The European Union hashed out a preliminary agreement on fiscal reform that will aim to reduce debt and protect investment in key areas such as defense and the green transition.

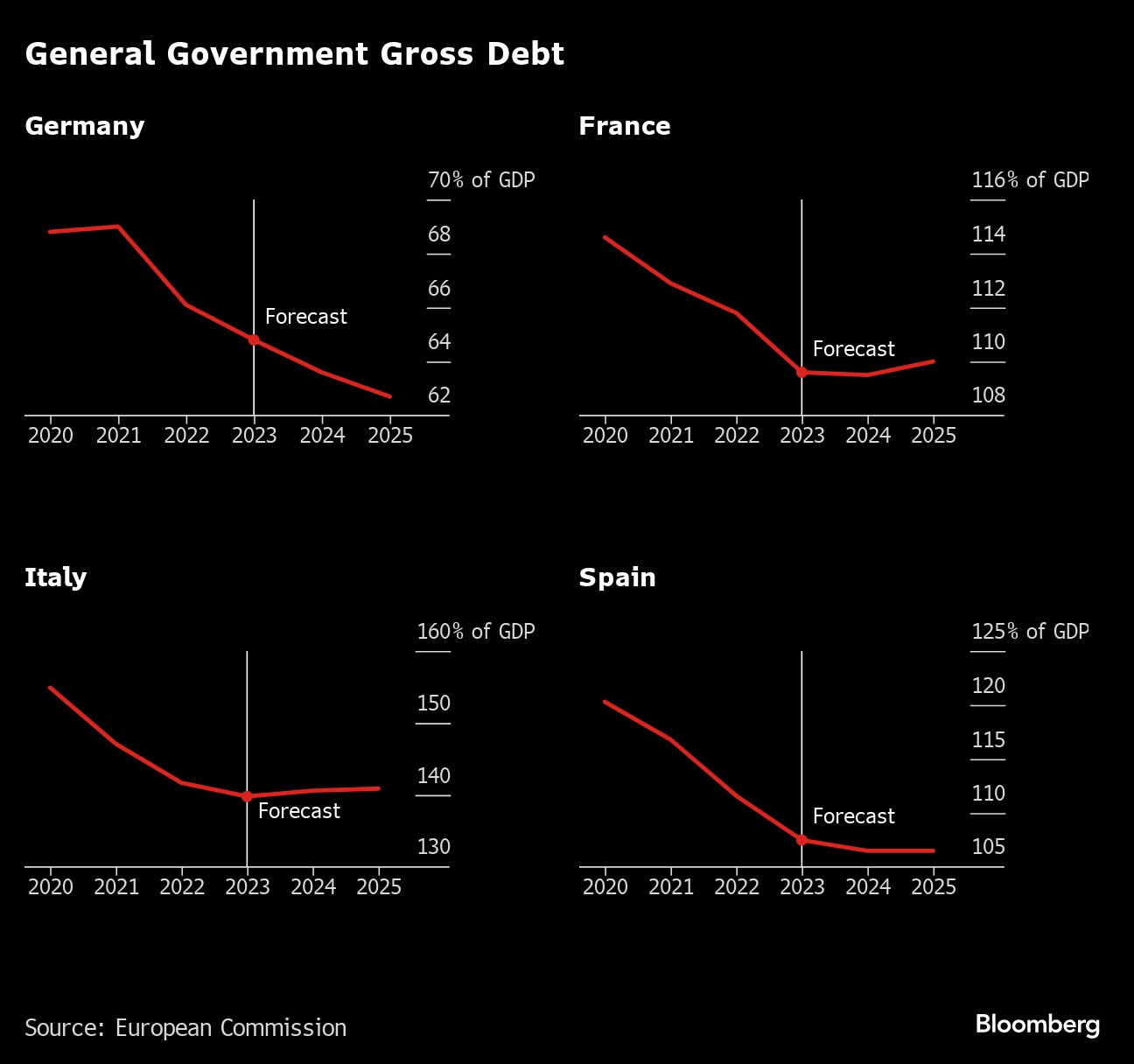

The political deal will introduce a gradual fiscal adjustment path for nations whose government debt exceeds 60% of gross domestic product or whose deficit is above 3% of GDP. The agreement struck in Brussels late Friday between representatives of the European Commission, the European Parliament and member states in the EU Council still needs formal approval by national governments and the EU assembly to become law.

“The new rules will significantly improve the existing framework and ensure effective and applicable rules for all EU countries,” Belgian Finance Minister Vincent Van Peteghem said in a statement Saturday. “They will safeguard balanced and sustainable public finances, strengthen the focus on structural reforms, and foster investments, growth and job creation throughout the EU.”

The fiscal rules that bind the euro area's eclectic economies exist to bring down deficits and put limits on how much debt governments can build up. The old rules were suspended to allow spending leeway during the pandemic and energy crisis, and are considered to be outdated.

Negotiations on the proposed reform in recent months exposed differences between hawkish countries led by Germany that called for strict targets to reduce debt, and those led by France and Italy that were concerned about the need to finance defense and digital industries, as well as the green transition.

“A new economic governance framework was much needed,” Esther De Lange, a Dutch member of the European People's Party in the EU Parliament, said in a statement. “We have taken our responsibility by ensuring that the new fiscal rules are sound and credible, while also allowing room for necessary investments.”

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.