The short-term texture for the market still shows weak momentum from a technical view and another week of consolidation appears likely, according to analysts. The Nifty is consolidating within a rising channel pattern and has indicated weakness after the previous session's red candle and formed a bearish engulfing candlestick pattern on a daily scale, according to Neeraj Sharma, technical and derivatives research analyst at Asit C Mehta Investment Interrmediates Ltd.

If the Nifty goes below 22,340, the slide may continue to 22,100–22,000 levels in the near future, Sharma said.

Another week of consolidation appears likely going ahead, Shrey Jain, chief executive officer of SAS Online said, advising traders to take a prudent and cautious approach. The Nifty's support levels are expected to range between 22,350 and 22,450, while the Bank Nifty's support is projected to be between 48,650 and 48,850, he said.

The short-term market texture is still on the weak side and 22,600 for Nifty would act as a trend decider level, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The GIFT Nifty was trading flat at 22,590.00 as of 06:19 a.m.

F&O Action

The Nifty May futures were down 0.05% to 22,550 at a premium of 107.3 points while its open interest was up 5.7%. The Nifty Bank May futures were down 0.07% to 49,045 at a premium of 149.7 points and its open interest was up 2.4%.

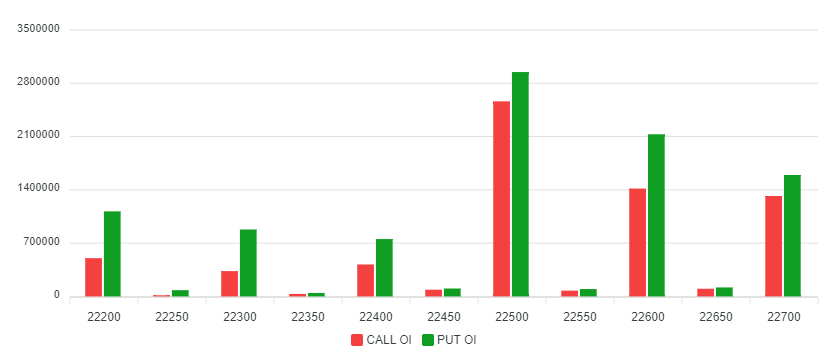

Open interest distribution for the Nifty May series indicates that 22,500–22,700 levels are seeing the most put strikes, and call strikes of 22,500 have the maximum open interest.

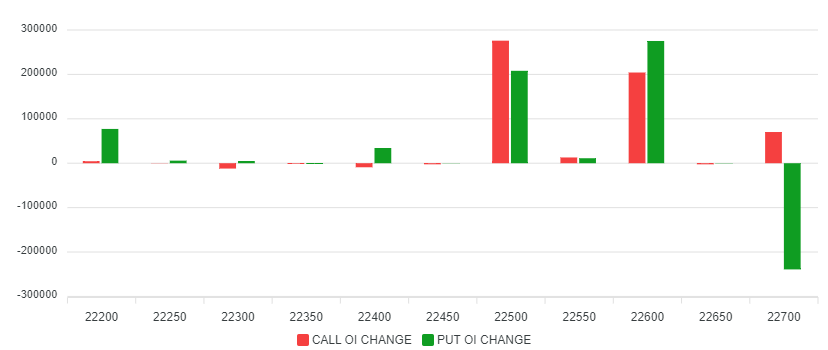

During the previous session, open interest at 22,600 saw the most decline in put strikes, and call strikes at 22,500 saw the maximum open interest change.

For the Bank Nifty options May expiry series, maximum call open interest was at 49,500 and the maximum put open interest was 48,500.

Open Interest Distribution

Open Interest Change

FII/DII Activity

Overseas investors stayed net sellers on Monday for the third straight day.

Foreign portfolio investors sold stocks worth Rs 2,168.75 crore and domestic institutional investors stayed net buyers for the ninth day, according to provisional data from the National Stock Exchange.

Markets On Monday

India's benchmark stock indices ended little changed amid a volatile session on Monday, even as a steep correction in public sector banks left the Nifty 50 down for the second session in a row while the Sensex closed marginally higher.

Titan, State Bank of India, and Reliance Industries Ltd. shares weighed on the indices, but Kotak Mahindra Bank's gains helped to limit the losses.

The NSE Nifty 50 closed 33.15 points, or 0.15%, lower at 22,442.7, while the S&P BSE Sensex closed 17.39 points, or 0.02%, higher at 73,895.54.

Most sectoral indices ended lower, with the Nifty PSU Bank falling the most. Nifty Realty gained nearly 3%.

Broader markets underperformed benchmark indices. The S&P BSE Midcap ended 0.95% down, and the S&P BSE Smallcap settled 1.06% down.

The market breadth was skewed in favour of the sellers as 2,625 stocks declined, 1,296 stocks advanced, and 173 stocks remained unchanged on the BSE.

Major Stocks In News

Wipro: The company collaborated with Microsoft to launch a suite of generative AI-powered virtual assistants for financial services.

Zee Media: The company announced the cessation of Abhay Ojha as CEO.

Lupin: The company received US FDA approval for Travoprost Ophthalmic Solution USP. Travoprost ophthalmic is used for the reduction of elevated intraocular pressure.

Global Cues

Markets in the Asia-Pacific region extended gains on Tuesday, taking cues from overnight gains on Wall Street as risk sentiment improved on hopes that the Federal Reserve will cut interest rates this year.

The Nikkei 225 was 521.80 points or 1.36% higher at 38,757.87, and the S&P ASX 200 was trading 41.00 points or 0.53% up at 7,723.40 as of 06:15 a.m.

In Asia, investors also await the Reserve Bank of Australia's policy decision, scheduled to be published on Tuesday. The central bank is expected to keep the benchmark rate steady at 4.35%.

The S&P 500 and Nasdaq Composite rose 1.03% and 1.19% respectively, as of Monday. The Dow Jones Industrial Average rose 0.46%.

Key Levels

U.S. Dollar Index at 105.15

U.S. 10-year bond yield at 4.49%

Brent crude up 0.53% at $83.77 per barrel

Nymex crude up 0.55% at $78.91 per barrel

Bitcoin was down 0.35% at $63,079.39

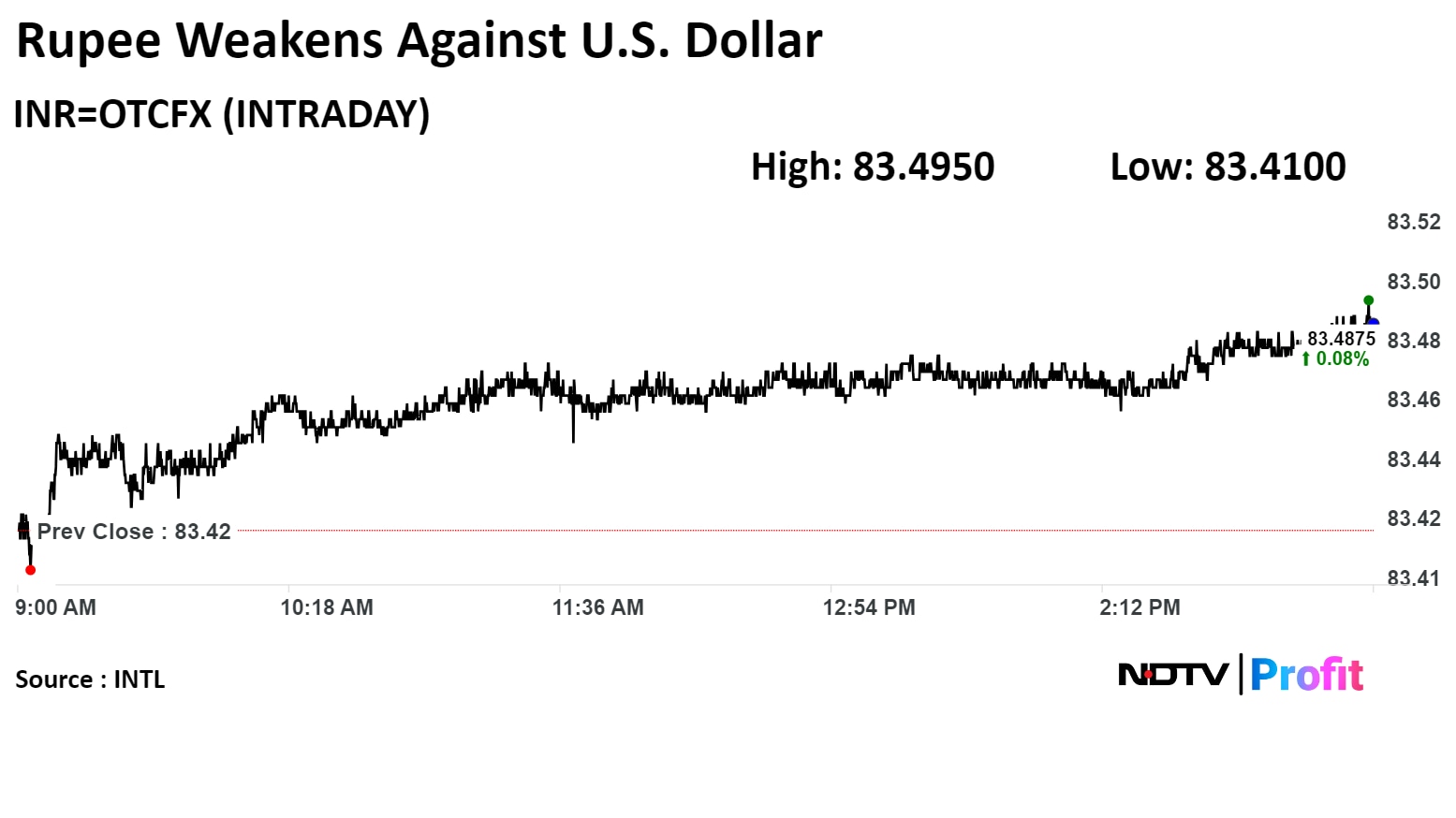

Rupee Update

The Indian rupee closed weaker against the US dollar on Monday due to a rise in crude oil prices.

The local currency depreciated six paise to close at Rs 83.49 against the greenback.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.