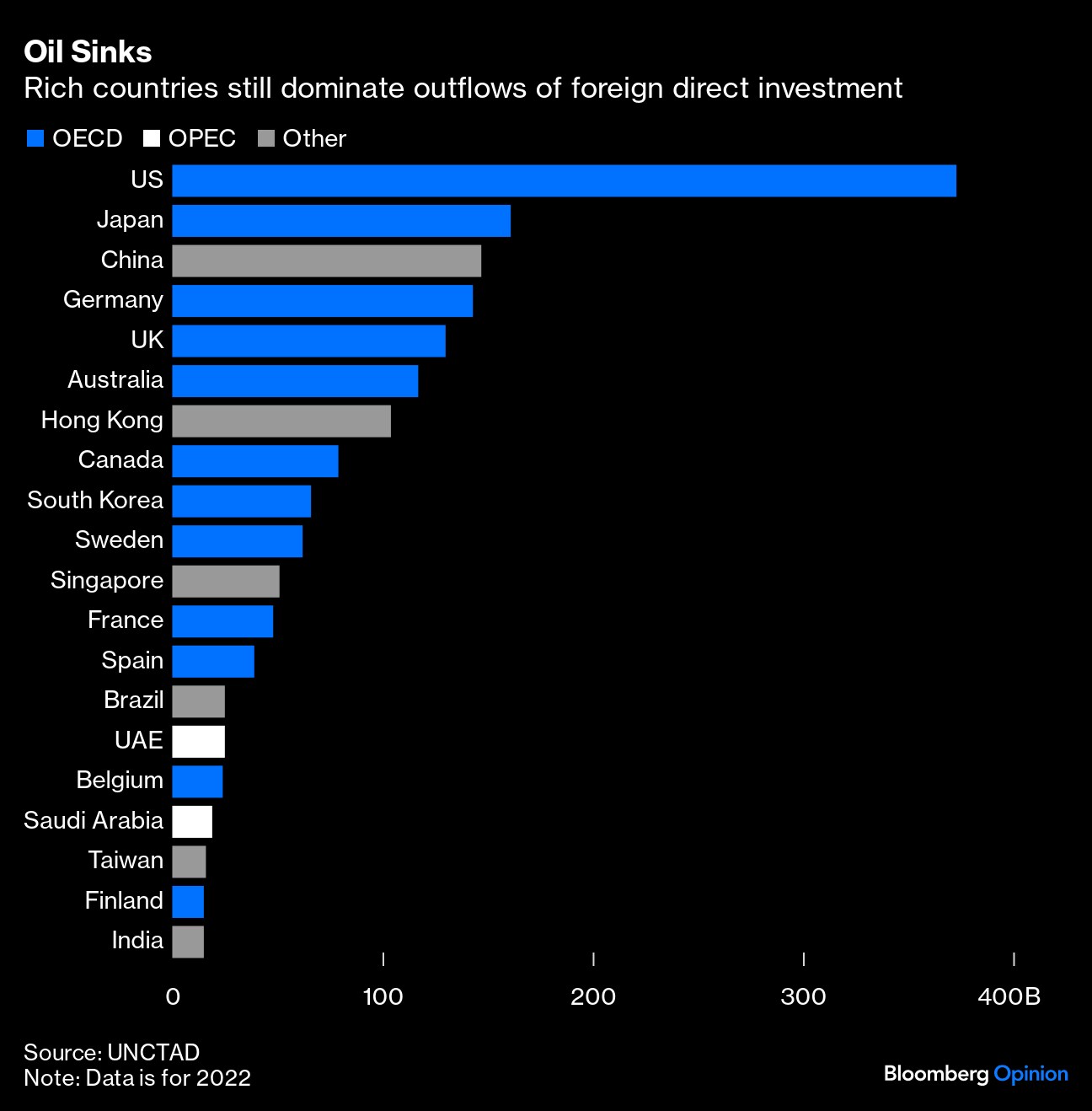

Oil exporters, to be sure, are starting off on the back foot. Rich democracies in the Organization for Economic Cooperation and Development remain the biggest providers of foreign direct investment, by far. Sweden, with $62 billion of outflows in 2022, sends more capital abroad than Saudi Arabia and the UAE's combined $44 billion. The US, on $373 billion, Japan's $161 billion, and China with $147 billion dwarf them all.

Those last two may be as important over the coming decades as the oil exporters. China's formidable renewables sector and engineering expertise have turned it into a major player in overseas power investment over the past decade.

Some $200 billion has been spent on about 128 gigawatts of generators under the aegis of the Belt and Road Initiative — a signature foreign-investment project for President Xi Jinping — energy analysts Wood Mackenzie wrote in November. The majority of that funding has traditionally gone on coal and gas, but with Xi promising to end finance for new coal power overseas, renewables now make up nearly 50% of the total, according to the report. Barriers to Chinese renewable equipment in countries such as India, Indonesia and the US may push down prices in economies more open to imports, providing an export market for Beijing to counteract a slowing domestic economy. Even the nations of the Gulf itself have partnered with Chinese businesses to build renewable projects, both at home and in third countries.

On the flip side, Japan has been fighting a rearguard action against the decarbonization policies of its fellow rich countries, inserting language supporting ammonia, hydrogen, and LNG into the communique from a G7 meeting in Hiroshima in May. That wording provides succor for Tokyo's decision to favor spraying fossil-derived fuels into coal furnaces, a costly policy with little or no environmental benefits. The phrases were echoed in the final statement from Dubai's COP28 climate meeting earlier this month. With government support, Japanese companies are trying to export the technology to Bangladesh, Indonesia, and Thailand, potentially slowing the pace of energy transition in each country.

The battle will only sharpen over the years ahead. Faced with declining oil and gas consumption, producing countries are more likely to spend money shoring up demand with mid- and down-stream port terminals, refineries and generation plants in importing countries, rather than adding more upstream supply to a glutted market. A potential turndown in global interest rates, too, will encourage yield-hungry investors to seek out returns in exotic destinations again, rather than taking shelter in the safety of US Treasuries. A changing climate will increase both the urgency of clean power investment, and the financial damage being done to developing economies by extreme weather.

Things need to change. COP28 failed to deliver the money the energy transition needs. If funders in the rich world don't start delivering, they shouldn't be surprised if other actors provide more cash to slow it down.

More From Bloomberg Opinion:

- Does COP28 Mark Beginning of End for Fossil Fuels?: Javier Blas

- COP28 Deal Shows Annual Gala Is Serious Business: Lara Williams

- The COP28 Deal Is Missing One Big Thing: Money: Mark Gongloff

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

David Fickling is a Bloomberg Opinion columnist covering energy and commodities. Previously, he worked for Bloomberg News, the Wall Street Journal and the Financial Times.

More stories like this are available on bloomberg.com/opinion

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.