(Bloomberg) -- Israel received its first-ever sovereign downgrade as Moody's Investors Service lowered its credit rating, citing the impact of the ongoing military conflict with Hamas on its finances.

The nation was cut by one notch to A2, the sixth-highest investment grade and on par with Poland and Chile. Moody's changed the outlook to negative, concluding a review that it started in October.

The conflict and its aftermath will “materially raise political risk for Israel as well as weaken its executive and legislative institutions and its fiscal strength, for the foreseeable future,” Moody's said in its statement on Friday, adding that it “expects that Israel's debt burden will be materially higher than projected before the conflict.”

Prime Minister Benjamin Netanyahu said the decision does not reflect the state of the country's economy.

“It is entirely due to the fact that we are at war,” he said in a statement. “The rating will go back up as soon as we win the war.”

The conflict, which erupted more than four months ago, is stretching public finances by pushing the budget deep into the red. The fiscal costs of Israel's worst armed conflict in 50 years are also forcing the government to rely far more on debt to fund its needs and pay a war bill the central bank estimates at 255 billion shekels ($69 billion) over 2023-2025.

The government's revised budget for 2024, which is pending final approval in parliament later this month, will come with a deficit of 6.6% of gross domestic product, which would be among the widest for Israel this century. The shortfall was wider only in 2020, when the government spent and borrowed heavily to contain the economic fallout of the coronavirus pandemic and the lockdowns that followed.

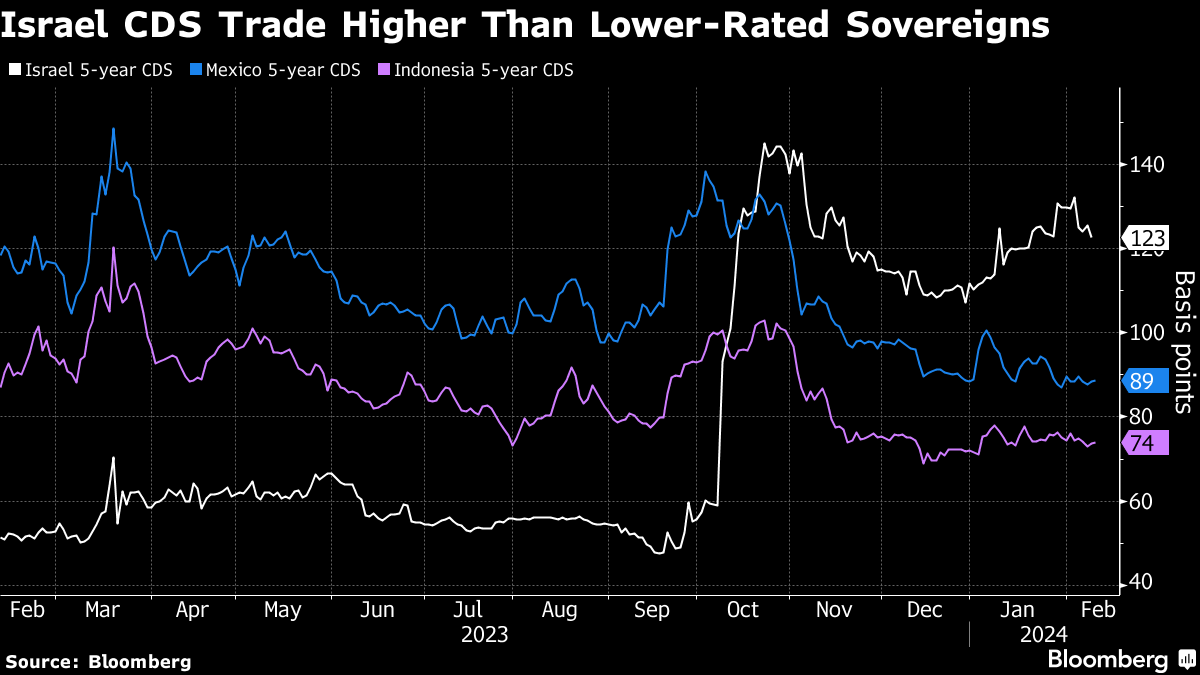

Traders have already priced in a possible downgrade, meaning a cut should have a muted impact on markets. The cost to insure Israel's debt against default in the next five years is now higher than for lower-rated sovereigns such as Mexico and Indonesia.

The war began on Oct. 7 when Hamas swarmed into southern Israeli communities from Gaza and killed around 1,400 people. Israel's retaliatory air and ground offensive has killed more than 27,000 people in Gaza, according to health officials in the Hamas-run territory.

The outlook for Israel's economy now hinges in large part on whether the conflict is contained. Since its onset, all three major rating firms have put out warnings on the government's credit score.

On Oct. 25, S&P Global Ratings became the last to revise the outlook to negative on risks the war could spread. Fitch Ratings and Moody's had already placed the nation's credit score on negative watch and on review for downgrade, respectively.

(Updates with prime minister comment in fourth paragraph.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.